ANTD.VN - Cashless payments will reach about 11 billion transactions in 2023, an increase of nearly 50% compared to last year, with a value of more than 200 million billion VND.

Cashless payments increased by more than 50%

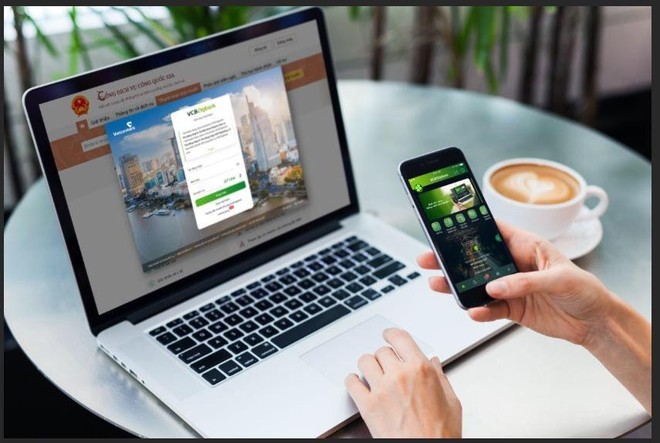

According to data from the State Bank, in 2023, non-cash payments (TTKDTM) recorded positive growth.

Mr. Pham Anh Tuan, Director of the Payment Department, State Bank of Vietnam, said that by the end of the year, non-cash payments reached about 11 billion transactions, with a value of more than 200 million billion VND, an increase of nearly 50% in quantity compared to 2022.

Of which, through the Internet channel, there were nearly 2 billion transactions, with a value of over 52 million billion VND, an increase of more than 56% in quantity and 5.80% in value; through the mobile phone channel, there were more than 7 billion transactions with a value of over 49 million billion VND, an increase of more than 61% in quantity and nearly 12% in value;

In particular, payment via QR code reached nearly 183 million transactions, with a value of more than 116 trillion VND, an increase of nearly 172% in quantity and more than 74% in value.

|

Cashless payments to increase sharply in 2023 |

Meanwhile, ATM transactions continued to decline, reaching about 900 transactions, worth about VND 2.6 million billion, down 8.84% in quantity and more than 9% in value compared to 2022.

The above results, according to the State Bank, show that people increasingly prefer non-cash payments.

Payment via NAPAS will also increase sharply by the end of 2023, reaching over 7.4 million transactions, with a value of about VND 54.1 million billion, an increase of 50% in quantity and 13% in value over the same period.

Regarding the implementation of technology applications, online account opening has been implemented since the end of March 2021. To date, nearly 27 million payment accounts opened electronically (eKYC) are in operation and 12.9 million cards in circulation are issued using eKYC.

The ATM and POS network covers all provinces and cities nationwide. By the end of November 2023, the country will have 21,014 ATMs and 513,550 POS machines (an increase of 0.6% and 26.89% respectively over the same period in 2022).

Regarding e-wallets, by the end of December 2023, the State Bank had granted operating licenses to provide payment intermediary services to 51 non-bank organizations providing payment intermediary services in the market.

By the end of 2023, the number of active e-wallets will be 36.23 million (accounting for 63.23% of the total of nearly 57.31 million activated e-wallets), with the total amount of money on these wallets being about VND 2.96 trillion.

Regarding Mobile Money, after 2 years of piloting, there has been good growth. At the end of 2023, the number of registered accounts was nearly 6 million, of which nearly 70% were accounts registered in remote, isolated and island areas; the total number of transactions was about 47 million, with a transaction value of over 2.4 trillion VND.

Actively “clean” customer data

According to Pham Anh Tuan, Director of the Payment Department (State Bank), by the end of 2022, over 77.41% of Vietnamese people aged 15 and over had bank accounts.

To ensure safety in online payments, the State Bank has signed with the Ministry of Public Security on the implementation of the Project "Developing applications of population data, identification and electronic authentication to serve national digital transformation in the period 2022-2025, with a vision to 2030" (Project 06).

Many important contents have been deployed in 2023 such as coordinating to clean up data of account openers through the national population database; Researching, exploiting and using information data through chip-embedded citizen identification cards; Researching to use VNeID identification numbers in opening and using banking services.

“By the end of 2023, the State Bank of Vietnam (SBV) has coordinated with Department C06 - Ministry of Public Security to clean up over 42 million customer records related to the CIC credit information database. 53 credit institutions have coordinated with enterprises licensed by the Ministry of Public Security to research and coordinate the implementation of solutions and equipment to authenticate users with chip-embedded Citizen Identification Cards.

43 credit institutions have been implementing data cleaning plans through the use of the national population database," Mr. Pham Anh Tuan informed.

Regarding the issue of fraud prevention in online transactions, the Director of the Payment Department said that there are currently many accounts and e-wallets that are not owned by the owner. This is a point that many subjects take advantage of for illegal activities.

Commercial banks have recorded cases of buying, selling, and lending accounts to scammers. In the context of increasingly complex high-tech fraud, many people are not aware of protecting personal data.

Faced with this situation, the State Bank has issued a document directing credit institutions to review and check accounts with documents that do not match their documents, and to research and find solutions to this problem.

Source link

Comment (0)