US growth exceeds expectations

On October 26, the US Department of Commerce said that gross domestic product (GDP) increased by 4.9% in the third quarter of 2023, higher than the 4.7% increase forecast by experts participating in the Dow Jones poll and also higher than the 2.1% increase in the second quarter.

This is the strongest increase since the fourth quarter of 2021, despite soaring interest rates and many other "headwinds". Since March 2022, the US Federal Reserve (Fed) has raised its operating interest rate 11 times, bringing the federal funds rate to a 22-year high of 5.25% - 5.5%. Surprisingly, the US economy is still growing quite strongly.

The main drivers of economic growth in the third quarter of 2023 are consumer spending, exports, household investment, and government spending. Consumer spending on goods increased by 4.8%, while that on services increased by 3.6%. This is the strongest increase in consumer spending since 2021.

The US growth performance was a surprise as many economists had previously believed that the US could at least experience a mild recession amid the drying up of government subsidies from the Covid era and soaring interest rates over the past year.

The US economy continues to grow even though the Fed has not only raised interest rates at a very rapid pace but also signaled that it will keep them high for an extended period.

With impressive economic growth, while US core inflation increased sharply in September (+0.3%), the Fed is likely to raise interest rates for the 12th time at its meeting next week.

Earlier, in a meeting in mid-October, Chairman Jerome Powell said the Fed was ready to raise interest rates again if the economy heats up. This statement was made when the yield on 10-year US government bonds exceeded 5%.

Not only the US, Europe is also maintaining a tough stance on monetary policy. Some experts shared on Reuters that the European Central Bank (ECB) is unlikely to loosen monetary policy. At the earliest, the ECB will only reverse its policy in July 2024.

Eurozone inflation remains double the target. Meanwhile, the Israel-Hamas conflict threatens to push up energy prices. The region’s bond market crisis will also keep EU policymakers on their toes.

The strengthening US dollar has put pressure on most Asian currencies. On October 26, the Japanese yen broke the warning level of 150 yen per dollar, its lowest level in more than a year. This is considered a "danger zone" that could trigger intervention from the Japanese government.

Great pressure on Vietnam's economy

It can be seen that whenever facing difficulties, the US often pushes a large amount of USD into the market. To recover the economy after the Covid period, the US has pumped out a large amount of money through the quantitative easing (EQ) policy.

This is also a common trend in many countries. Countries also release large amounts of money. Along with geopolitical conflicts, inflation has increased sharply. This is also the time when countries are forced to withdraw money to control inflation and exchange rates.

For the US, high economic growth and a positive labor market are the basis for the Fed to continue tightening monetary policy.

Meanwhile, many Asian economies, including Vietnam, are facing difficulties as there is not much room left for a loose monetary policy, while the USD/VND exchange rate is still increasing continuously.

Since mid-October, the USD/VND exchange rate has been very high and has shown no signs of going down, even though the State Bank has spent 5 weeks strongly withdrawing money in the open market. As of October 27, the central exchange rate was at 24,107 VND, only 3 VND lower than the historical peak of 24,110 VND/USD recorded on October 20.

Most banks are setting the USD selling price at 24,730-24,760 VND/USD. This is the highest level since the beginning of the year and is only slightly lower than the historical peak of 24,888 VND/USD recorded on October 25, 2022.

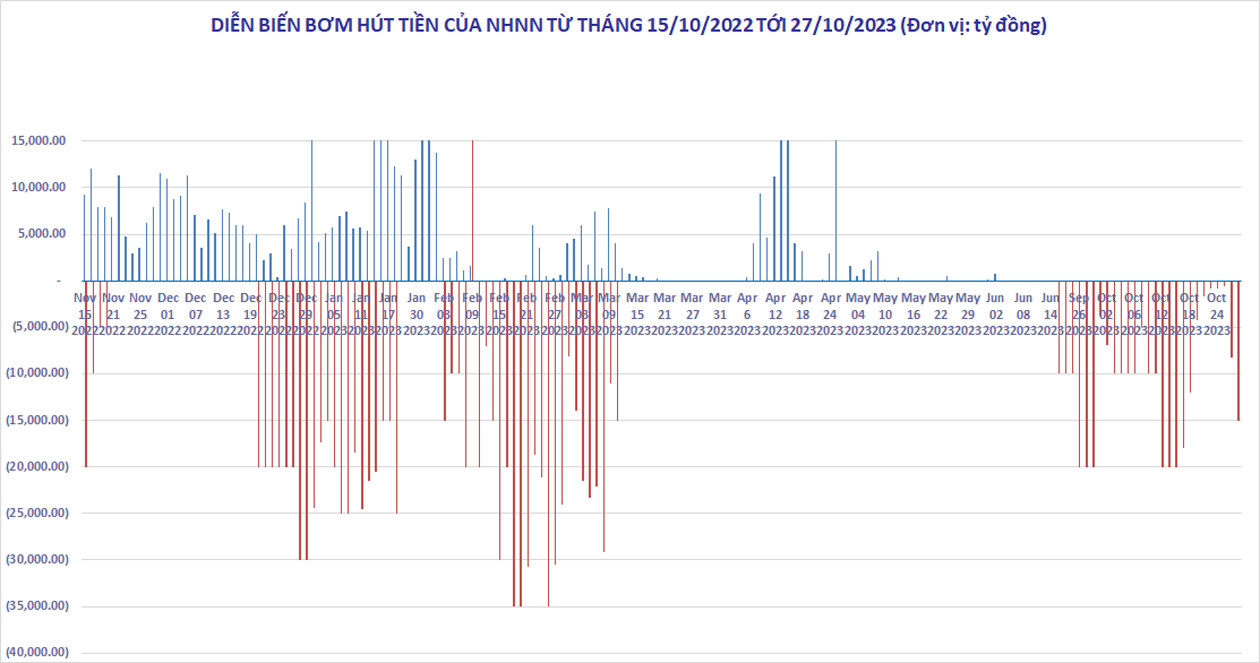

On October 27, the State Bank of Vietnam (SBV) withdrew nearly VND11,200 billion in net money on the open market to prevent the USD/VND exchange rate from increasing. Since September 21, the SBV has withdrawn a total of VND193,000 billion in net money.

Money withdrawal is inevitable when the US is still tightening monetary policy and Europe is still taking strong measures to fight inflation. However, if the SBV continues to increase money withdrawal to control exchange rates and inflation, commercial interest rates will increase again. This could affect the Government's efforts to restore economic growth and real estate businesses that have not yet recovered from the shock since 2022.

Agriseco Securities and ACB Securities recently both said that the USD/VND exchange rate will face increasing pressure in the coming time when the Fed forecasts an interest rate hike in November while Vietnam maintains low interest rates. Most likely, the State Bank will have to have additional solutions such as selling USD forwards to banks.

For now, the USD is still inching up. On October 27, the DXY index reached 106.6 points, up 0.4% over the past week, after the US announced strong economic growth.

The recent Israel-Hamas conflict could cause global inflation to rise along with oil prices. Inflation is still hot, which could cause the US to extend its tight monetary policy. The USD will still be a safe haven and continue to increase in value. The US currency is expected to remain overbought, thereby negatively affecting the world financial market, including Vietnam.

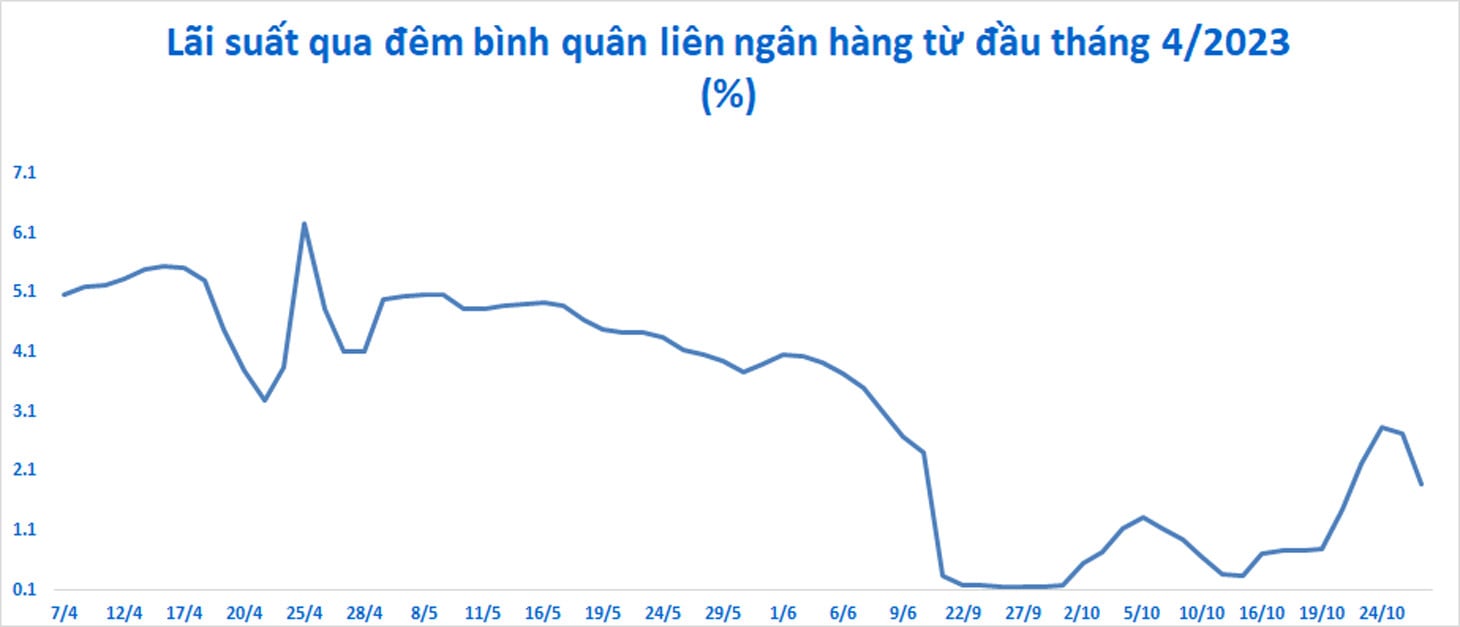

In the interbank market, interest rates have recently increased rapidly again (at times the overnight interest rate reached 2.84%/year) and money is no longer cheap in the market 2. This is a factor that makes it difficult for Vietnam to reduce interest rates to support economic growth even though credit growth is still very low and real estate and manufacturing businesses are facing difficulties with high financial costs.

Source

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)