The National Assembly passed the Law amending and supplementing a number of articles of the Securities Law; non-prefunding applied from November 2, 2024; technology stocks continuously flourished... are highlights of the stock market in 2024 voted by Investment Electronic Newspaper.

The most prominent highlights in the stock market 2024

The National Assembly passed the Law amending and supplementing a number of articles of the Securities Law; non-prefunding applied from November 2, 2024; technology stocks continuously flourished... are highlights of the stock market in 2024 voted by Investment Electronic Newspaper.

NATIONAL ASSEMBLY OFFICIALLY PASSES AMENDED SECURITIES LAW

On November 29, 2024, within the framework of the 8th Session of the 4th National Assembly, the National Assembly passed the Law amending and supplementing a number of articles of the Securities Law.

Accordingly, the Securities Law is amended and supplemented in Article 1 of the Law amending 9 Laws, specifically adding provisions on improving transparency and efficiency as well as strengthening supervision and strict handling of fraudulent and deceptive acts in securities issuance and offering activities; Amending and supplementing regulations to remove practical obstacles, promoting the development of the securities market with the goal of upgrading the securities market.

This is an important step to further enhance transparency and efficiency in stock market activities, prevent manipulation and fraud, and promote market development towards the goal of upgrading.

APPLYING NON-PREFUNDING, VIETNAM IS CLOSER TO UPGRADE MILESTONE

On November 2, 2024, Circular 68/2024/TT-BTC was officially applied with notable content related to the fact that foreign institutional investors can trade to buy shares without requiring sufficient funds and the roadmap for information disclosure in English.

The most notable content is the regulation that foreign institutional investors can trade to buy stocks without requiring sufficient funds (Non Pre-funding solution - NPS). The new Circular stipulates that investors must have sufficient funds when placing orders to buy securities, except for two cases: (1) investors trading on margin as prescribed in Article 9 of this Circular; (2) Organizations established under foreign law participating in investment in the Vietnamese securities market buying stocks do not require sufficient funds when placing orders as prescribed in Article 9a of this Circular.

With the application of non-prefunding, Vietnamese securities take an important step forward and bring expectations that the Vietnamese stock market will soon be upgraded in 2025.

WELCOMING THE WORLD'S "EAGLES", TECHNOLOGY STOCKS CONTINUOUSLY "TAKE OFF"

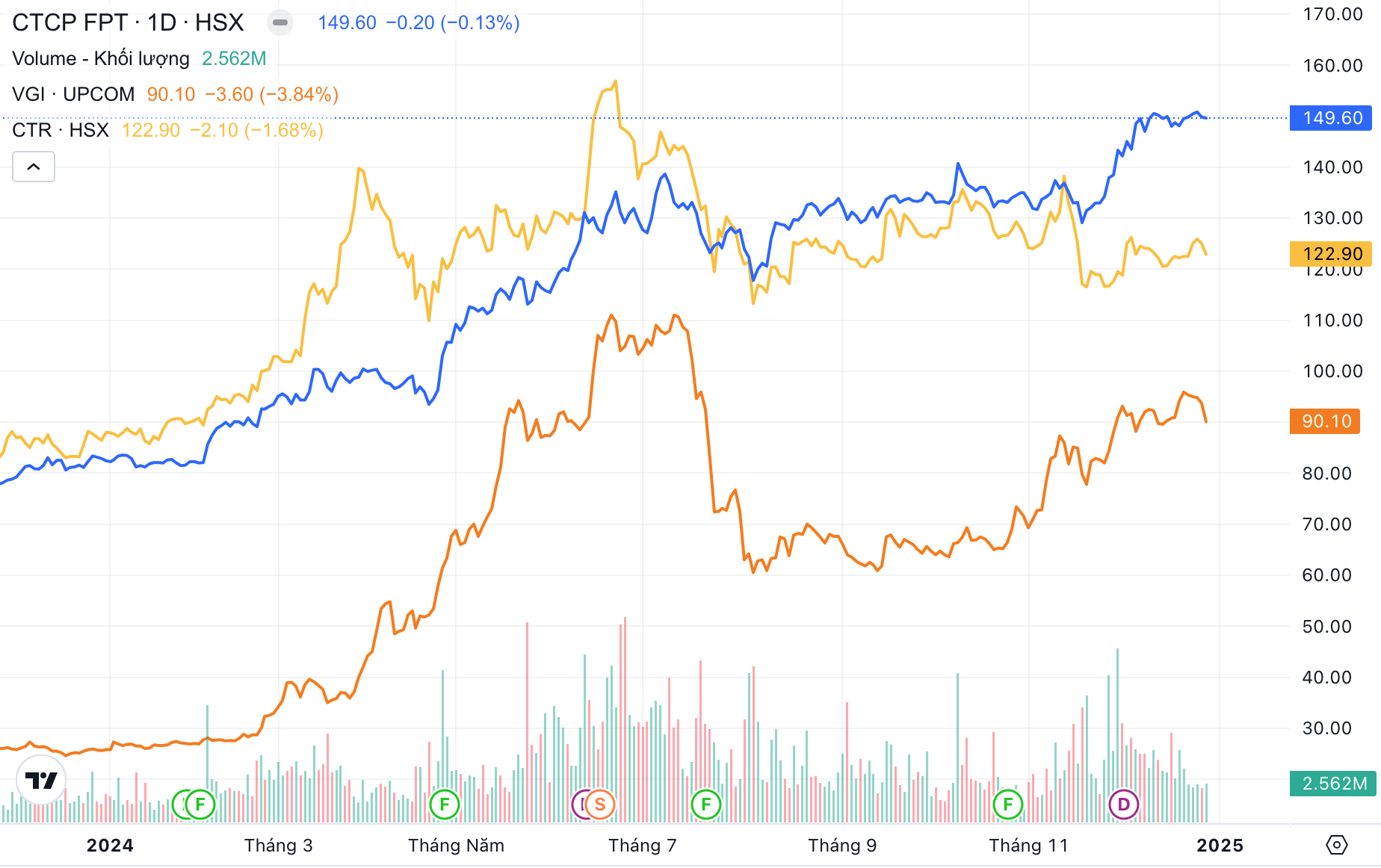

From the beginning of the year, the wave of technology stocks formed and continued until the end of the year. A series of positive information in the industry has given momentum for technology stocks to "take off". Although not accounting for a large proportion of the stock market, many stocks in this industry have had a spectacular increase in the past year and most of them have reached historical peaks.

Typically, FPT has increased by 81% compared to the beginning of the year, continuously breaking its own historical peak. VGI shares had a period of increasing by more than 156,000 VND/share in June 2024, currently at the price of 122,900 VND/share, VGI is still priced 2.4 times higher than at the beginning of the year. CTR has also increased by 40% in the past year and had a period of being above 100,000 VND/share in the middle of the year.

|

| Tech stocks like FPT, VGI, CTR all peaked in 2024. |

Vietnamese technology stocks have exploded along with the wave of technology stocks around the world. Along with that are historic events. Last April, the US semiconductor giant Nvidia visited Vietnam and announced a $200 million project with FPT to establish an artificial intelligence (AI) factory to serve AI development in the region, while improving the capacity to deploy AI and Cloud services worldwide. In December 2024, NVIDIA Chairman Jensen Huang officially visited Vietnam, signing an agreement between the Vietnamese Government and NVIDIA on cooperation to establish the NVIDIA Artificial Intelligence (AI) Research and Development Center and the AI Data Center in Vietnam.

INVESTORS DISAPPOINTED BY THE UNFULL PROMISE OF THE KRX SYSTEM

The promise of the KRX system to investors in the Vietnamese stock market was prepared since 2012, after more than 12 years, this system has not been introduced to investors yet. Not only has it been delayed many times, 2024 is also the first time investors have been "disappointed" when there was a specific announcement of the KRX's operational date but then continued to be delayed.

At the end of April 2024, the Ho Chi Minh City Stock Exchange (HoSE) sent a notice to securities companies that the KRX system was preparing to operate from the beginning of May 2024 and requested securities companies to check transactions on their systems with the new KRX system. Securities companies will make the conversion between April 27, 2024 and April 30, 2024. If the conversion is successful, the KRX system will officially be deployed from May 2, 2024 with transaction data taken from the end of April 26, 2024. Immediately after the announcement of HoSE, securities companies simultaneously notified investors about this new conversion.

However, shortly thereafter, the State Securities Commission notified the Exchanges and the Vietnam Securities Depository and Clearing Corporation (VSDC) that it did not approve the application of KRX on May 2, 2024, as submitted by HoSE, on the grounds that this application did not comply with legal regulations. Securities companies also stopped implementing the connection of the new trading system and re-established the trading system connected to the current system of the Exchange in operation.

Since then, KRX has not yet set an official return date.

FOREIGN INVESTORS RECORD NET SELLING IN VIETNAM'S STOCK MARKET

2024 marks a year of record net withdrawal of foreign investors from the Vietnamese stock market. This development has been prolonged under strong net selling pressure, which has become a major obstacle that has held back the VN-Index and reduced new cash flow into the market.

In total, in the first 11 months of 2024, foreign investors net sold about VND88,000 billion on the HoSE, a record number in more than 24 years of the Vietnamese stock market's operation. January was the only month that foreign investors stopped net selling, while in May and June 2024, foreign investors net sold more than VND14,000 billion per month on the HoSE. The net withdrawal of foreign investors is assessed to be mainly due to the impact of exchange rate pressure in the past year.

|

| Foreign investors' trading volume on HoSE in 2024. |

Along with that, market liquidity also decreased due to investors being more cautious in the face of unpredictable variables in the market, while waiting for new supporting factors.

FIRST INSTANCE TRIAL OF THE CASE OF STOCK MARKET MANIPULATION AT FLC GROUP

From July 22 to August 5, the Hanoi People's Court opened the first-instance trial of the case that occurred at FLC Group Joint Stock Company. The trial panel sentenced defendant Trinh Van Quyet (former Chairman of the Board of Directors of FLC Group Joint Stock Company - FLC Group, Chairman of Tre Viet Aviation Joint Stock Company) and other defendants in the case for the crime of "Fraudulent appropriation of property" (as prescribed in Article 174, Clause 4, Point a-Penal Code) and "manipulation of the stock market" (Article 211, Clause 2, Point b-Penal Code).

Accordingly, defendant Trinh Van Quyet was sentenced to 18 years in prison for "fraudulent appropriation of property", 3 years in prison for "stock market manipulation", the total sentence for defendant Quyet is 21 years in prison.

After the first instance trial, defendant Quyet filed an appeal to reduce his criminal liability and civil liability. The appeal trial of the case of “Stock Market Manipulation” and “Fraudulent Appropriation of Property” occurring at FLC Group Joint Stock Company took place on December 26, but had to be postponed due to the absence of many defendants and victims.

SILENCE OF HIGHLIGHTED DEALS

In addition to foreign investors' net withdrawal and weak market liquidity, 2024 is also a year with few outstanding deals recorded in the market.

In the whole year of 2024, there was only 1 IPO transaction from the beginning of 2024 from DNSE Securities JSC, raising 37 million USD. With this small number, Vietnam ranked last in the number of IPOs in Southeast Asia, according to statistics from Deloitte.

The market is also gloomy as the number of newly listed enterprises is small on both main exchanges, and state capital divestment has no breakthrough due to the lack of "blockbusters".

A rare historic transaction recorded last year came from Vinhomes JSC through the repurchase of treasury shares. From October 23 to November 21, 2024, Vinhomes repurchased nearly 247 million treasury shares, with an average purchase price of VND 42,444/share, equivalent to a transaction value of up to VND 10,500 billion, the largest in the history of Vietnam's securities market.

Source: https://baodautu.vn/nhung-diem-nhan-noi-bat-nhat-tren-thi-truong-chung-khoan-2024-d236712.html

Comment (0)