Many banks are rushing to increase savings interest rates to attract more deposits - Photo: QUANG DINH

Why do small banks increase interest rates?

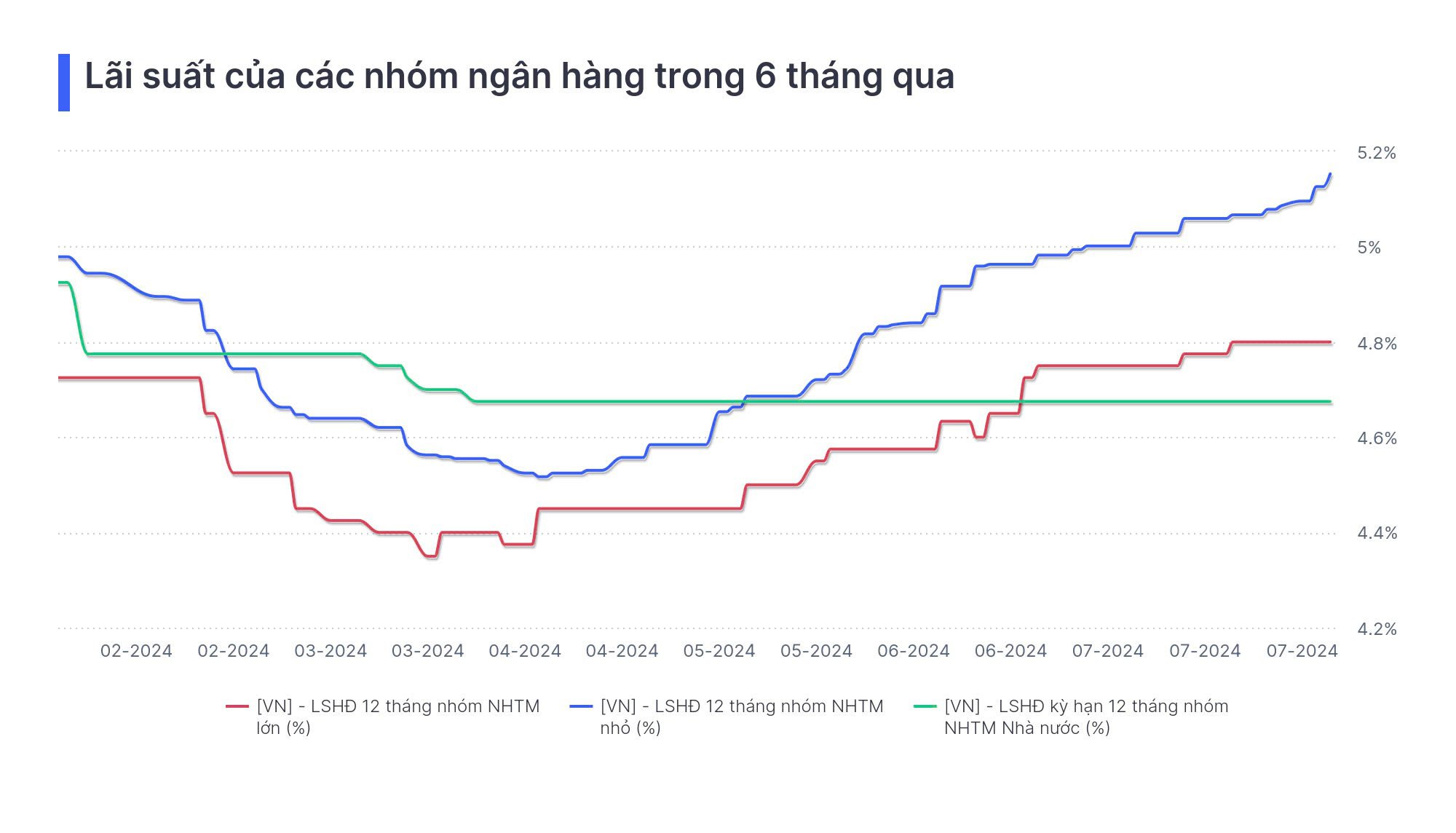

Data from Wigroup - a data solutions provider - shows that the recent increase in deposit interest rates occurred mainly at small commercial banks.

In the past week alone, interest rates for this group increased from an average of 5.07% to 5.15% in 2-8.

Looking back at the fluctuations from February to August this year, the 12-month term deposit interest rates of small commercial banks have increased sharply compared to those of state-owned commercial banks and large commercial banks.

Among them, small commercial banks (Oceanbank, NCB, NamABank...) have increased interest rates from the bottom of 4.5% to 5.15%. The highest is BacABank, which just increased interest rates on July 29 to 5.75%.

Meanwhile, the interest rates of larger commercial banks (MBB, ACB, TCB, VPB...) increased slightly but at a lower rate, from 4.35% to 4.8%. The group of state-owned commercial banks remained unchanged at the bottom level of 4.68%.

The increase in deposit interest rates of small commercial banks is believed to come from many factors, mainly stemming from the need to compete to attract capital.

Mr. Truong Dac Nguyen - Head of Analysis Department of Wigroup Data Solutions Company - commented that in the first 6 months of this year, the mobilization interest rates of banking groups were almost the same, making small commercial banks less attractive when compared with large reputable banks.

Therefore, increasing interest rates is a measure to create an attractive interest rate gap, attracting depositors.

Interest rate developments of banking groups in the past 6 months - Data: Widata

However, Mr. Nguyen forecasts that 12-month deposit interest rates of major banks could also increase by 25 to 50 basis points in the remaining period of 2024, reaching 5% to 5.2% by the end of the year.

Factors affecting liquidity of small and medium private commercial banks

The report of the KB Securities Vietnam (KBSV) analysis team also believes that deposit interest rates will continue to increase from now until the end of the year, reaching levels around the Covid-19 bottom in the 2020-2021 period.

In particular, key factors affecting the mobilization interest rate level include exchange rate pressure and recovering credit demand.

According to KBSV, the exchange rate in the third quarter will still have fluctuations, although the risk of a sharp increase is no longer worrisome.

The State Bank will still maintain its orientation of keeping interbank interest rates at a high enough level to limit carry trade, in parallel with the USD selling business to meet business demand in the context of imports forecast to continue to increase in the coming time.

These will directly impact system liquidity and increase deposit interest rates in market 1, especially in the group of small and medium-sized private commercial banks with less flexible deposit sources and banks recording good credit growth, KBSV experts commented.

In addition, the expected recovery in credit demand will lead to a demand for capital mobilization, thereby causing the upward trend in mobilization interest rates to continue at the end of the year.

According to KBSV, credit growth is forecast to recover more clearly as the economy warms up in the second half of 2024.

In fact, credit in the second quarter recorded an improvement, reaching 6% year-on-year as of June 30, mainly led by real estate and infrastructure development loans.

Source: https://tuoitre.vn/ngan-hang-nho-don-dap-tang-lai-suat-huy-dong-nhom-quoc-doanh-binh-chan-o-day-20240802220337369.htm

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)