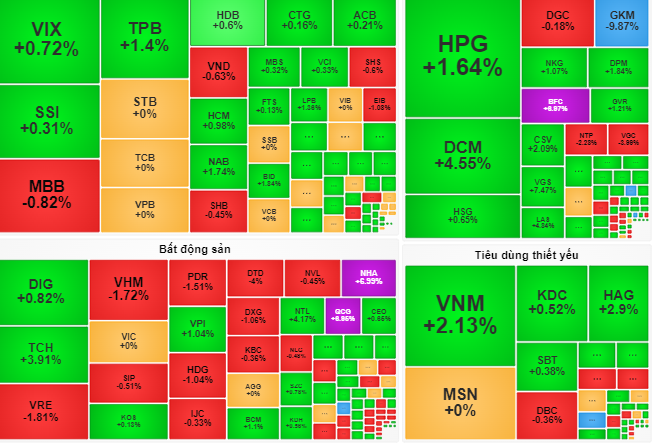

At the end of the session on July 29, the VN-Index increased by nearly 4.5 points (+0.36%), closing at 1,246 points.

Vietnamese stocks on July 29 had a fairly good performance in terms of points but the supporting cash flow remained low. Investors traded cautiously as the VN-Index approached the 1,250-point threshold. The fluctuation range during the session was quite narrow with tentative developments before this resistance level.

At the end of the session, the VN-Index increased by nearly 4.5 points (+0.36%), closing at 1,246 points. Liquidity on the HoSE floor was low with only 496.8 million shares successfully traded.

Among the 30 large stocks (VN30), 14 codes increased in price such as VNM (+2.1%), BID (+1.8%), HPG (+1.6%), MWG (+1.6%), TPB (+1.4%)... On the contrary, 7 codes decreased in price such as VRE (-1.8%), VHM (-1.7%), VJC (-1.5%), MBB (-0.8%), SHB (-0.5%)...

With the market recovering, many stock groups continued to be green. Steel, food, retail, chemical groups... traded quite actively, positively supporting the market.

According to Dragon Capital Securities Company (VDSC), liquidity on July 29 increased compared to the previous session but remained low. This shows that the supply of shares has not put much pressure on the market.

"It is likely that the VN-Index will continue to probe the 1,250-point resistance zone in the next trading session. The weak purchasing power of stocks will weaken the market in the coming time" - VDSC forecasts.

However, Vietcombank Securities Company (VCBS) commented that the market is showing positive developments thanks to increased demand for stocks.

"Short-term investors can consider taking profits on stocks that have reached their price increase target, while selecting stocks that attract stable cash flow in some industry groups such as chemicals, fertilizers, steel..." - Mr. Tran Minh Hoang, Director of Research and Analysis of VCBS advised.

Source: https://nld.com.vn/chung-khoan-ngay-mai-30-7-luc-ban-co-phieu-co-the-khong-manh-196240729173505093.htm

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)