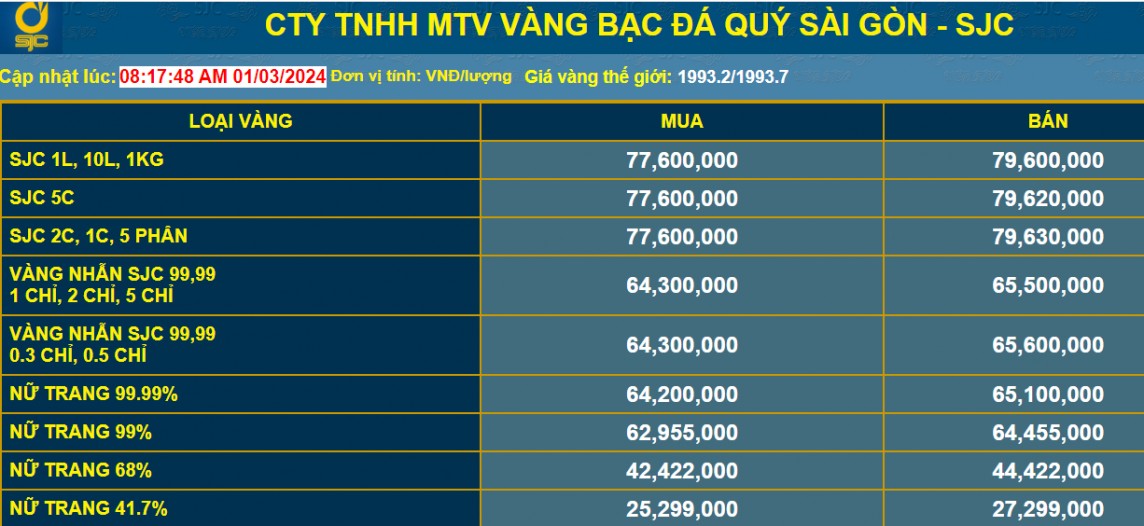

At 11:00 a.m. on March 1, 2024, the domestic SJC gold price continued to be adjusted up compared to the early morning of the same day. Saigon Jewelry Company Limited - SJC listed the SJC gold price at 77.6 million VND/tael for buying and 79.6 million VND/tael for selling. The difference between buying and selling prices at this unit is still at 2 million VND.

Compared to the early morning of the same day, the price of SJC gold at this unit was adjusted up 100,000 VND for buying and up 80,000 VND for selling.

|

| Gold price listed at Saigon Jewelry Company Limited. Website screenshot at 11:00 on March 1, 2024 |

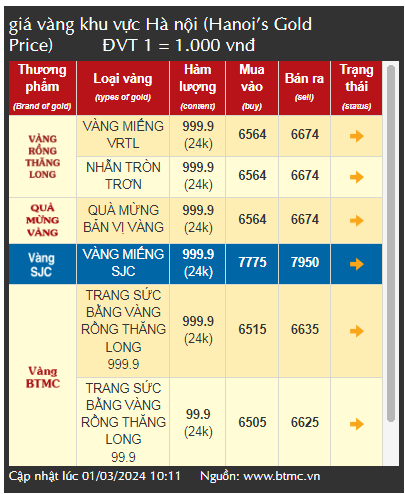

At the same time, Bao Tin Minh Chau listed the domestic SJC gold price at 77.75 million VND/tael for buying and 79.5 million VND/tael for selling. Compared to the early morning of the same day, the SJC gold price at this unit was adjusted up 100,000 VND for buying and up 50,000 VND for selling.

|

| Gold price listed at Bao Tin Minh Chau. Website screenshot at 11:00 on March 1, 2024 |

As of today, the price of SJC gold is at its highest increase since the beginning of 2024. Compared to the price of gold bars on December 26, 2023, today, the price of gold bars is only 1.4 million VND/tael lower for buying and 700,000 VND lower for selling.

SJC gold prices have skyrocketed, but many investors and consumers still lose money if they buy gold on God of Fortune Day 2024 because the difference between buying and selling prices is still at 2 million VND. Ms. Thu Phuong (Bac Tu Liem, Hanoi) is worried because she bought SJC gold on God of Fortune Day 2024 (February 19, 2024) at 78 million VND/tael, if she sold it that day, she would immediately lose 3 million VND. If she sold it today, she would still lose about 400,000 VND/tael.

A survey by giavang.net shows that if every year God of Wealth Day is the peak time for people to buy and sell gold, this year, although God of Wealth Day has passed for a long time, the number of people interested in and coming to trade at gold and silver businesses is still very large. This is part of the reason why gold prices have increased and continuously reached new peaks in 2024.

Bao Tin Minh Chau representative said that at the business establishments of this unit, this morning, March 1, 2024, the number of customers coming to buy and sell had a ratio of 55% of customers buying and 45% of customers selling.

|

| Tensions and conflicts in Ukraine and the Middle East will continue to be important drivers for gold prices to accelerate in the future. Illustrative photo |

Forecasting the domestic gold bar price in the coming time, some economic experts believe that if there is policy intervention from the management agency, the gold price will decrease. If the State Bank has not yet had a policy to intervene in the gold market, the gold price is forecast to have room to increase due to the impact of the world gold market.

According to HSBC Bank, gold is considered a safe investment channel in the long term when geopolitical instability increases. Tensions and conflicts in Ukraine and the Middle East will still be an important driving force for gold prices to accelerate in the future.

Source

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)