The Banking Inspection and Supervision Agency recently announced the inspection conclusions at Vietnam Thuong Tin Commercial Joint Stock Bank, Binh Duong Branch (VietBank Binh Duong) and Saigon Thuong Tin Commercial Joint Stock Bank, Ba Ria - Vung Tau Branch (Sacombank BRVT).

Require VietBank Binh Duong to reduce bad debt to below 3%

The inspection at VietBank Binh Duong, the Banking Inspection and Supervision Agency, and the State Bank of Vietnam, Binh Duong Branch, pointed out a number of limitations and shortcomings. Specifically, there was no timely issuance of guidance documents on disbursement, supervision and quality control procedures for the implementation of insurance agency activities, and regulations on the time limit for applying transaction delay measures.

VietBank Binh Duong has not really paid close attention to the assessment of customers' loan plans and repayment sources, only focusing on loan security measures.

The overdue debt transfer notice is missing the content "overdue interest".

Regarding errors in credit granting activities, VietBank Binh Duong violated the lending principles for 3 customers with a total outstanding debt of 101,991 billion VND (including 1 customer with group 4 debt). The branch has recovered 1 loan ahead of schedule, and there are two loans with a total outstanding debt of 98.3 billion VND.

The appraisal and approval of loans was not strict, complete, appropriate and there were no documents proving the total capital needs of 14 customers, the total outstanding debt error was 973,116 billion VND.

Regarding collateral, VietBank Binh Duong has not updated the project land use rights owner to the company name, has not notarized the mortgage contract and registered the secured transaction for the land use rights. This error occurred with two customers, with a total outstanding debt of VND 466,625 billion.

The granting of credit to 4 customers, with a total outstanding debt of VND 161,557 billion, has not been strictly inspected and supervised after lending, has not been guaranteed or has not collected sufficient documents proving the purpose of capital use, or has collected inappropriate documents.

The inspection conclusion issued a credit risk warning when VietBank Binh Duong did not have measures or could not manage the debt repayment sources and revenue sources of customers, especially some customers with a large source of cash income; revenue from capital contributed to the company was not guaranteed and not appropriate; the source of principal repayment was from the sale of real estate in the future; revenue from loan projects for sponsored branches, to ensure that customers made debt repayments according to the agreement.

In addition, 9 customers have unhealthy financial situations or financial reports, and unfavorable business performance indicators, leading to potential credit risks.

Customers are granted credit limits to supplement working capital for production and business at many credit institutions, but the Branch has not yet had pre-disbursement control measures to ensure that the total amount disbursed at the branch and other credit institutions does not exceed the total capital needs of the customer.

VietBank Binh Duong does not use reserves to handle credit risks for bad debts; the work of urging bad debt handling is still slow, not timely and effective.

Some bad debt records also violate lending principles, and there are errors in appraisal, disbursement, and loan inspection and supervision.

VietBank Binh Duong has not yet collected complete and timely identification information for 2 customers in anti-money laundering activities.

The inspection and supervision agency recommended that the Director of the State Bank of Vietnam, Binh Duong Branch, issue a document recommending that the People's Committee of Binh Duong province handle, according to its authority, the former director of the Binh Duong Provincial Development Investment Fund, who used the fund's seal to sign and issue a debt repayment commitment on June 13, 2024 for a customer's loan at VietBank Binh Duong, which is not in accordance with legal regulations.

Regarding credit granting activities, the inspection team proposed to collect early debt and classify debt of VND 92 billion for customer Phan Van Cu; collect and re-evaluate loans of customers such as An Lac Viet Land Company, Thao Tam Company Limited, Huy FC Truong An Company Limited, SkyBridge Company Limited, Green Construction Materials Company Limited, and customer Nguyen Thanh Tri.

The inspection team also recommended that the branch urge and thoroughly recover bad debts, ensuring the bad debt ratio is reduced to below 3%.

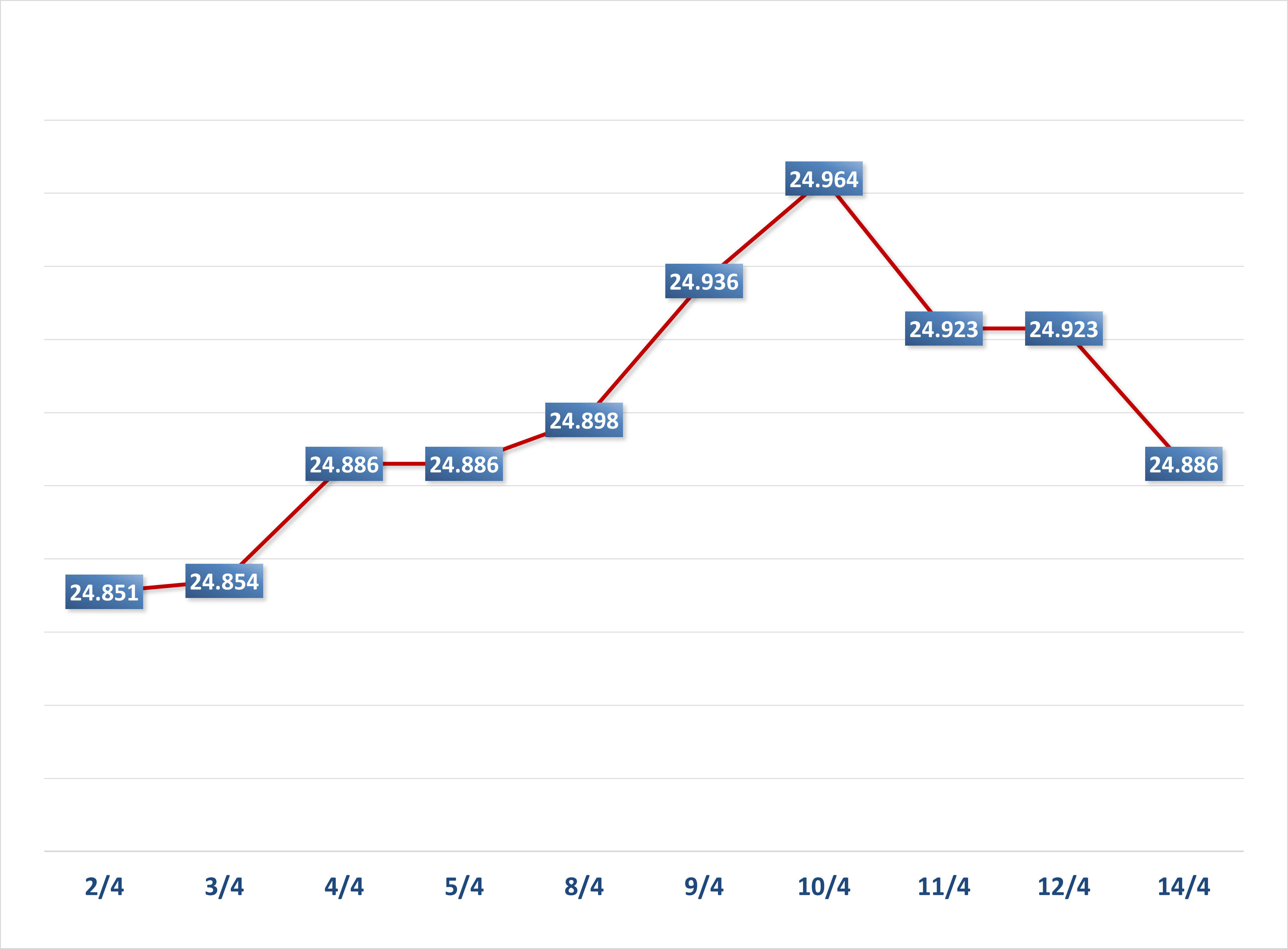

| As of October 31, 2024, total mobilization at VietBank Binh Duong reached VND 2,132 billion, down 6.78% over the same period in 2023 and down 4.26% compared to the end of 2023; the branch's accumulated profit lost VND 2.06 billion. |

Borrowers at Sacombank BRVT have not been closely monitored for debt repayment sources.

At Sacombank BRVT, the inspection of lending activities still found some shortcomings. Specifically, the customer's loan plan did not have information on the total capital source and details of the total capital source needed. The inspection discovered a case of project investment loan with outstanding debt as of July 31, 2024 of VND 470,336 billion without strict inspection and supervision of debt repayment sources according to regulations.

With the above shortcomings, the cause is pointed out to be due to the large number of customers, the management staff is not thorough in collecting loan documents, in the post-loan inspection work, leading to the existence and errors in credit granting operations.

These errors are the responsibility of the branch management, relevant functional departments and individuals assigned responsibilities directly related to the performance of work that led to the existence and errors.

The Chief Inspector and Supervisor of the State Bank of Vietnam, BRVT Branch, recommends that the Board of Directors of Sacombank BRVT seriously rectify and learn from the existing problems in operations; direct relevant functional departments to strengthen internal inspection and control; review and rectify the problems mentioned in this Conclusion; and implement solutions and rectify recommendations on credit operations, no later than March 31, 2025.

Source: https://vietnamnet.vn/mot-chi-nhanh-vietbank-bi-yeu-cau-dua-no-xau-ve-duoi-3-2366378.html

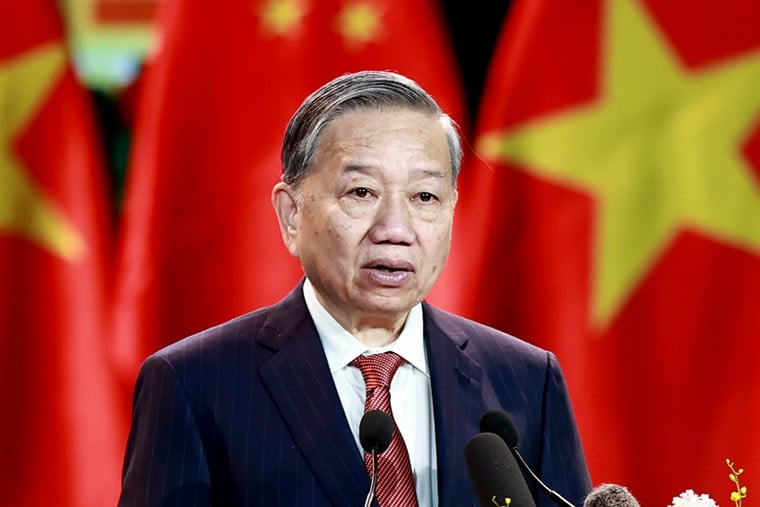

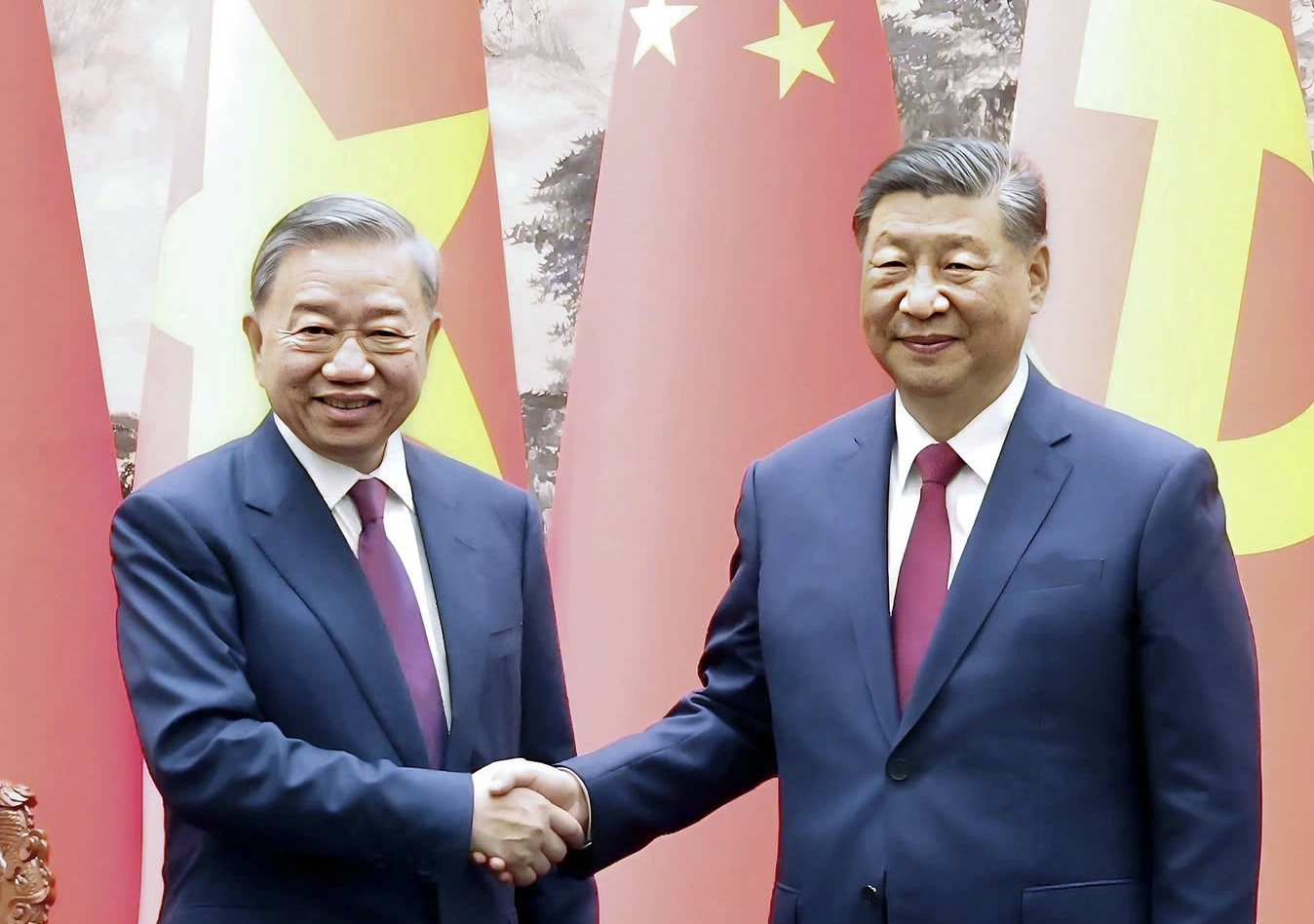

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

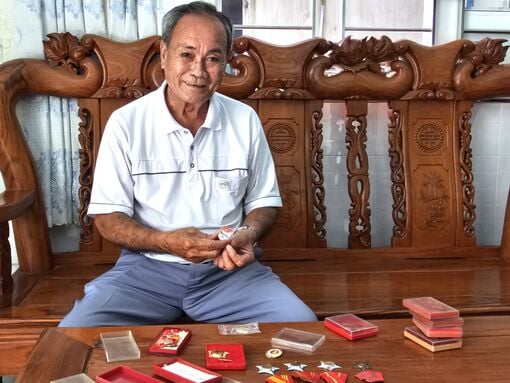

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

Comment (0)