From the beginning of the month, the provincial Social Insurance transferred monthly pension and social insurance allowance payments to the beneficiaries' personal accounts. People did not have to go to a centralized location to receive cash as before.

When pensions and social insurance benefits are transferred to the account, people can withdraw money anytime, anywhere, regardless of the payment schedule. This saves time and costs, and avoids the risk of loss or misplacement of cash for beneficiaries.

Ms. Ngo Thi Huong Tra, in Chanh Lo ward (Quang Ngai city) said, before, we had to check the calendar and arrange the time to receive the money, but since the pension is paid through the bank account, we no longer worry about forgetting the date or losing money while traveling.

We also received a text message saying the money had been transferred to our account. Every month, I calculate my expenses and the remaining amount is left in the account, which is very reassuring.

According to Head of the Department of Communication and Subject Development (Provincial Social Insurance) Ha Tuyen, promoting the payment of pensions and social insurance benefits without using cash is considered by the Provincial Social Insurance as a breakthrough task for 2024 in implementing Project 06 that the Provincial Social Insurance has registered to implement with the Provincial People's Committee.

As of August 30, the rate of pensioners and monthly social insurance beneficiaries receiving money through their accounts reached 55.3%; of which, in urban areas, nearly 64%. Regarding pension payments through accounts, the provincial Social Insurance pays monthly to more than 15,000 people, with a total amount of 115 billion VND, reaching 80% of the total number of pensioners in the province.

In addition, the rate of one-time beneficiaries receiving benefits through bank accounts also reached nearly 90.2%. Of which, urban areas reached more than 93%; unemployment benefits beneficiaries reached nearly 100%.

In the coming time, the provincial Social Insurance will continue to coordinate with relevant agencies to promote propaganda and mobilize pension and social insurance benefit recipients to open bank accounts, striving to make 100% cashless payments to these beneficiaries.

“Not using cash in paying pensions and social insurance benefits helps people and management agencies save time. At the same time, it minimizes risks in the payment process, contributing practically to digital transformation, gradually turning each citizen into a digital citizen in a digital society,” said Mr. Tuyen.

Besides the convenience of transferring pensions and social insurance benefits through bank accounts, there are still shortcomings for people in rural areas. These are areas where there are not many ATMs, people who want to withdraw money must go to the district, town or city center.

Therefore, many people want banks to open more ATMs in rural and mountainous areas to make it easier to withdraw money. Mr. Le Long, in Duc Phong commune (Mo Duc), shared, I receive my pension through my bank account. However, rural communes like Duc Phong do not have ATMs, so people have to go to Mo Duc town or to the Duc Phong Commune People's Credit Fund to withdraw cash.

“People are very supportive of receiving salaries through accounts, but banks need to consider investing in ATMs in commune centers to help people withdraw money more conveniently without having to travel far,” Mr. Long suggested.

According to BA SON (Quang Ngai Newspaper)

Source: https://vietnamnet.vn/nhan-luong-huu-qua-tai-khoan-ngan-hang-loi-ca-doi-be-2322939.html

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

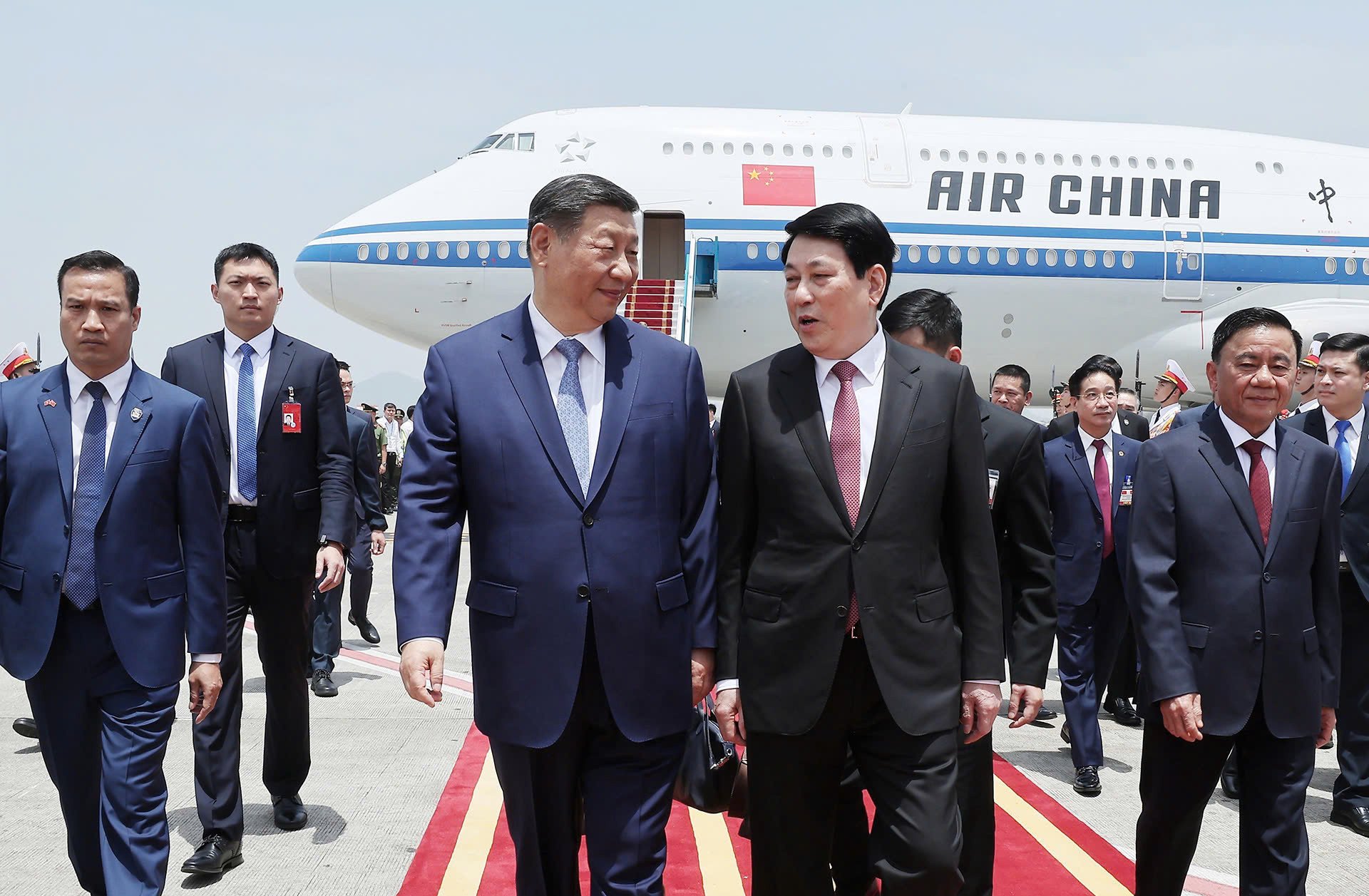

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)