According to the latest data from the State Bank, the amount of savings deposits of residents as of the end of August 2024 reached 6,924 trillion VND, an increase of 6% compared to the end of 2023. In August alone, the amount of new deposits increased by 86,475 billion VND, meaning that on average, nearly 2,900 billion VND was poured into banks every day.

In contrast to the population, the amount of deposits from businesses and economic organizations decreased slightly. By the end of August, this figure reached 6,838 trillion VND, lower than the end of last year. However, the total amount of deposits in the entire system, including residents and organizations, reached a record of more than 13,763 trillion VND.

Explaining this increase, experts said that the increase in deposit interest rates played an important role. In fact, many commercial banks have adjusted deposit interest rates at different terms, creating great attraction for the savings channel.

For example, Viet A Bank increased short-term interest rates by 0.3-0.6%, bringing the highest rate to 5.4%/year. Other banks such as Military Commercial Joint Stock Bank (MB), Vietnam International Commercial Joint Stock Bank (VIB), Vietnam Technological and Commercial Joint Stock Bank (Techcombank)... have also adjusted their rates up by 0.2-1%/year since the beginning of the year.

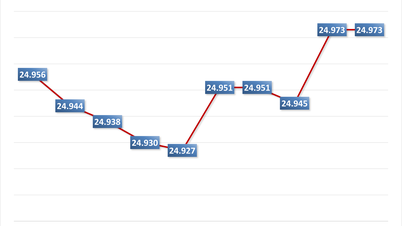

According to a survey of commercial banks, the 36-month term interest rate for individual customers currently ranges from 3.9-6.35%/year. Bac A Bank is currently leading with 6.35%/year for deposits of VND1 billion or more. Nam A Bank and Dong A Bank also recorded high interest rates, at 6.2% and 6.1%/year, respectively.

Notably, for a term of 12-13 months, Vietnam Public Joint Stock Commercial Bank (PVcomBank) is applying an interest rate of up to 9.5%/year, but requires a minimum deposit of up to VND2,000 billion.

According to experts from Dragon Viet Securities Corporation (VDSC), the interest rate increase not only helps banks maintain liquidity but also supports businesses with loans to increase production and business in the final period of the year. This also shows the flexibility of banks in ensuring capital sources to serve the economy, while maintaining safety and liquidity for the system.

The driving force from high credit demand at the end of the year is expected to continue to create pressure to increase deposit interest rates, keeping the savings channel in an attractive position. Economist Dr. Nguyen Tri Hieu predicts that the last months of the year are often the period when banks increase capital mobilization to meet the high demand for loans from businesses. Deposit interest rates may continue to increase as capital demand increases sharply. This means that the savings channel is still the top choice thanks to its safety and attractive interest rates.

In addition to bank savings, some other investment channels such as gold, stocks, real estate... are also evaluated by experts. However, the attractiveness of each channel has clear differences.

Regarding the gold market, according to Dr. Nguyen Tri Hieu, this is an investment field that requires caution. Because gold prices are greatly affected by policy factors and global market fluctuations. In addition, expected policy changes in 2024 can cause gold prices to fluctuate strongly, reducing the attractiveness of this channel.

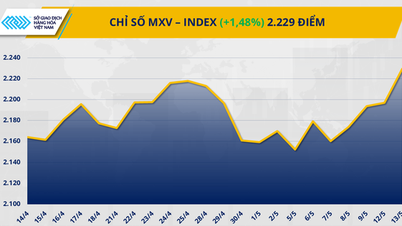

Meanwhile, the stock market is forecasted to be one of the potential channels, especially in the context of the upcoming interest rate reduction cycle. According to Mr. Tran Hoang Son, Director of Market Strategy of VPBank Securities Joint Stock Company (VPBankS), the current adjustment period could be an opportunity for investors to accumulate stocks for 2025. However, the selection of stock codes needs to be cautious to avoid risks in the context of the market being affected by economic and tax policies.

Regarding real estate, experts say the market is clearly differentiated between segments. While land, resort and commercial real estate have not yet flourished, urban and industrial real estate have maintained good growth momentum. In particular, housing demand in big cities remains very high, bringing great profit potential to investors. However, experts recommend that capital sources should be carefully considered and prepared for interest rate reduction cycles to optimize investment opportunities.

In general, in the current economic context, bank savings still dominate the list of safe and stable investment channels. However, experts also recommend that investors consider a portfolio diversification strategy to optimize profits. In particular, choosing channels that match their risk appetite and personal financial goals is an important factor. Investors with a long-term vision can take advantage of opportunities from the stock and real estate markets when market factors are more favorable.

According to VNA

Source: https://doanhnghiepvn.vn/kinh-te/kenh-dau-tu-nao-dang-hut-dong-tien-nhung-thang-cuoi-nam/20241118092144664

Comment (0)