Domestic gold price today April 18, 2025

At the time of survey at 4:30 a.m. on April 18, 2025, the domestic gold price increased to a new peak of 121 million VND/tael. Specifically:

DOJI Group listed the price of SJC gold bars at 115.5-118 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 115.5-118 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118-121 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 4.5 million VND/tael for both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 115.5-118 million VND/tael (buying - selling, up 3 million VND/tael in buying direction - up 2.5 million VND/tael in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 114.5-117 million VND/tael (buy - sell), gold price increased by 3.5 million VND/tael in buying direction - increased by 3 million VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114.5-117.5 million VND/tael (buy - sell); an increase of 4 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); an increase of 3 million VND/tael in both buying and selling compared to yesterday.

The latest gold price list today, April 18, 2025 is as follows:

| Gold price today | April 18, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 115.5 | 118 | +2500 | +2500 |

| DOJI Group | 115.5 | 118 | +2500 | +2500 |

| Red Eyelashes | 118 | 121 | +4500 | +4500 |

| PNJ | 115.5 | 118 | +2500 | +2500 |

| Vietinbank Gold | 118 | +2500 | ||

| Bao Tin Minh Chau | 115.5 | 118 | +3000 | +2500 |

| Phu Quy | 114.5 | 117 | +3500 | +3000 |

| 1. DOJI - Updated: April 18, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 115,500 ▲2500K | 118,000 ▲2500K |

| AVPL/SJC HCM | 115,500 ▲2500K | 118,000 ▲2500K |

| AVPL/SJC DN | 115,500 ▲2500K | 118,000 ▲2500K |

| Raw material 9999 - HN | 114,300 ▲4000K | 116,600 ▲4000K |

| Raw material 999 - HN | 114,200 ▲4000K | 116,500 ▲4000K |

| 2. PNJ - Updated: April 18, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,000 ▲3500K | 117,000 ▲3400K |

| HCMC - SJC | 115,500 ▲2500K | 118,000 ▲2500K |

| Hanoi - PNJ | 114,000 ▲3500K | 117,000 ▲3400K |

| Hanoi - SJC | 115,500 ▲2500K | 118,000 ▲2500K |

| Da Nang - PNJ | 114,000 ▲3500K | 117,000 ▲3400K |

| Da Nang - SJC | 115,500 ▲2500K | 118,000 ▲2500K |

| Western Region - PNJ | 114,000 ▲3500K | 117,000 ▲3400K |

| Western Region - SJC | 115,500 ▲2500K | 118,000 ▲2500K |

| Jewelry gold price - PNJ | 114,000 ▲3500K | 117,000 ▲3400K |

| Jewelry gold price - SJC | 115,500 ▲2500K | 118,000 ▲2500K |

| Jewelry gold price - Southeast | PNJ | 114,000 ▲3500K |

| Jewelry gold price - SJC | 115,500 ▲2500K | 118,000 ▲2500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,000 ▲3500K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,000 ▲3500K | 117,000 ▲3400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,000 ▲3500K | 117,000 ▲3400K |

| Jewelry gold price - Jewelry gold 999.9 | 113,500 ▲3000K | 116,000 ▲3000K |

| Jewelry gold price - Jewelry gold 999 | 113,380 ▲2990K | 115,880 ▲2990K |

| Jewelry gold price - Jewelry gold 9920 | 112,670 ▲2970K | 115,170 ▲2970K |

| Jewelry gold price - Jewelry gold 99 | 112,440 ▲2970K | 114,940 ▲2970K |

| Jewelry gold price - 750 gold (18K) | 80,700 ▼1700K | 87,150 ▲2250K |

| Jewelry gold price - 585 gold (14K) | 61,560 ▼2200K | 68,010 ▲1750K |

| Jewelry gold price - 416 gold (10K) | 41,960 ▼2700K | 48,410 ▲1250K |

| Jewelry gold price - 916 gold (22K) | 103,860 ▲2750K | 106,360 ▲2750K |

| Jewelry gold price - 610 gold (14.6K) | 64,460 ▼2120K | 70,910 ▲1830K |

| Jewelry gold price - 650 gold (15.6K) | 69,100 ▼2000K | 75,550 ▲1950K |

| Jewelry gold price - 680 gold (16.3K) | 72,580 ▼1910K | 79,030 ▲2040K |

| Jewelry gold price - 375 gold (9K) | 37,200 ▼2830K | 43,650 ▲1120K |

| Jewelry gold price - 333 gold (8K) | 31,980 ▼2960K | 38,430 ▲990K |

| 3. SJC - Updated: April 18, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 115,500 ▲2500K | 118,000 ▲2500K |

| SJC gold 5 chi | 115,500 ▲2500K | 118,020 ▲2500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 115,500 ▲2500K | 118,030 ▲2500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 ▲3500 | 117,000 ▲3500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 ▲3500 | 117,100 ▲3500 |

| Jewelry 99.99% | 114,000 ▲3500 | 116,400 ▲3500 |

| Jewelry 99% | 110,747 ▲3465 | 115,247 ▲3465 |

| Jewelry 68% | 73,809 ▲1880 | 79,309 ▲2380 |

| Jewelry 41.7% | 43,193 ▲959 | 48,693 ▲1459 |

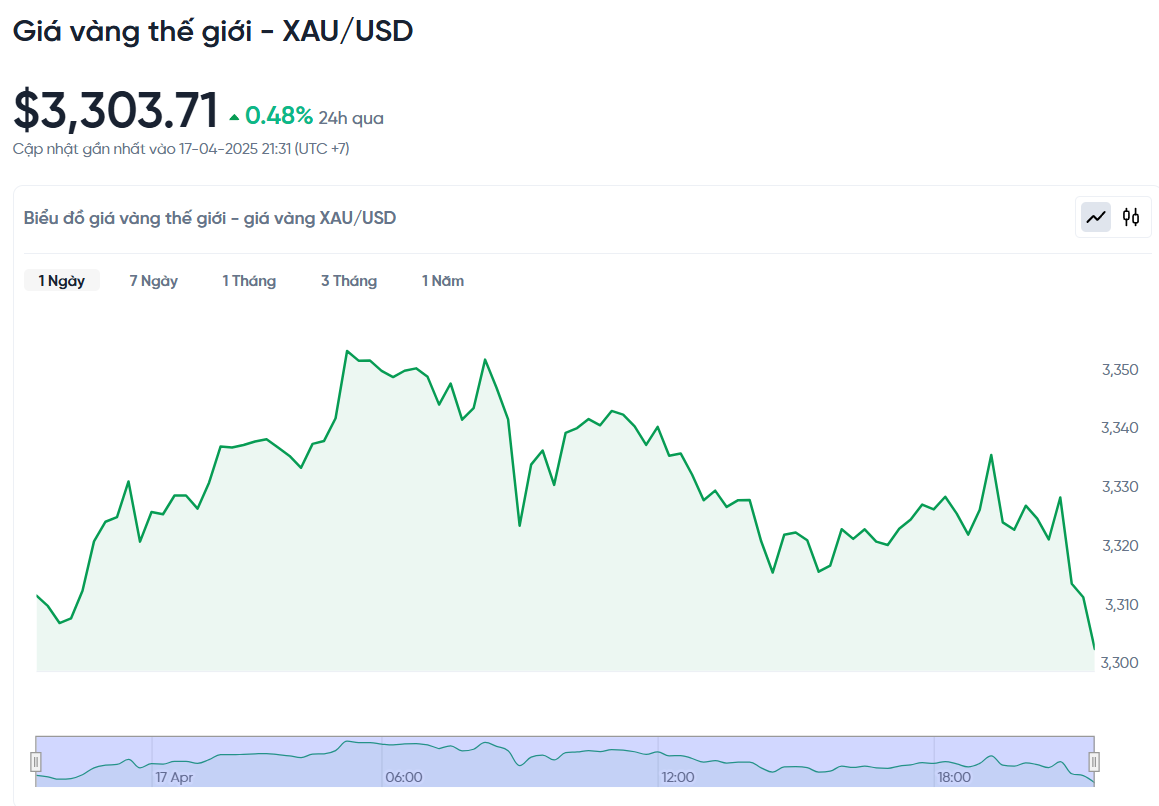

World gold price today April 18, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. today, Vietnam time, was at 3,303.71 USD/ounce. Today's gold price increased by 16.02 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,060 VND/USD), the world gold price is about 104.83 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 13.17 million VND/tael higher than the international gold price.

The world gold price has temporarily stopped increasing after setting a new record, as investors took profits after the previous strong increase. The initial reason for the increase in gold price was due to concerns about the new wave of tariffs by US President Donald Trump.

Specifically, the price of gold previously hit a record high of 3,357.4 USD. Since the beginning of the week, the price of gold has increased by 2.5%. The price of gold futures in the US also decreased by 0.5% to 3,330.5 USD. The heat of the gold market is also shown in the fact that the trading volume of gold futures has surpassed many other investment channels, becoming one of the most vibrant commodities on Wall Street.

"This correction could be due to profit-taking. In addition, the US dollar has recovered slightly after a period of weakness, making gold less attractive. However, every dip has been bought immediately, showing that market sentiment remains very positive," said analyst Ross Norman.

The dollar rebounded from a three-year low, making gold more expensive for holders of other currencies. Gold prices jumped 3.6% yesterday after President Trump ordered an investigation into possible tariffs on critical minerals, in addition to assessments of tariffs on pharmaceuticals and chips.

Fed Chairman Jerome Powell said he would wait for more data before adjusting interest rates, while warning that Trump's tariff policies could push inflation further away from the central bank's target.

"The market seems to think that gold will benefit in any situation," said Carsten Menke, an expert at Julius Baer. However, physical demand in India was quite quiet this week due to high prices, while in China, the world's largest gold consumer, the price difference remained stable.

"The lack of participation from traditional investors in this gold rally could signal that the trend is nearing a peak. However, it is difficult to see a sharp decline in gold prices at this point, unless it is technically overbought," Norman said.

In other precious metals, silver fell 0.9% to $32.46 an ounce, platinum fell 1% to $957.18 and palladium lost 2.3% to $949.72. Despite the slight decline, gold is still considered a safe haven in the current volatile market.

Gold Price Forecast

The gold market is witnessing a slight profit-taking from investors after the release of positive US employment data. According to the US Department of Labor, the number of people filing for unemployment benefits for the first time in the week ending April 12 reached 215,000, lower than the 225,000 forecast by analysts. Although there was selling pressure after the employment report, the gold market's reaction was quite mild compared to the strong increase in recent days.

In addition, gold prices continue to trade at high levels due to strong support after the European Central Bank (ECB) cut interest rates. The ECB once again lowered three key interest rates by 25 basis points. Specifically, the deposit rate, main refinancing rate and marginal lending rate will be reduced to 2.25%, 2.40% and 2.65%, respectively.

Technically, June gold futures remain in a strong uptrend with the bulls in the driver’s seat. The bulls’ next target is to close above solid resistance at $3,500.

Meanwhile, the bears are aiming to push gold prices below the $3,200 support level. Key levels to watch include resistance at $3,371.90 (last night’s high) and $3,400, while support lies at $3,325.50 (last night’s low) and $3,300.

KCM Trade expert Tim Waterer said that the weakening of the US dollar and the defensive sentiment of investors continue to create favorable conditions for gold to increase. Sharing the same view, Mr. Jerry Prior, CEO of Mount Lucas Management, commented that although gold has entered the "overbought" zone, it is still well supported by the risk-off sentiment in the market.

Investors have never faced such uncertainty, Prior said. In previous crises, such as the COVID-19 pandemic or the Russia-Ukraine conflict, markets had clear strategies for responding. But now, every scenario is unpredictable and there are no rules that really work.

He believes that gold prices may continue to rise in the coming time, because this year alone, prices have increased by more than 22% and increased by 37% compared to the same period last year. This is a good opportunity for investors to rebalance their portfolios.

Goldman Sachs also noted that central bank demand for gold is exceeding expectations. The global recession and geopolitical risks continue to drive money into gold. ANZ Bank predicts that gold prices could reach $3,600 an ounce by the end of the year and $3,500 an ounce within the next six months.

Source: https://baonghean.vn/gia-vang-hom-nay-18-4-2025-gia-vang-trong-nuoc-va-the-gioi-tam-dung-da-tang-do-chot-loi-10295352.html

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)