(NLĐO) - Several securities companies predict that investors will trade stocks modestly before there are clear supply and demand signals.

At the close of trading on December 2nd, the VN-Index only increased by 0.75 points (+0.06%), closing at 1,251 points.

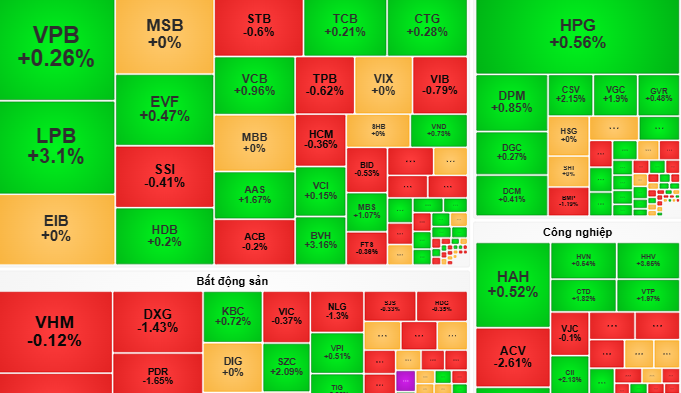

Vietnamese stocks continued their upward trend at the start of trading on December 2nd, with some blue-chip stocks and public investment stocks rising in price. However, due to increasing selling pressure, the prices of many stocks reversed and fell or retreated to their reference prices.

The afternoon session showed no improvement as selling pressure continued to prevail, and the red trend spread, causing the market to lose momentum. Towards the end of the session, periods of sideways trading occurred more frequently. Some banking stocks rose in price, but only helped the market regain an insignificant amount of points.

At the close of trading, the VN-Index only increased by 0.75 points (+0.06%), closing at 1,251 points. Liquidity decreased with 388.8 million shares traded on the HoSE exchange.

Rong Viet Securities (VDSC) forecasts that the market will continue to trade sideways in the near future, before clearer supply and demand signals emerge. If supply increases again and becomes dominant, the market will decline.

"Investors still need to observe supply and demand developments to assess the market's state. However, short-term traders can exploit some stocks that are gradually improving, considering recovery rallies to take short-term profits," VDSC recommends.

Meanwhile, VCBS Securities Company advises investors to take advantage of intraday fluctuations to gradually disburse funds into stable stocks in the banking, fertilizer, and retail sectors, among others.

Source: https://nld.com.vn/chung-khoan-ngay-3-12-mua-ban-co-phieu-se-giang-co-196241202170731149.htm

Comment (0)