Meaning of remittances

Remittances help the State increase foreign exchange reserves, contributing significantly to stabilizing and increasing the supply of foreign currency. This helps balance the trade balance and the balance of payments, reduce dependence on foreign investment capital, and limit pressure on foreign exchange rates.

Thanks to the foreign currency flow from remittances, a part of the population in the country has improved their income and raised their living standards... Not only contributing to personal consumption, remittances are also a source of capital for investment activities in production, business, securities...

Conditions for remittances to the country

To transfer remittances to Vietnam, the sender must meet the following conditions:

- Must have valid CCCD/ID card/Passport, still valid, birth certificate, household registration

- Documents proving the purpose of transferring money to another country.

- Provide recipient information such as: Full name, recipient account number, recipient bank name.

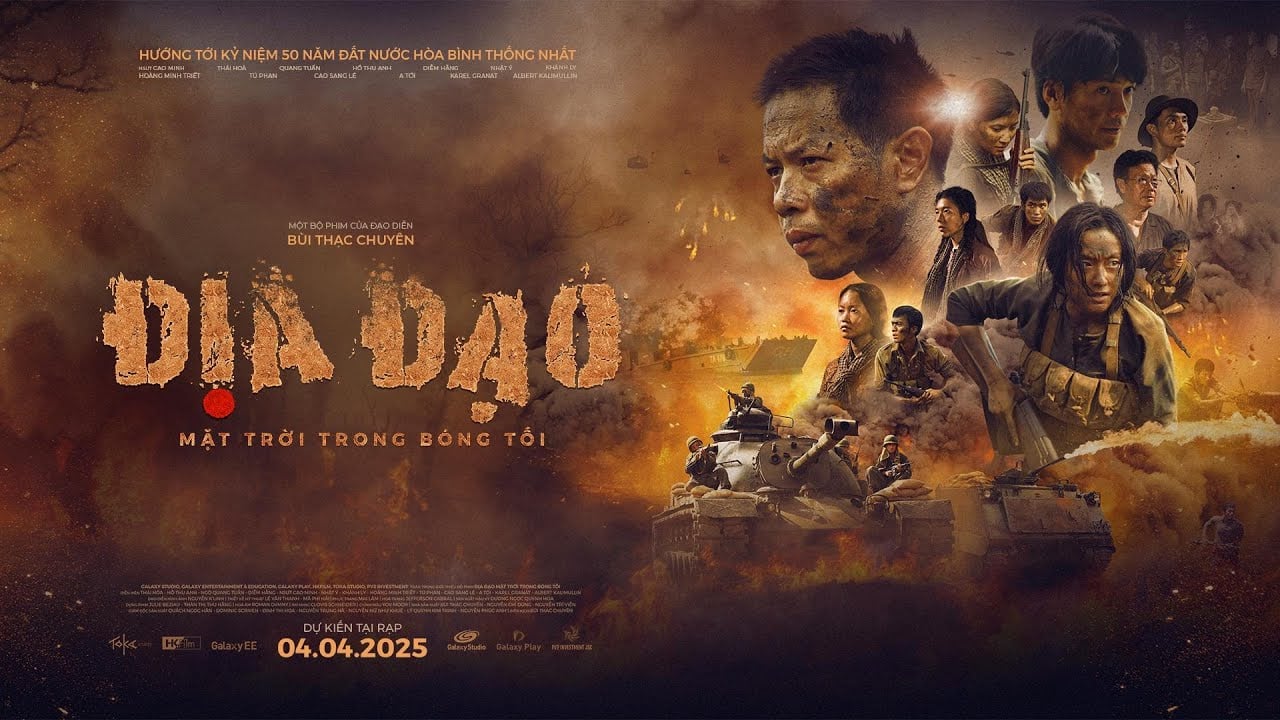

Remittances are foreign currency sent home by Vietnamese people living abroad. (Illustration photo).

How to transfer remittances to Vietnam

- Transfer via international credit institutions: Reputable international credit institutions with large networks around the world are suitable channels for transferring remittances, such as Western Union, MoneyGram or UniTeller. The procedure for transferring money abroad via credit institutions is very quick and simple. The total time from sending to receiving is only 2 - 5 days (depending on the type of foreign currency).

- Bank transfer:

Banks are considered a convenient method of remittance for both senders and recipients, even if the recipient does not have a bank account. Especially if the beneficiary needs to exchange, sell or deposit foreign currency into a savings account, sending remittances through banks is the most convenient and optimal option. In addition, banks often have many preferential policies for recipients and depositing remittances into savings accounts.

The person sending remittances only needs to go to a bank abroad, provide information about the beneficiary including full name, account number and name of the domestic bank and complete the money transfer procedure. If the recipient does not have an account at the bank, the sender needs to add personal information (citizen identification number/ID card/passport/equivalent document) with a photo for the bank to complete the remittance procedure.

Currently, most banks in Vietnam provide remittance and receiving services from countries around the world.

- Transfer via international postal organizations: In case of need to send remittances quickly, with short procedures, transferring foreign currency via international postal organizations is the option chosen by many people. The service fee at these organizations ranges from 4 - 6% depending on the policy of each place. In addition, if the recipient and the sender both own international payment cards (VISA, Mastercard, ...), remittances can be transferred via card.

- Individuals bringing remittances back to Vietnam

Remittances brought into Vietnam by individuals abroad account for a fairly high proportion of the total annual remittances. However, individuals bringing remittances back to Vietnam must comply with a number of legal regulations, specifically Article 2 of Circular 15/2011/TT-NHNN:

When carrying remittances, you must declare them to the customs at the border gate: Any foreign currency with a value exceeding 5,000 USD must be declared to the customs when completing entry and exit procedures through international border gates in Vietnam.

Exception: If an individual carries valuable documents such as savings books, traveler's checks, or means of payment such as bank cards..., there is no need to declare at the border customs gate.

Subjects allowed to receive remittances

According to the law, the subjects that are allowed to receive remittances sent by overseas Vietnamese and pay remittances to beneficiaries include:

- Licensed credit institutions, or agents of credit institutions.

- Economic organizations licensed by the State Bank to operate foreign exchange services.

- Business providing financial and international postal services.

Source: https://vtcnews.vn/kieu-hoi-la-gi-ar913452.html

![[Photo] National Assembly Chairman Tran Thanh Man receives Lao National Assembly Vice Chairman Suvon Luongbunmi](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/21/fced4939316d4eda89a94ff457019594)

![[Photo] Chemical Corps trains hard for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/21/82ecc68be4724bc2af475dc669f11a1a)

![[Infographics] Vietnam National Brand: Breakthrough from innovation and creativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/20/3a037811a5774d639acf15b107c9d294)

Comment (0)