VN-Index had a session of increase of over 2%, the first time since the session on August 16, 2024 (2.34%). A series of stock groups made strong breakthroughs.

Stocks lead, VN-Index jumps 2%, strongest in nearly 4 months

VN-Index had a session of increase of over 2%, the first time since the session on August 16, 2024 (2.34%). A series of stock groups made strong breakthroughs.

After a slight decline with improved liquidity, Vietnamese stocks had a strong rebound. Although at the beginning of the session, in the trading session on December 5, investor sentiment was not too pessimistic and all indices regained green. Large-cap stocks recorded quite a lot of positivity, but the increase of most codes was modest. Although there were occasional fluctuations, the selling pressure was not too strong and only occurred in a few small and medium-sized stocks. Some steel stocks such as NKG, HSG or VND were sold very strongly. VN-Index at times fell below the reference level, but the decrease was only about 2 points. Immediately after that, the index quickly regained green.

The market focus was on the afternoon session when bottom-fishing demand increased and helped a series of stock groups recover strongly. In particular, stocks in the securities group led and helped the cash flow spread widely to many stock groups. The indices therefore also broke out.

At the end of the trading session, VN-Index increased by 27.12 points (2.19%) to 1,267.53 points. HNX-Index increased by 4.98 points (2.22%) to 229.6 points. UPCoM-Index increased by 0.51 points (0.55%) to 92.95 points. The last time VN-Index increased by more than 2% was on August 16, 2024 (2.34%).

The whole market had a total of 557 stocks increasing while only 181 stocks decreased and 825 stocks remained unchanged or not traded. Notably, the number of stocks increasing to the ceiling was 34 while only 13 stocks decreased to the floor. The securities group continued to play a leading role in the general market when it was the group that increased the most strongly and synchronously in today's session. In which, SSI, HCM, VCI, FTS, BSI, VIX... all closed at the ceiling price. Other securities codes such as AGR, SBS, VND, IVS... all had very strong price increases. Although closing without increasing the ceiling price, the amplitude of VND was very large. At one point in the trading session, VND decreased by nearly 5.7%, but ended the session up more than 4.5%. Corresponding to a fluctuation amplitude of 10.8%.

|

| A series of pillar stocks increased, pulling VN-Index up more than 2% |

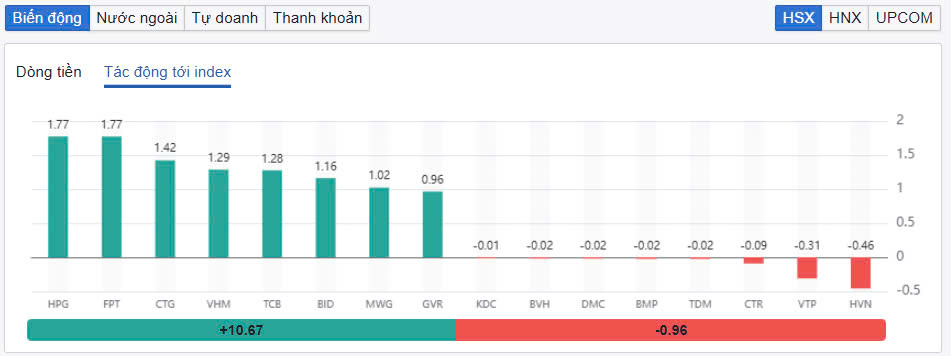

Cash flow spread to many other stock groups. In the VN30 group today, there were 29 stocks that increased in price, while only 1 stock decreased, which was BVH with a decrease of 0.19%. Besides SSI, MWG after yesterday's strong selling session also increased by 5%, STB increased by 4.78%, HPG increased by 4.3%, BCM increased by 4.29%, FPT continued to increase by 3.5%. HPG and HPG were the stocks that had the most positive impact on the VN-Index, both contributing 1.77 points. CTG contributed 1.42 points. VHM also contributed 1.29 points.

Stock groups such as retail, textiles, seafood, public investment, etc. also increased sharply in price.

In the opposite direction, HVN went against the positive trend of the general market and decreased by 3.15% to VND26,150/share. HVN was also the code that put the most pressure on the VN-Index when it took away 0.46 points. Viettel stocks surprised when they were sold off very strongly, completely opposite to what happened in the general market. VTP hit the floor to VND140,400/share and took away 0.31 points from the VN-Index. CTR also took away 0.09 points when it decreased by 2.61%. CTG and VTK decreased by 2.61% and 2%, respectively.

|

| Foreign investors return to net buying of nearly 700 billion VND |

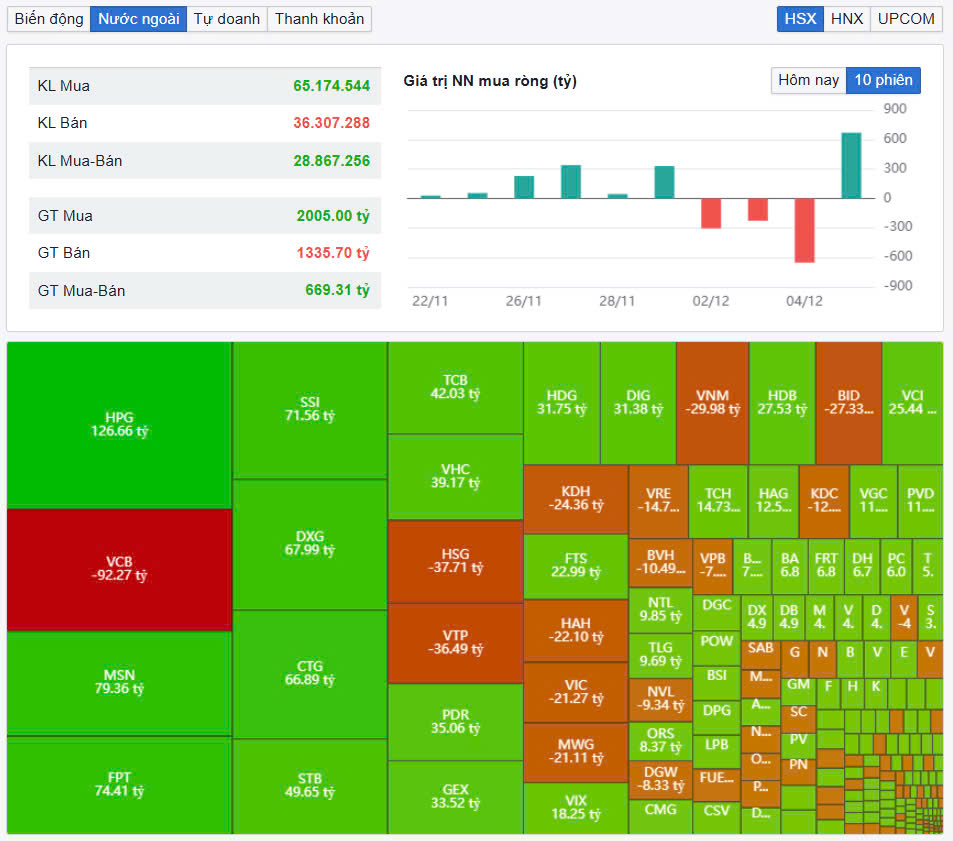

Market liquidity increased sharply compared to previous sessions and far exceeded the average. Total trading volume on HoSE reached 908.4 million shares, equivalent to a trading value of VND21,041 billion (up 51% compared to the previous session), of which negotiated transactions contributed VND1,847 billion. Trading value on HNX and UPCoM also increased, reaching VND1,554 billion and VND632.9 billion, respectively.

HPG was the most traded stock today with a trading value of over VND1,220.9 billion. SSI and FPT traded VND889 billion and VND707 billion respectively. Foreign investors returned to net buying with VND669 billion on HoSE. Foreign investors net bought the most HPG with VND127 billion. MSN and FPT were net bought with VND79 billion and VND74 billion respectively. Meanwhile, VCB was the most net sold with VND92 billion. HSG was behind but the net selling value was only VND38 billion.

Source: https://baodautu.vn/co-phieu-chung-khoan-dan-dat-vn-index-vot-tang-2-manh-nhat-gan-4-thang-d231765.html

Comment (0)