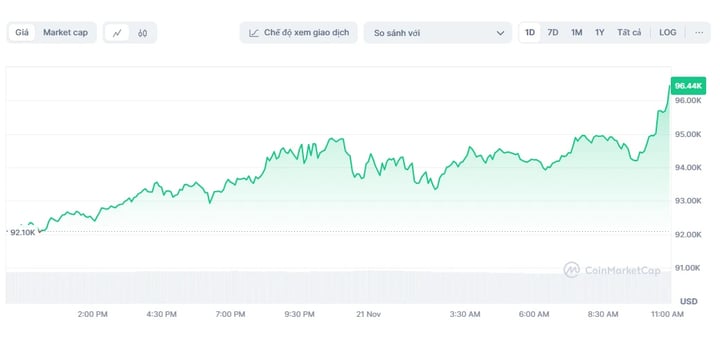

Bitcoin price rises to record $96,500/BTC. (Photo: Thomas Trutschel)

According to CoinMarketCap, the Bitcoin fever shows no signs of cooling down as investors continue to push the digital currency's market price to $96,500. In the past 24 hours, Bitcoin has increased by nearly 5% and has broken its own record three times.

The increase on the morning of November 21 (Vietnam time) also brought the capitalization of this digital currency to over 1,910 billion USD for the first time.

However, while all the attention was on Bitcoin, the rest of the cryptocurrency market was relatively gloomy. In general, the world's largest cryptocurrencies fluctuated up/down in a narrow range, typically Ethereum (+0.4%), Solana (+2%), XRP (+2.3%), Binance Coin (-0.8%), Dogecoin (-1%), Cardano (+2.5%), TRON (-0.07%).

According to Bloomberg , the first options trades of BlackRock's iShares Bitcoin Trust ETF show that investors predict the coin could continue to set new records.

More than 350,000 options contracts were traded after the Nasdaq listed on November 19, of which about 80% were bullish bets.

Bitcoin's 24-hour liquidity rises to $80 billion. (Photo: CoinMarketCap)

Of the 10 most traded options, nine were bullish bets. The most active trading was in January calls with a strike price of $55, followed by December calls with a strike price of $65—a 25% premium to the ETF’s closing price on Nov. 18.

Bitcoin hit an all-time high in tandem with the launch of these options. Some investors hope that the launch of a Bitcoin ETF in the US will attract more capital into the digital asset, which has surged after the election of Donald Trump, a cryptocurrency advocate, in the US presidential election.

Options products of the Grayscale Bitcoin Trust, Grayscale Bitcoin Mini Trust, and Bitwise Bitcoin ETF will also begin launching on November 20.

According to Joel Kruger, market strategist at LMAX Groug, the approval of Bitcoin and Ethereum spot ETFs this year shows the maturity of the cryptocurrency market as well as mainstream, institutional adoption from regulators.

Meanwhile, CNBC said traders are closely watching President Trump's upcoming appointment of Treasury Secretary and Chairman of the US Securities and Exchange Commission (SEC).

Source: https://vtcnews.vn/pha-ky-luc-3-lan-trong-ngay-gia-bitcoin-vuot-96-500-usd-ar908737.html

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

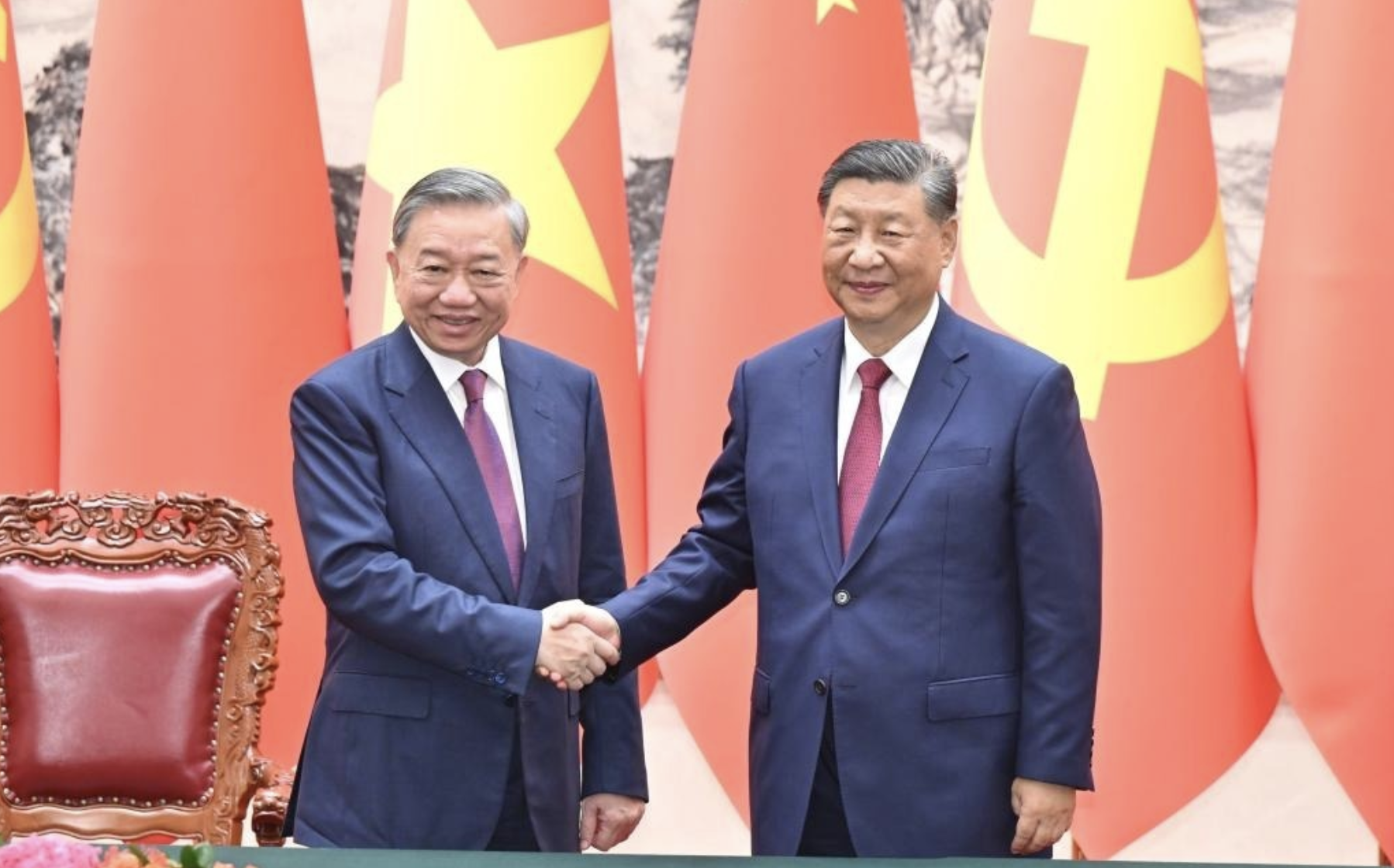

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)