Experts say that stocks have not yet surged, but are moving from the bottom to the recovery phase, which is an opportunity to accumulate stocks for 3 months to a year.

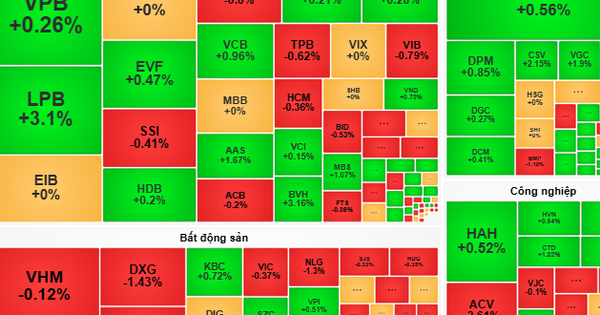

Despite positive information such as lowering the ceiling on operating interest rates, a new decree on bonds to help ease difficulties for real estate businesses, and a reduction in VAT to stimulate consumption, the stock market has not shown any signs of an explosion in recent times. The VN-Index has been fluctuating in the price range of 1,030-1,080 points in the past two months, with a range of no more than 20 points per session. This range is significantly narrower than in the first three months of the year, when the index sometimes fell close to 1,000 points and then rose to nearly 1,120 points.

The grey tone of the market is also reflected in the weakening of new accounts and investor cash flow. Last month, only 22,740 new accounts entered the market - the lowest number in three years. The average trading value per session was about 11,000 billion VND and some sessions were less than 7,000 billion VND, which is less than 20% compared to the period when the market was bustling.

"This shows that stock investors are in a highly defensive state after a year of losing more than they gained," said Mr. Le Vu Kim Tinh - Director of Tan Binh branch, Phu Hung Securities Company (PHS).

According to Mr. Tinh, the current stock market is not bright but not too dark because bad information about financial health and business growth prospects has been released after the annual shareholder meeting season and good information is appearing with higher density. Monetary easing and business support policies are considered the biggest support for recovery. However, because policies need time to permeate and create impact, the market cannot immediately rise but must wait at least a few months.

Mr. Tinh commented that the VN-Index’s strong fluctuations over many months are a sign that the market has bottomed out. Investors should therefore not fear that the market will suddenly plummet like the scenario that happened in the second half of last year, but instead should accumulate stocks for a medium-term vision of 3-6 months and a long-term vision of over a year.

For investors with high risk appetite, he said the current situation can easily make them lose patience because they cannot buy because prices are rising slowly, and cannot sell because profits are not as expected.

Investors monitor stock prices at a stock exchange in District 1, Ho Chi Minh City. Photo: Quynh Tran

Sharing the same view, Mr. Le Anh Tuan - Director of Securities Division of Dragon Capital Investment Fund - in a meeting with investors a week ago also affirmed that VN-Index is moving from the bottom to the recovery phase. Monetary policy is shifting from tightening to loosening, stock valuations are relatively attractive, interest rates are decreasing, and exchange rates are stable, which will limit the possibility of the index falling 15-20% in a short period of time.

Mr. Tuan recommends that investors should not leave the market when it is quiet, but should consider this as an attractive accumulation period for the medium and long term. Downtrends should be viewed as opportunities to restructure and reduce the cost of capital for the portfolio, but avoid using too much leverage.

"We should not expect a profit of 30% or 50% this year. Whoever can do that is a genius. This is the accumulation phase for a growth phase next year. If the market falls and you feel scared, just close your eyes and buy," said Mr. Tuan.

Analyzing potential industry groups, Mr. Tinh said that when the market zigzags slowly and cash flow is not abundant, agricultural stocks, textiles and export goods should be prioritized. These are often groups that accelerate very quickly when the market is stable and businesses release positive information about new orders.

In addition, Mr. Tinh also highly appreciated the medium and long-term price increase prospects of groups that benefit from public investment disbursement such as infrastructure construction, construction materials and energy. For pillar stocks such as banks, securities or real estate, this expert said that they should only disburse with a short-term trading strategy when the market really surges and liquidity explodes.

Orient

Source link

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)