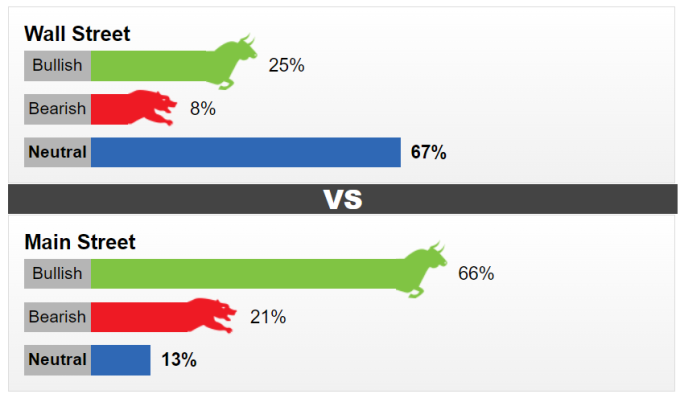

While retail investors maintain positive forecasts, analysts are leaning more towards a sideways gold price trend in the short term outlook.

This week, 12 Wall Street analysts participated in the Kitco News gold survey. Like last week, only three analysts (25%) predicted further gains in gold prices, one said the precious metal would fall, and eight (67%) were neutral.

Of the nearly 600 retail investors surveyed, 66% expect gold to rise this week. 21% predict gold prices will close lower this week and 13% think the market will be flat.

Adrian Day, president of Adrian Day Asset Management, expects gold prices to be little changed this week. "After the recent rally, gold is very vulnerable to bad news. The medium-term drivers remain strong because at some point the Fed and other central banks will ease their tightening. But that hasn't happened yet," Adrian said.

Daniel Pavilonis, senior commodities broker at RJO Futures, also said that gold will need a period of sideways consolidation as buying pressure from geopolitical concerns has eased.

"We're at the upper end of the range that we've been at for a few weeks. It's very possible that we won't see any more rate hikes and a rate cut in May next year, but I doubt it," Pavilonis said, predicting that gold prices could struggle for a while before confirming a clear trend.

Pavilonis also said that while gold prices continue to react to economic indicators, this development does not provide a clear direction for the precious metal. "Gold will have a hard time moving higher if inflation data continues to weaken and the Fed does not cut interest rates. I do not know what the buying momentum will be without geopolitical volatility," the expert at RJO Futures assessed.

Kitco's weekly gold survey for November 20-24. Photo: Kitco News

Everett Millman, chief market analyst at Gainesville Coins, believes that gold investors' attention is shifting from geopolitical volatility to macroeconomics.

“I think we’re seeing a shift in the focus of the gold market away from the ‘safe haven’ role in the geopolitical volatility that we’ve seen,” Millman said. “I think that’s increasingly becoming the primary concern for the gold market, and now the focus is shifting more to the macroeconomic picture and specifically what Fed policy is going to be.”

Millman said the market's focus now is whether the Fed is done raising interest rates and when it will cut. "Fundamentally, lower interest rates are the biggest bullish driver for gold, barring a deep recession," said Gainesville Coins chief market analyst.

Ole Hansen, head of commodity strategy at Saxo Bank, also said he doesn't see any major momentum for gold in the near term. Colin Cieszynski, chief market strategist at SIA Wealth Management, is neutral as markets head into the Thanksgiving holidays. "The market in general is likely to be quieter over the next ten days," Hansen predicted.

On the bright side, Darin Newsom, senior market analyst at Barchart.com, is bullish on gold. “The short-term uptrend in December gold has been solidified over the past week, with prices approaching $2,000 an ounce at times,” Newsom said.

Kitco senior analyst Jim Wyckoff also expects gold prices to rise this week. "The technical signals from the charts are becoming more positive and so is U.S. monetary policy, following weaker inflation reports this week," Kitco said.

Minh Son ( according to Kitco )

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)