Trading on the market was cautious, volatile and recorded differentiation in many stock groups. Market liquidity remained low.

Red dominates, VN-Index turns to adjust after 3 increasing sessions

Trading on the market was cautious, volatile and recorded differentiation in many stock groups. Market liquidity remained low.

|

| VCB shares negatively impact VN-Index |

Vietnamese stocks all turned down, "sinner" Vietcombank dragged VN-Index down

After three sessions of increasing points, the pressure of differentiation increased even though the cash flow tended to be more positive in the trading session on December 10. The lack of leading stocks in the market caused the VN-Index to trade sideways, fluctuating around the reference level with a narrow range after the first opening hour. Although the sellers did not want to push out their "goods", the pressure increased somewhat every time the index was excited. Meanwhile, weak demand made the differentiation stronger.

Trading in the afternoon session was still volatile but more inclined to the downside. Selling pressure was somewhat stronger at the end of the session, causing red to dominate. VN-Index closed the session in red and partly due to continued pressure from foreign investors.

At the end of the trading session, VN-Index decreased by 1.77 points (-0.14%) to 1,272.07 points. HNX-Index increased by 0.03 points (0.01%) to 229.24 points. UPCoM-Index decreased by 0.17 points (-0.18%) to 92.74 points. The whole market recorded a balanced number of stocks increasing and decreasing. Specifically, there were 361 stocks increasing while 359 stocks decreased and 853 stocks remained unchanged. The number of stocks increasing to the ceiling in today's session was 27, while there were 9 stocks decreasing to the floor.

The market still lacks a leading industry group. Meanwhile, large stocks fluctuated with red dominating. In the VN30 group today, 17 stocks decreased while only 11 stocks increased. Stocks that decreased by more than 1% in this group included VIC, STB, VHM and GVR. VIC decreased the most in the group with 1.55%, STB decreased by 1.47%, VHM and GVR decreased by 1.2% and 1.09% respectively.

VCB topped the list of stocks that had the most negative impact on the VN-Index, taking away 1.08 points. At the end of the session, VCB fell 0.84%. In addition, VIC took away 0.6 points. VHM also took away 0.5 points.

Meanwhile, HDB increased sharply by 3.7% to VND28,000/share and was the second most positive stock on the VN-Index, contributing 0.7 points. The top stock on the list of positive stocks on the index was FPT with 0.89 points. At the end of the session, FPT increased by 1.7% to VND149,500/share.

In addition, HPG also attracted attention when it increased by 0.9% in today's session. It is known that on December 5, 2024, Hoa Phat Dung Quat Steel Joint Stock Company - a member company of Hoa Phat Group (HPG) officially opened a 300-ton blast furnace at Hoa Phat Dung Quat 2 Iron and Steel Complex located in Dung Quat Economic Zone, Binh Son District, Quang Ngai Province. The ceremony was attended by leading international partners such as SMS Group, WISDRI and MINMETALS, marking an important step in the process of testing the project's production system.

Red also dominated some industry groups such as real estate, securities, fertilizers, etc. In the real estate group, LDG could no longer maintain its positivity when it fell back to 3%. Codes such as TIG, SCR, HDG, QCG, DXG, etc. were all submerged in red.

The insurance and steel groups traded more positively than the general market. In the insurance group, BVH is still the leading stock in this industry. At the end of the session, BVH increased by 1.74%. Other insurance codes such as BLI, BIC, ABI... also increased in price.

Foreign investors net bought, mainly in Ha Tay Pharmaceutical

Market liquidity remained low. Total trading volume reached over 631 million shares, equivalent to a trading value of VND14,447 billion (down 14%), of which negotiated transactions accounted for VND2,900 billion. Trading values on HNX and UPCoM reached VND1,151 billion and VND621 billion, respectively.

HPG was the largest traded stock today with a value of VND913 billion. HDB and FPT followed with trading values of VND545 billion and VND534 billion, respectively.

|

| Foreign investors strongly net buy Ha Tay Pharmaceutical shares |

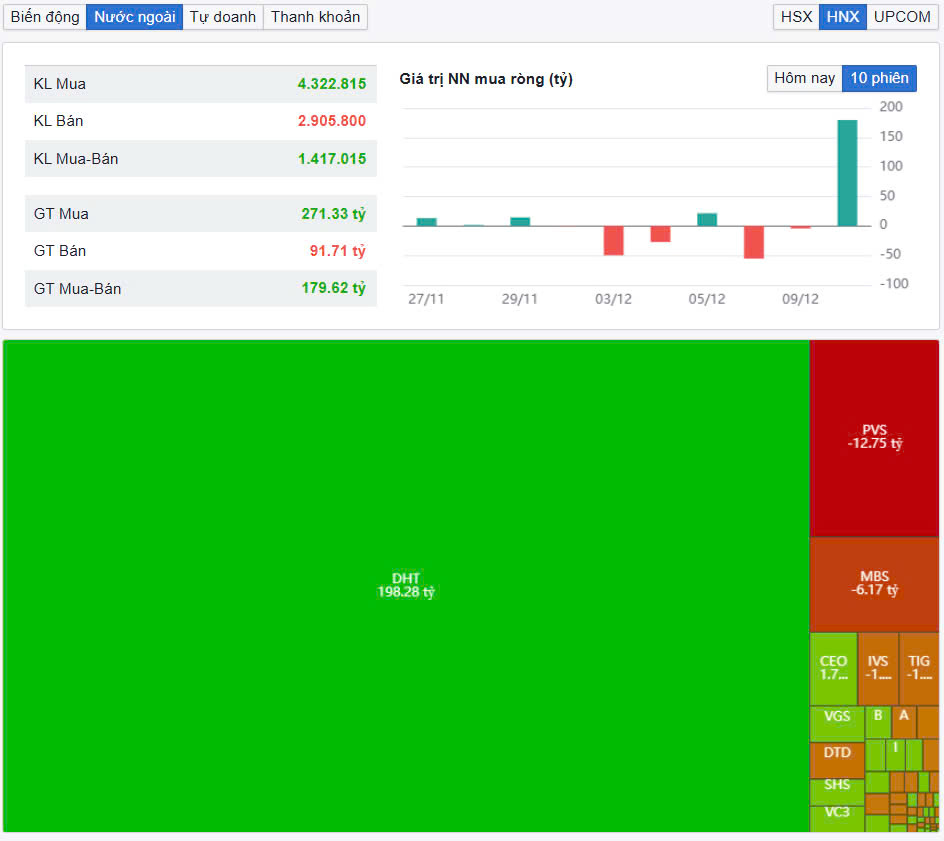

Foreign investors net bought slightly about 28 billion VND on all 3 exchanges. However, this capital flow net sold 132 billion VND on HoSE. DHT topped the list of net buying by foreign investors with 198 billion VND. FPT followed with a net buying value of 124 billion VND. Meanwhile, MWG was the most net sold with 80 billion VND. KDC and VNM were net sold 48 billion VND and 34 billion VND respectively.

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)