|

| China's inflation in June 2023 was close to 0%, surprising economists. (Source: Reuters) |

Deflation risk

Just six months ago, economists worried that China’s reopening after nearly three years of strict Covid-19 containment policies would lead to a surge in economic activity, exacerbating sky-high global inflation.

But now, while consumers are back shopping and enjoying entertainment, the reopening has not produced the results the world had hoped for. The real estate sector remains ailing, youth unemployment is high, and $35 trillion in local government debt has weighed on economic growth, causing domestic consumer prices to stagnate.

China's consumer price index (CPI) was nearly zero percent in June 2023, surprising economists who had expected another 0.2 percent increase, according to the National Bureau of Statistics (NBS). This brought China's inflation to its lowest level since February 2021, mainly due to lower pork and energy prices.

Meanwhile, core inflation (excluding more volatile food and energy prices) fell 0.1% to 0.4%, from 0.6% in May.

“The risk of deflation is very real,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “Both measures of inflation add to evidence that the recovery is weakening, with deflationary concerns weighing on consumer confidence.”

Nomura analysts predict inflation will “slip further” next month, to -0.5%.

Also in June 2023, China's producer price index (PPI) fell 5.4% year-on-year, the sharpest decline in producer prices in more than seven years and the ninth consecutive month of decline for the index.

Nomura economist Harrington Zhang said the PPI result was largely due to a sharp decline in raw material prices and weak demand from manufacturers.

Amid signs of weak growth and falling producer prices, the Chinese government and the People's Bank of China (PBoC) have been trying to boost spending and investment in the country.

While other countries have been raising interest rates to fight inflation, the PBoC decided to cut its key medium-term interest rate in June. China's State Council also pledged to introduce stronger measures to boost economic growth.

Nomura analysts believe the latest inflation data will prompt the world's second-largest economy to unleash more fiscal and monetary stimulus throughout the year.

“The ultra-low inflation reading supports our view that the PBoC is likely to deliver two more policy rate cuts in the remainder of the year,” the analysts stressed.

Alarm bells

An economy mired in deflation can be a nightmare scenario for a country.

“The risk of the economy being stuck in this deflationary environment is real,” explained Gregory Daco, chief economist at accounting firm Ernst & Young (EY). “In terms of growth potential, if you have a deflationary risk and a high debt environment at the same time, that’s the worst thing you can do.”

| China is facing a “balance sheet recession” like that seen during Japan’s “lost decade” in the 1990s. |

Deflation makes debt more expensive and also delays consumer spending and investment, Daco noted. As a result, deflation delays growth and increases the cost of debt.

Nomura Research Institute chief economist Richard Koo warned that China is facing a “balance sheet recession” similar to that seen during Japan’s “lost decade” in the 1990s, when consumers and businesses shifted from investment and spending to debt reduction due to persistent deflation.

The impact could be even worse in China, where the country lacks a social safety net, Daco said. Without government support, Chinese consumers are forced to save more instead of spending and investing to fuel economic growth.

“It’s a longstanding, structural problem in the world’s second-largest economy that has been going on for decades,” said economist Daco. “Consumers tightening their purse strings and increasing their savings are one of the reasons why Beijing has seen such an impressive growth trajectory despite the difficulties.”

Good news for the Fed

While deflation certainly won't help China's economy, it could be a welcome sign for the US Federal Reserve, which is trying to quell inflation.

Mr. Ed Yardeni, President of market research company Yardeni Research, said that China's deflation could cause the US PPI index to "suddenly drop".

Historically, the world's largest economy's PPI has been "highly correlated" with China's due to the close trade ties between the two countries. Beijing's weak post-pandemic recovery could be a deflationary force for the global economy, he noted.

Economist Daco said that while no central bank wants to see deflation, the Fed might be comfortable seeing “deflation from the rest of the world.”

Still, experts say China's deflation may be good news for Fed officials, but it's a risk to the global economy in the long term.

China’s rise from a developing country to a global superpower and major economic rival to the United States since the 1990s has reshaped the world. Persistent deflation could change that.

Especially for Generation Z (born between 1997 and 2012) of the world's second-largest economy - who are struggling with record unemployment rates of more than 20% - deflation is a disaster waiting to happen.

Source

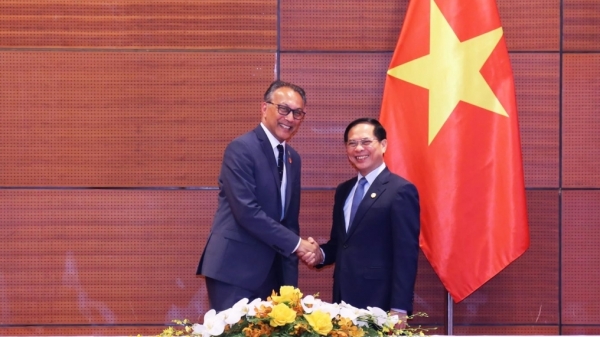

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)