| Coffee export volume decreases but turnover is forecast to reach the same level as in 2022 EVFTA Agreement: “Leverage” for coffee exports to the EU |

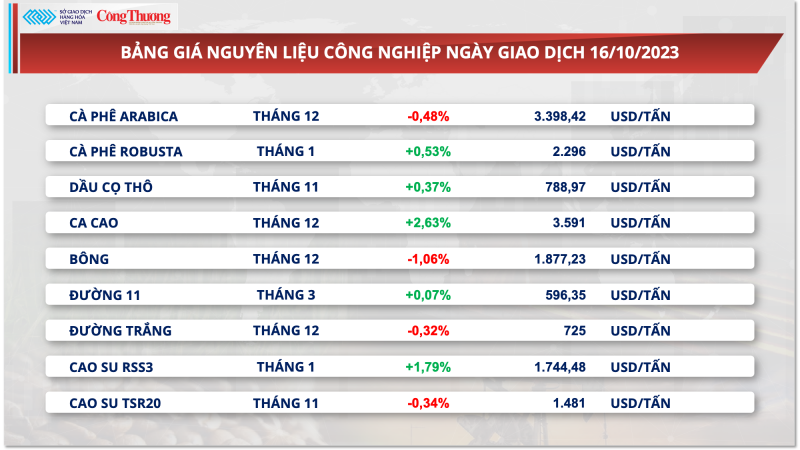

According to statistics from the Vietnam Commodity Exchange (MXV), at the end of the trading session on October 16, Arabica prices reversed and decreased after 6 consecutive sessions of increase, closing 0.48% lower than the reference price. The coffee supply situation in Brazil is shifting in a positive direction, thereby putting pressure on prices.

|

| Robusta coffee prices maintain upward momentum |

Preliminary statistics from the Brazilian Coffee Exporters Association (CECAFE) show that in the first 13 days of October, 1.65 million 60kg bags of coffee were exported, higher than the 1.33 million bags in the same period last month. Of which, Arabica beans were the coffee type with the strongest increase, with 1.36 million bags exported, an increase of 33.33% compared to 1.02 million bags in the first 13 days of September 2022.

At the same time, rains are returning and temperatures are cooling in Brazil’s main coffee growing regions, which should facilitate coffee growth and lead to good production prospects in the 2024/25 crop year.

On the other hand, Robusta prices continued to increase from the last session of last week, closing 0.53% higher than the reference price. Robusta demand is expected to remain high if the economy continues to face difficulties.

BMI, a unit of Fitch Solutions, continues to give optimistic forecasts on Robusta price prospects. According to this organization, Robusta production will be affected by extreme El Nino weather, while demand for this commodity may remain high due to its price advantage over Arabica.

According to the latest data from the General Department of Customs, Vietnam's coffee exports in September 2023 decreased sharply, reaching the lowest level in the past 12 years, reaching 50,967 tons (equivalent to 849,450 bags), down nearly 40% compared to August 2023 and more than 47% compared to the same period in 2022. The turnover reached 168.68 million USD, down 35% compared to August 2023 and down 28% compared to the same period last year.

Cumulative coffee exports in the first 9 months of this year stood at 1.25 million tons, down 8.3% year-on-year, and the total export value was 0.7% higher than the same period last year.

The average export price of Vietnamese coffee reached 3,151 USD/ton, up 3.2% compared to August 2023 and up 29.6% compared to September 2022. In the first 9 months of 2023, the average export price of coffee is estimated at 2,499 USD/ton, up 9.9% over the same period in 2022.

|

| China favors Vietnamese coffee (Photo: Dak Lak Electronic Information Portal) |

Notably, China is emerging as a potential coffee consumption market in the world and Vietnam is currently in the top 3 largest coffee supplying markets to China.

According to the Import-Export Department - Ministry of Industry and Trade, the significant change in coffee consumption in China has promoted the development of the market. While the growth rate of international coffee consumption is 2%, the growth rate of coffee consumption in China is steadily growing at 30%/year.

On average, Chinese people consume 14 billion cups of coffee each year. Recent research shows that 63% of coffee consumption is instant coffee, most of which is imported.

According to data from the China Customs Administration, in the first 8 months of 2023, China imported 79,980 tons of coffee, worth 452.1 million USD, up 7.7% in volume and 5.6% in value over the same period last year. The structure of coffee supply to China is mainly concentrated from the markets of Brazil, Ethiopia, Vietnam, Columbia, and Malaysia.

Source link

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

Comment (0)