After the wave of interest rate hikes by small joint stock commercial banks, banks in the Big4 group also joined in.

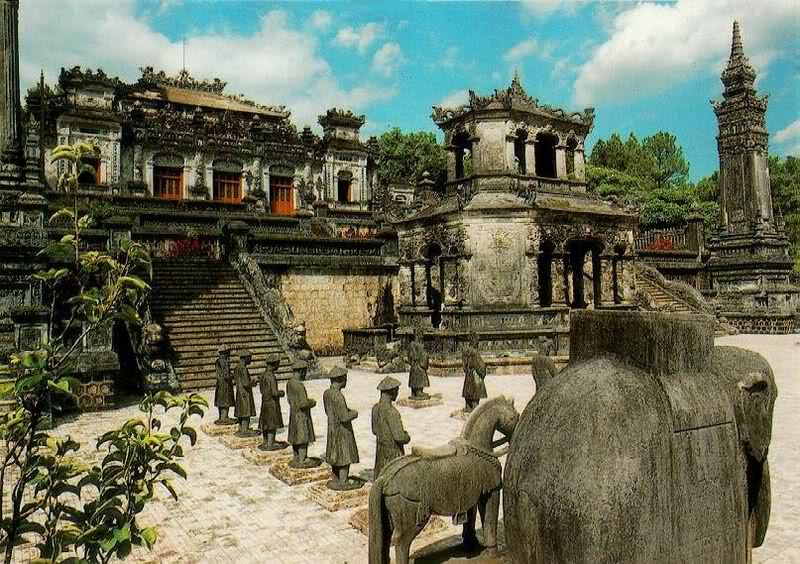

After Tet, deposit interest rates set a new level - Photo: QUANG DINH

Big4 banks import interest rate hike

According to Tuoi Tre Online , interest rates on the market have begun to heat up with the participation of banks in the Big4 group.

BIDV and Vietcombank have just raised their 36-month long-term deposit interest rates to 4.8%/year, an increase of 0.1%/year compared to before.

The remaining terms remain unchanged, such as 12 months is 4.7%/year; 6 months is 3%/year and 1.7%/year applies to 1-month term.

Although the interest rate only increased slightly by 0.1%/year, this is a signal that big banks cannot stay out of the game.

At VietinBank and Agribank, deposit interest rates have been kept unchanged since the beginning of January. For long-term deposits of over 24 months, these banks listed the rate at 4.8%/year. The rate of 4.7% applies to terms of 12 to under 24 months.

At Vietcombank, the mobilization interest rate is kept stable. The highest level is 4.7%/year, applied for a term of 24 months.

The remaining terms are 1 month at 1.6%/year; 6 months at 2.9%/year; 12 months at 4.6%/year.

Small banks increase interest rates by 9% with strict conditions poor

At commercial banks, especially small banks, deposit interest rates have heated up after Tet with an increase of 0.2-0.3%/year for many long terms.

Accordingly, the common interest rate for a 12-month term is around 6%/year. Some banks list 6.3%/year such as MSB; Kien Long Bank is 6.1%/year...

At VPBank, the interest rate for 12-month deposits is 6%/year for amounts over 300 million VND. For deposits under 300 million VND, the interest rate is 5.4%/year.

For long-term deposits of over 36 months, small banks also offer interest rates approaching 7%/year. For example, Eximbank offers 6.6%/year; GPBank offers 6.35%/year…

In particular, the highest interest rate on the market is currently up to 9%/year, but customers have to deposit a very large amount of money. For example, PVcomBank applies 9%/year for a term of 12 - 13 months, with a minimum deposit of 2,000 billion VND.

HDBank applies 8.1%/year for 13-month term, 7.7%/year for 12-month term, but also requires a minimum balance of VND500 billion.

Previously, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (BVBank) also increased the deposit interest rate by 0.6%/year for customers opening online savings accounts for the first time. The program applies to all terms with a minimum deposit of VND10 million.

Residents' deposits exceed 7 million billion VND

According to the latest statistics from the State Bank, as of November 2024, total deposits from residents have officially exceeded 7 million billion VND, an increase of 7.16%, equivalent to 467,549 billion VND compared to the end of 2023.

For businesses and economic organizations, deposits reached 7.26 million billion VND, the highest level ever.

In addition, people's deposits in personal payment accounts by the end of the third quarter of 2024 reached nearly 1.2 million billion VND.

Source: https://tuoitre.vn/sau-tet-lai-suat-huy-dong-thiet-lap-mat-bang-moi-20250214203607763.htm

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

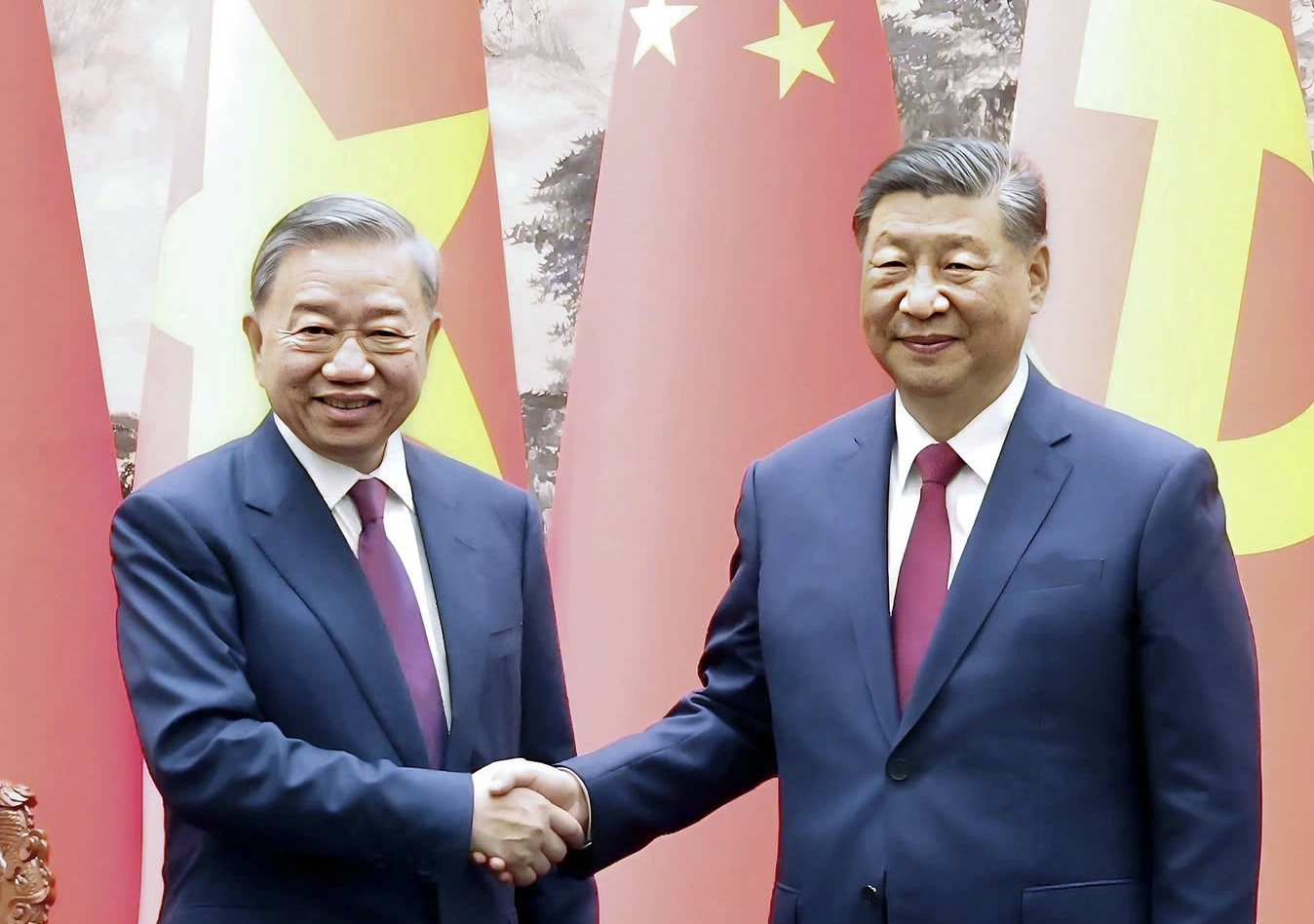

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)