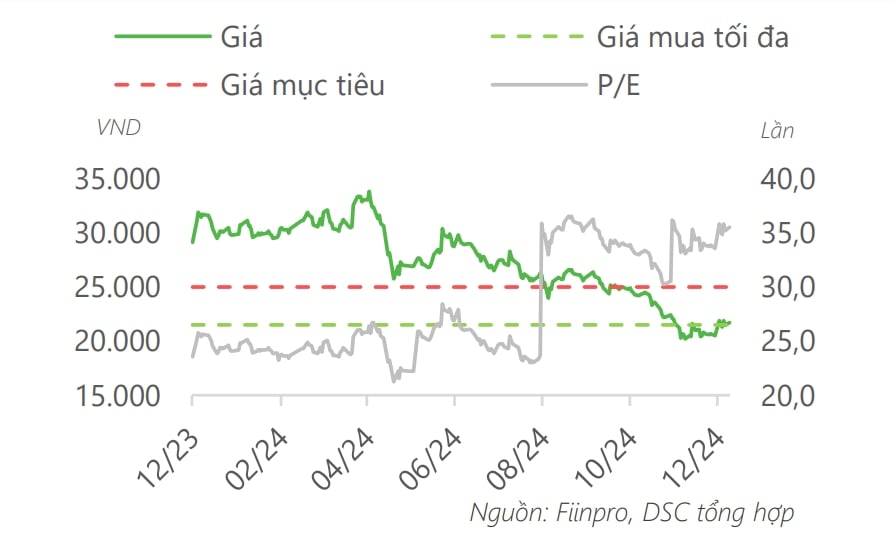

Buy recommendation for PLC stock

According to experts from DSC Securities Company, the business results of Petrolimex Petrochemical Corporation (PLC) "plummeted" in the first 9 months of 2024, specifically, revenue reached VND 4,808 billion (-16.7% compared to the same period last year), profit after tax (LNST) reached VND 23 billion (-71.8% compared to the same period last year); respectively completing 62% and 29% of the yearly plan. The enterprise had to ask for the opinion of the General Meeting of Shareholders on adjusting down the 2024 production and business plan. Under the pressure of slow disbursement of public investment, price competition with imported products, and excess supply.

In 2025, demand from the public investment sector may "revive" sales volume, but low profit margins will remain due to high competitive pressure. Therefore, DSC maintains the valuation for PLC shares at VND25,000/share, with a conservative projected PB valuation of 1.55x for fiscal year 2025; and recommends a safe buy zone around VND21,500/share.

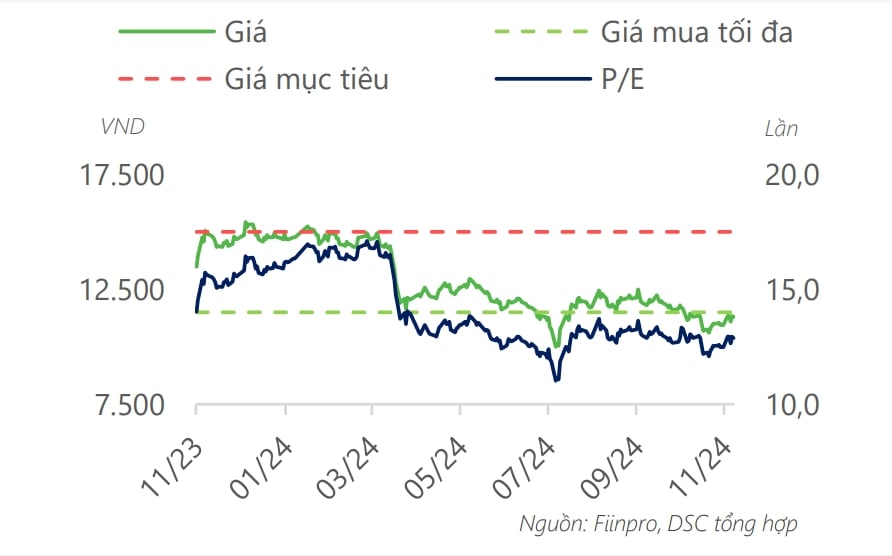

Buy recommendation for HHV stock

DSC believes that the business results of Deo Ca Transport Infrastructure Investment Joint Stock Company (HHV) will continue to record strong growth in 2025, with projected revenue reaching VND 3,790 billion (+16% YoY), and projected profit after tax reaching VND 553 billion (+12% YoY). Supporting factors: Freight and passenger transport activities continue to expand, BOT revenue is forecast to grow at a CAGR of 14%, promoting the progress of the expressway project in the last year of the 2021-2025 fiscal year.

Using P/B valuation, DSC forecasts the target price of HHV shares at VND15,000/share, equivalent to a projected P/B of 1.1 times. DSC recommends that investors can disburse shares at a safe price range of around VND11,000-11,500.

Buy recommendation for PNJ stock

According to KB Securities Vietnam (KBSV), at the end of the third quarter of 2024, PNJ recorded net revenue of VND 7,225 billion (+3.1% over the same period last year), completing 78.7% of the annual net revenue plan. Gross profit reached VND 1,251 billion, equivalent to a gross profit margin of 17.5%, up 0.2ppts over the same period last year due to the decline in the proportion of gold bar revenue - a segment with low gross profit margin. Net profit reached VND 216 billion, down 14.8% over the same period last year due to PNJ's corporate income tax increasing by 70% to VND 102 billion.

24K gold revenue reached VND 10,264 billion, up 43.5% year-on-year due to the bustling gold trading activities. However, PNJ's 24K gold revenue in Q3/2024 decreased by 48.2% year-on-year to VND 1,087 billion due to the decrease in supply, people mainly buy gold and rarely sell during the tense period of world geopolitics.

Jewelry retail revenue in Q3/2024 reached over VND 4,991 billion, up 22.3% over the same period last year, PNJ opened 16 new stores and closed 3 stores in Q3. Jewelry retail continued to maintain growth thanks to PNJ taking advantage of market opportunities to develop its store network and effectively marketing to customers through marketing strategies and sales programs. In addition, wholesale revenue also recorded an increase of 30.2% over the same period last year thanks to customer demand shifting to reputable manufacturers.

KBSV forecasts PNJ's 2025 business results with net revenue reaching VND33,237 billion (-12.1% YoY), after-tax profit reaching VND2,619 billion (+26.2% YoY). With the prospect of maintaining long-term growth in the jewelry retail segment, we recommend buying PNJ shares for 2025 with a target price of VND115,100/share.

► Stock market commentary 12/12: VN-Index may retest the resistance level of 1,278 points

Source: https://vov.vn/thi-truong/chung-khoan/mot-so-co-phieu-can-quan-tam-ngay-1212-post1141426.vov

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)