Overview of the workshop related to special consumption tax on products harmful to health on the morning of September 20 - Photo: N.NHIÊN

On September 20, the Ministry of Health held a workshop on the necessity of increasing special consumption tax on items harmful to health to achieve the goal of reducing the rate of use of alcohol, beer, cigarettes, and sugary drinks for the benefit of public health in Hanoi.

Impact of taxes on unhealthy products

In the draft revised Law on Special Consumption Tax, which is being consulted, a number of goods that are harmful to health are added, specifically tobacco, pipe tobacco and other types of drugs; soft drinks according to Vietnamese Standards (TCVN), with sugar content over 5g/100ml...

Speaking at the workshop, Ms. Dinh Thi Thu Thuy, Deputy Director of the Legal Department (Ministry of Health), affirmed that the application of special consumption tax on products harmful to health is important and necessary to protect people's health. The draft Law on Special Consumption Tax (amended) this time has included these items. This is a good sign, Ms. Thuy commented.

Mr. Nguyen Tuan Lam shared at the workshop - Photo: N.NHIÊN

Speaking at the workshop, Mr. Nguyen Tuan Lam, expert in preventing non-communicable disease risk factors, World Health Organization (WHO) Office in Vietnam, affirmed that three products, tobacco, alcohol and sugary drinks, are directly harmful to health as well as future consequences.

Smoking is a risk factor for 11 types of cancer and a host of other chronic diseases. In particular, tobacco production and consumption have recently tended to increase rapidly.

"International experience shows that tobacco tax is the main measure to reduce demand. However, this solution is being implemented very poorly in Vietnam. In Southeast Asia, Vietnam is in the top 3 countries with the cheapest tobacco prices, only behind Laos and Cambodia. Thailand is the country with the highest tobacco prices," said Mr. Lam.

Mr. Lam cited the contribution of tobacco harm prevention policies in reducing the number of smokers in Thailand, of which 61% is due to taxes, 22% is due to banning advertising and promotions, and the rest is due to other health warning and communication measures.

Meanwhile, in Vietnam, the average price of a pack of cigarettes has remained virtually unchanged for 10 years. The real price of beer and wine has decreased significantly in the past 10 years. Mr. Lam believes that the current tax increase does not affect cigarette smuggling or reduce beer and wine consumption in Vietnam.

Taxes need to be raised to change behavior.

Ms. Hoang Thi Thu Huong, Department of Legal Affairs (Ministry of Health), said that the mixed tax calculation method and total tax rate must be large enough to impact changes in consumption levels.

Taxes need to be increased on a regular schedule so that cigarette prices keep up with income growth and gradually move towards the optimal tax rate of 70-75% of retail prices as recommended by WHO.

For sugary drinks, the draft proposes a tax rate of 10% on the selling price of manufacturing and importing enterprises. According to calculations, this tax rate will only increase the retail price by 5%. Such an increase in retail price is insignificant and not enough to change consumer behavior.

For example, a soft drink product currently priced at VND10,000/bottle after applying special consumption tax has a selling price of VND10,500/bottle.

Mr. Nguyen Tuan Lam also said that WHO recommends that taxes on products that are harmful to health should be increased regularly, so that the increase is higher than the increase in inflation and income. According to international experience, tax rates have a significant impact in reducing the consumption of products that are harmful to health.

For sugary drinks in particular, Vietnam should consider applying a sugary beverage tax roadmap to reach a tax rate of 20% of the retail price (ie increasing the manufacturer's selling price by 40%) as recommended by the global WHO, to reduce health risks for future generations. In the long term, it is advisable to consider taxing by sugar content or threshold to encourage products with less sugar.

It is expected that the draft will be submitted to the National Assembly for comments in October and approved in May 2025.

Source: https://tuoitre.vn/nguoi-viet-dung-nhieu-san-pham-co-hai-tang-thue-co-the-giam-tieu-thu-20240920113621006.htm

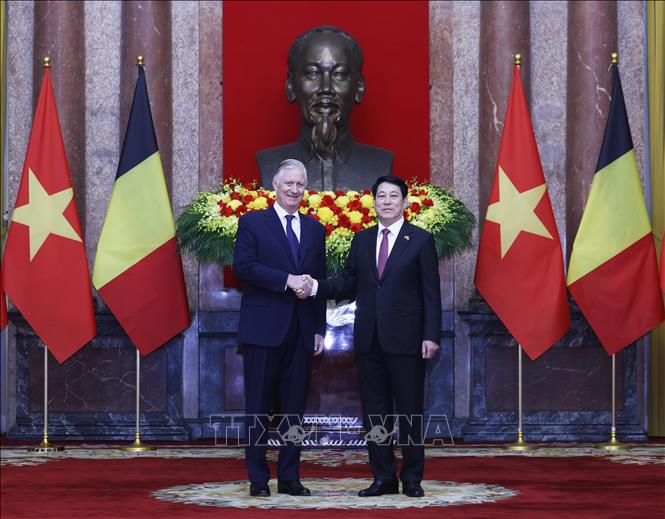

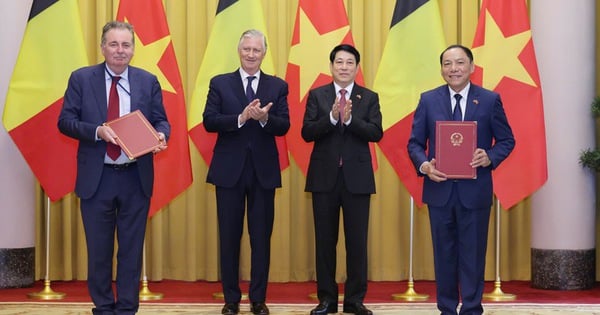

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

Comment (0)