Red covers Asian stocks, VN-Index reverses trend and increases

VN-Index jumped nearly 30 points from the lowest point of the day. A series of stock groups such as securities, steel, retail, banking, etc. made waves, pulling the general index back despite the negative developments on Asian stock exchanges.

|

| Foreign investors net bought strongly on the Vietnamese stock market in the session of August 2. |

Rare green amid sell-off in global stock markets

After the first trading session of August saw a sharp drop in points and a sharp increase in trading volume, selling pressure appeared right from the start of the session. Trading remained negative as a series of stock groups were in the red. The indices traded below the reference mark for most of the session.

At the same time, today is the time for domestic ETF funds to conduct transactions to complete the restructuring of investment portfolios for ETF funds using HoSE indexes such as VN30, VNDiamond, VNFinLead... as reference indexes. This also significantly affects investor sentiment.

However, an unexpected development occurred in the second half of the afternoon session. Demand suddenly increased and helped a series of stock groups recover, so the indices also recovered. VN-Index even reversed and closed at the session's highest level, from a decrease of about 16 - 17 points to a gain of nearly 10 points at the end of the session.

At the end of the trading session, VN-Index increased by 9.64 points (0.79%) to 1,236.6 points. The entire floor had 267 stocks increasing, 160 stocks decreasing and 72 stocks remaining unchanged. HNX-Index increased by 2.33 points (1.02%) to 231.56 points. The entire floor had 94 stocks increasing, 71 stocks decreasing and 53 stocks remaining unchanged. UPCoM-Index increased by 0.25 points (0.27%) to 93.77 points.

Vietnam stocks were the only green in the Asian stock market today. Red also spread globally as major stock exchanges around the world all fell deeply. The manufacturing PMI index, which accounts for 10.3% of the US economy, fell to 46.8 in July from 48.5 in June, due to a drop in new orders. This is also the lowest recorded level since November 2023. This also shows that the manufacturing industry is facing many difficulties after a strong recovery in the second quarter. Weaker data from the world's number one economy is expected to raise concerns about an economic recession.

A series of Asian stock exchanges sold off heavily on August 2. The Japanese stock exchange had its worst day in nearly four years. The Nikkei 225 index ended the session down 2,182 points, or 5.27%, at 35,917 points. This is also the lowest level of the Japanese stock exchange index in nearly six months. The Bank of Japan (BOJ) announced this week its decision to raise its policy interest rate to 0.25%, the highest level since 2008, and plans to reduce monthly bond purchases to about 3,000 billion yen per month in the first quarter of 2026. The decision helped the Japanese yen recover after a sharp depreciation in recent times, while investors sold off Japanese stocks, negatively affecting the stock market.

A series of other Asian stock exchanges also fell sharply, such as the Korean stock index - KOSPI (-3.67%), Taiwan stock (-4.43%), Hong Kong or Australia both fell 2.08%.

Stock market "surging", foreign investors' support pulls the market

The stock group showed signs of bottoming out when it fell before the market and recovered strongly in today's session. Of which, BSI, CTS and FTS were pulled up to the ceiling price. MBS increased by more than 6%, AGR increased by 4.9%, VGS increased by 4.6%...

Steel stocks also recorded many good recoveries after being sold off heavily in the last 1-2 sessions. Leading the way were TVN up 11%, VGS up 5.9%, HSG up 2.9%, NKG up 2.8%, HPG up 2%.

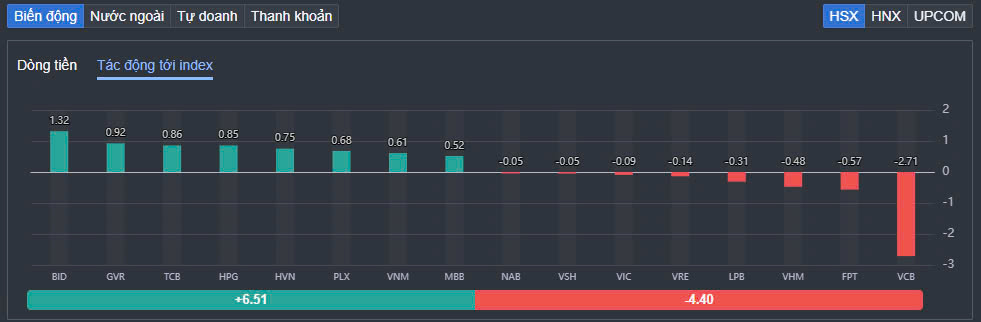

In the VN30 group, 22/30 stocks increased in price, overwhelming the number of stocks that decreased (6/30). BIDV (BID) shares increased by 2% and were the stocks that contributed the most to helping the VN-Index reverse. This stock contributed 1.32 points to the VN-Index. Next, GVR increased by 3% and contributed 0.92 points. Stocks such as TCB, HPG, PLX... also increased in price well in today's session. Although outside the VN30, with a ceiling increase of VND22,050/share, HVN was also the stock with the 5th largest influence on the VN-Index, contributing 0.75 points.

|

| VCB curbs the overall increase of VN-Index |

On the other hand, VCB, after a few sessions of supporting the market well, reversed and decreased today (-2.21%). This stock alone took away 2.71 points from the VN-Index. FPT stock price decreased by 1.28%, also contributing 0.57 points to the general index. According to estimates of many securities companies, FPT is the stock that was sold the most during the restructuring period of domestic ETF funds this time. In addition, stocks such as VHM, LPB, VRE... also had a negative impact on the VN-Index.

In the group of small and medium-cap stocks, DBC attracted attention when it hit the ceiling price of VND28,050/share. Stocks such as NTL, DGW, DCM, VIX… all recovered well.

The total matched volume on the HoSE floor only reached VND696.66 billion, down 22% compared to the previous session, equivalent to a trading value of VND16,387 billion. The trading value on the HNX and UPCoM reached VND1,139.9 billion and VND1,060 billion, respectively. VIX was the strongest matched code on the market with 24.8 million units. SHB and MBB matched 24.4 million units and 23.8 million units, respectively.

|

| Foreign investors net bought strongly in the session of August 2 |

Foreign investors increased their net buying by VND740 billion in today's session. Of which, this capital flow bought the most VNM with VND300 billion. MSN and DGC were net bought by VND61 billion and VND59 billion respectively. In the opposite direction, VIX was the most net sold with VND44.4 billion. VHM and DXG were net sold by VND40 billion and VND34.5 billion respectively.

Source: https://baodautu.vn/sac-do-bao-trum-chung-khoan-chau-a-vn-index-loi-nguoc-dong-bat-tang-d221510.html

Comment (0)