Businesses and people expect that lending interest rates will continue to decrease to support businesses and people to recover and promote production and business.

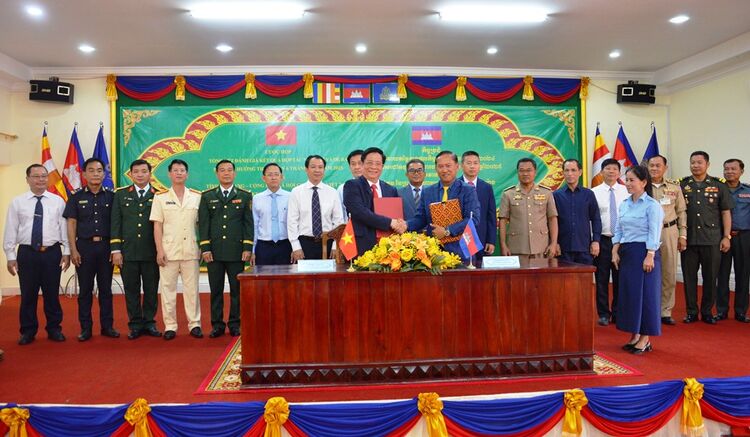

Consulting interest rates for customers at Southeast Asia Commercial Joint Stock Bank. Photo: Do Tam

Many banks reduce deposit interest rates

According to information from the State Bank, as of January 31, the average deposit and lending interest rates continued to decrease. The average deposit and lending interest rates for new transactions of commercial banks decreased by about 0.15%/year and 0.25%/year, respectively, compared to the end of 2023. Even according to the latest interest rate schedule on February 20, a large-scale joint-stock commercial bank headquartered in Hanoi mobilized deposits at an interest rate of about 4.6%/year, equivalent to the mobilization interest rate of state-owned commercial banks.

According to statistics in February 2024, 19 banks reduced their deposit interest rates, including joint stock commercial banks: Vietnam International Bank (VIB), Saigon Thuong Tin Bank (Sacombank), National Bank (NCB), Viet A Bank, Vietnam Technological and Commercial Bank (Techcombank) ... reduced interest rates for the second time since the beginning of the month. Most recently, on February 22, Vietnam Construction Bank (CBBank) reduced a series of deposit interest rates for all terms, the highest reduction was up to 0.6%/year. This is the first time after 3 months that CBBank has reduced deposit interest rates, thereby becoming the 19th bank to reduce deposit interest rates in February. In CBBank's deposit interest rate table, the highest is for terms of 13 months or more at 5.3%/year.

Up to now, no bank has maintained a 6-month deposit interest rate above 5%/year. For 9-11 month deposits, only Vietnam Thuong Tin Commercial Joint Stock Bank (VietBank) applies an interest rate of 5%/year, other banks all list interest rates below 5%/year, even below 4%/year such as Vietnam Maritime Commercial Joint Stock Bank (MSB), Southeast Asia Commercial Joint Stock Bank (SeABank), Military Commercial Joint Stock Bank (MB) 3.9%/year; Vietnam Technological and Commercial Joint Stock Bank (Techcombank) 3.7%/year...

Although deposit interest rates have dropped to a low level, lending interest rates have not decreased proportionally. Some banks even "anchor" lending interest rates at a high level, citing old debts or lending interest rates that need a delay after deposit interest rates are reduced.

To avoid this situation causing difficulties for businesses and individual borrowers, the Prime Minister has directed the banking sector to announce average lending interest rates for corporate customers. According to the State Bank's Permanent Deputy Governor Dao Minh Tu, the State Bank has issued Official Dispatch No. 117/NHNN-CSTT (dated February 7, 2024), requesting credit institutions to implement the direction of the Prime Minister and the State Bank on interest rates and report on the announcement of average lending interest rates, the difference between average deposit and lending interest rates. There are currently no sanctions for credit institutions not announcing average lending interest rates for corporate and individual customers, but the State Bank will include them in the assessment criteria and will have measures to handle them. If the average lending interest rate is not announced at an appropriate level, it will be difficult to attract borrowers, especially for businesses.

There is still room to reduce interest rates.

Representatives of banks all affirmed that in 2024, banks will have the conditions to continue reducing deposit interest rates to lower lending interest rates. Leaders of the Bank for Agriculture and Rural Development of Vietnam (Agribank) informed that Agribank's average lending interest rate decreased by 0.42%/year compared to the beginning of 2023 and decreased by 0.13%/year compared to the beginning of 2024 (commonly at 7-9%/year for short-term loans and 9-9.5%/year for medium and long-term loans). Agribank also improved lending processes and procedures, promoted the application of technology to speed up the speed and time of processing records, minimize the time for credit appraisal and approval; continue to have appropriate support policies on interest rates, restructure debt repayment terms for borrowers facing prolonged difficulties due to objective reasons...

Le Hoang Khanh An, Director of Finance at Vietnam Prosperity Joint Stock Commercial Bank (VPBank), said that in late 2023 and early 2024, the recently matured deposits will continue to help the bank reduce capital costs, expected to be at least around 1-1.5%/year. VPBank's representative also commented that the current capital costs of the entire market are quite stable. The downward trend will continue in the current macroeconomic context, including the liquidity situation at banks.

Financial experts also assessed that the liquidity index maintained at a healthy level by the end of 2023, creating a good foundation for banks to boost asset growth and control capital costs well in the next 12 months. The group of state-owned commercial banks has a good deposit growth rate, while private banks are also operating quite effectively, which will help restructure and consolidate the capital mobilization structure (higher customer deposits and less interbank loans). The decrease in bank capital costs is an important basis supporting the trend of reducing lending interest rates of banks, but another equally important reason is the pressure on credit growth.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

Comment (0)