SSI Research believes that FDI flows will continue to grow, even when new US tax laws are applied.

Demand for industrial real estate expected to increase sharply thanks to attracting new customers

SSI Research believes that FDI flows will continue to grow, even when new US tax laws are applied.

According to a recent analysis report by the analysis department of SSI Securities Corporation (SSI Research), the growth of FDI capital inflows into Vietnam has maintained its growth momentum over the past 10 years, thanks to the trend of production shift. Countries such as Singapore, Taiwan, and China have contributed significantly to this growth. The reason is that Vietnam has a competitive advantage in terms of favorable investment policies, low labor costs, and a stable economy.

According to the Ministry of Planning and Investment, from 2019 to 2023, industrial land leasing activities in Vietnam have seen positive growth with the area of MOUs and newly signed agreements reaching a compound annual growth rate (CAGR) of 35%. This growth mainly comes from large FDI enterprises such as Samsung, LG, Hyundai, Lotte, Luxshare, Lego, Hyosung and Foxconn, aiming to diversify production and reduce risks in the global supply chain. Average rental prices have also increased significantly, with industrial parks in the North increasing by 35%, while industrial parks in the South increased significantly by 67% from 2020 to Q2/2024.

|

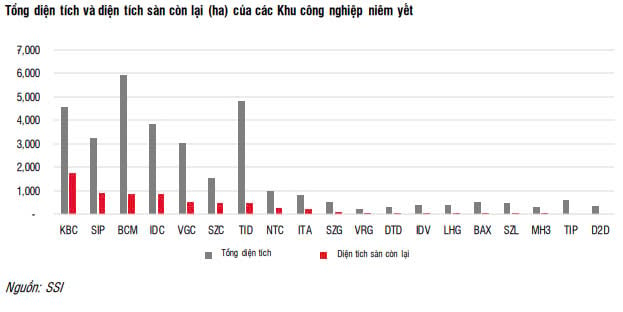

| Companies with large available space for lease such as SIP, IDC, VGC, SZC, KBC, NTC |

However, in 2024, FDI inflows into Vietnam will slow down. In the first 10 months of 2024, total registered FDI capital reached 27.26 billion USD, up only 1.9% over the same period. In the short term, FDI enterprises may wait to see President Trump's new tariff policies, including tax laws affecting imports from Vietnam.

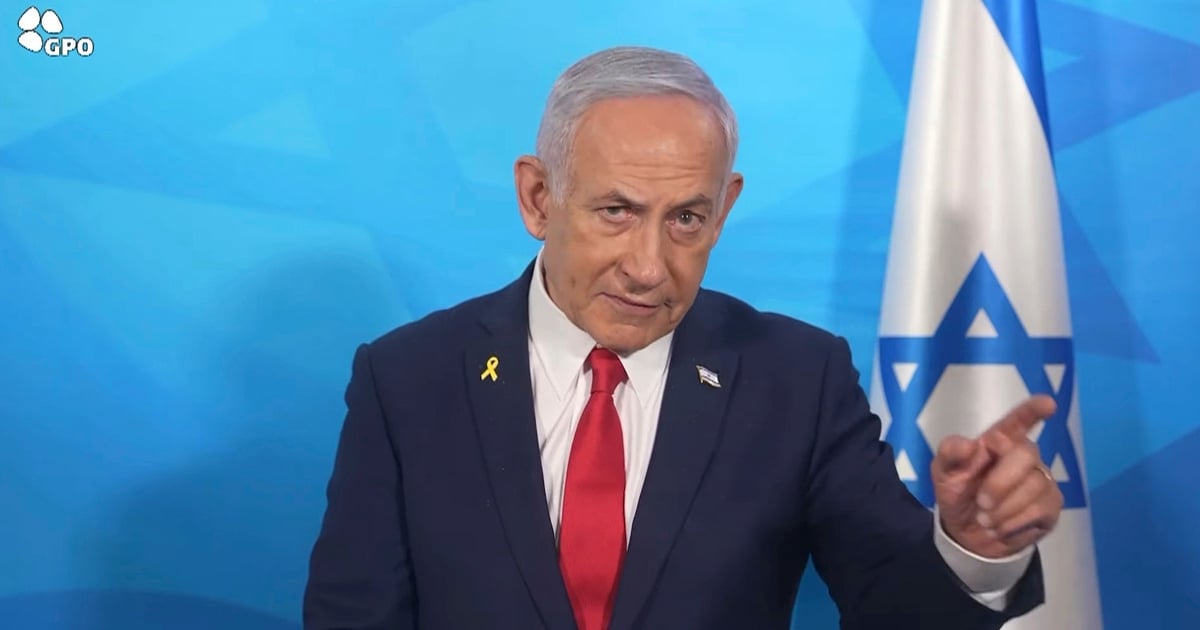

During his 2024 presidential campaign, Mr. Trump emphasized trade measures to protect the US economy. These included a 60% tariff on Chinese goods to reduce the trade deficit and promote domestic production, along with a normal tariff of 10-20% on other countries to protect US industries from foreign competition.

The campaign’s statements indicate a shift toward more protectionist policies, which leaves policies on imported products unclear. In the short term, FDI businesses may wait for more specific information on Trump’s new tariff policies, including tax laws affecting imports from Vietnam.

Explaining the slowdown in FDI capital flows into Vietnam's industrial park real estate sector in 2024, experts from SSI said that a major factor is exchange rate fluctuations. Exchange rate fluctuations can affect project efficiency, leading to FDI enterprises hesitating in making new investments.

Second, SSI Research also emphasized the need for reforms in FDI policies to attract foreign capital into target industries. Currently, Vietnam is competing to attract FDI with neighboring countries such as Indonesia with the Omnibus Law issued or Thailand also has a fund to enhance competitiveness and applies a corporate income tax of 10%.

Third, infrastructure in Vietnam is limited, especially in the southern region. Slow progress in infrastructure construction, leading to higher logistics costs, may make investment less attractive.

Finally, according to experts from SSI, there is not much remaining space available for lease in major industrial parks. This makes it difficult for investors to choose an investment location: According to CBRE, the average occupancy rate reached 81% in the North and 92% in the South by the end of June 2024.

|

| There is not much remaining available space for lease in major industrial parks. |

However, SSI Research also emphasized that the Government is taking actions to address bottlenecks to attract FDI inflows, including researching and establishing mechanisms to support large enterprises affected by the global minimum tax; proposing a Digital Technology Industry Law with incentives for investment in semiconductor manufacturing enterprises. The Government will also amend some provisions in the current Investment Law so that provincial People's Committees can issue investment certificates for new industrial parks. In addition, improving infrastructure to connect industrial centers, such as the North-South Expressway and the railway connecting China and Vietnam, is also a positive factor. Therefore, SSI Research expects FDI inflows to continue to grow, even when new US tax laws are applied.

|

| Logistics Performance Index 2023 in selected countries |

The implementation of new land price lists in many localities from the end of 2024 has led to a significant increase in compensation costs for site clearance in new industrial parks. This will cause increased costs to reduce the profit margin of new industrial park projects to 30-35%, compared to more than 50% in existing industrial park projects.

Source: https://baodautu.vn/batdongsan/nhu-cau-bat-dong-san-khu-cong-nghiep-du-kien-tang-manh-nho-hut-khach-moi-d230006.html

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)