Closing the trading session, with 5 out of 7 commodities decreasing in price, corn was the commodity with the strongest price decline in the context of slowing US export activities.

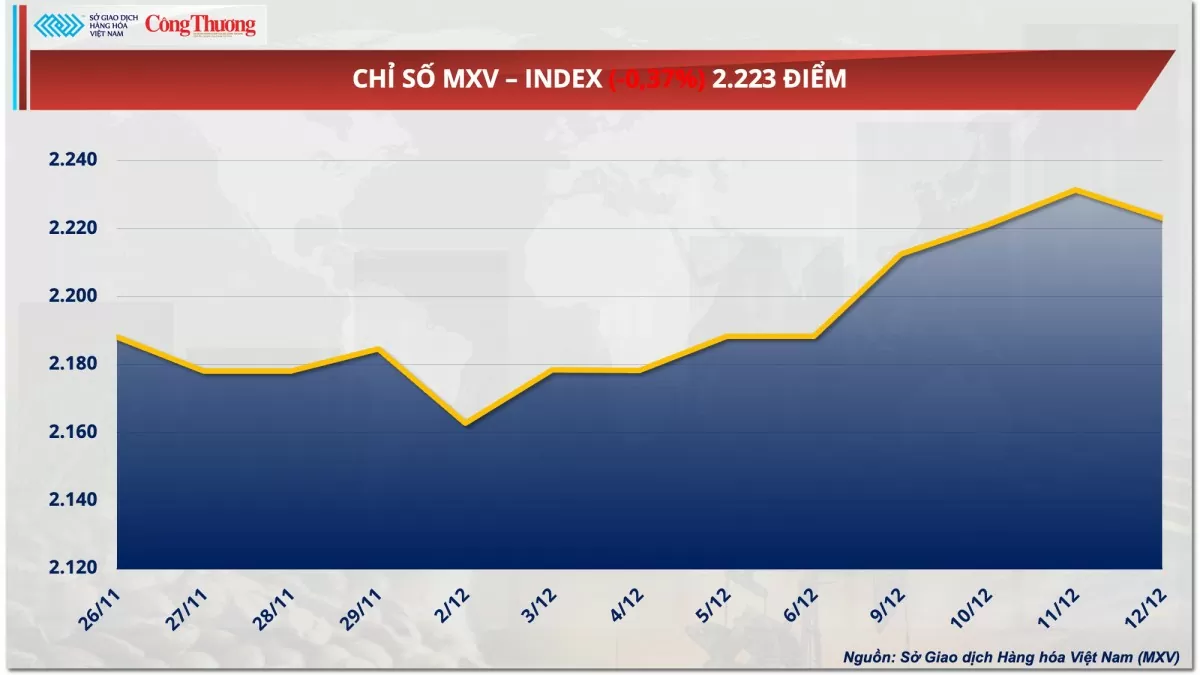

According to the Vietnam Commodity Exchange (MXV), red dominated the world raw material price list in yesterday's trading session (December 12). At the close, the MXV-Index fell 0.37% to 2,223 points, breaking a three-session winning streak. Notably, the metal market led the overall market decline with 8 out of 10 commodities weakening simultaneously. In particular, silver prices plunged 4% from a one-month peak due to strong profit-taking activities.

|

| MXV-Index |

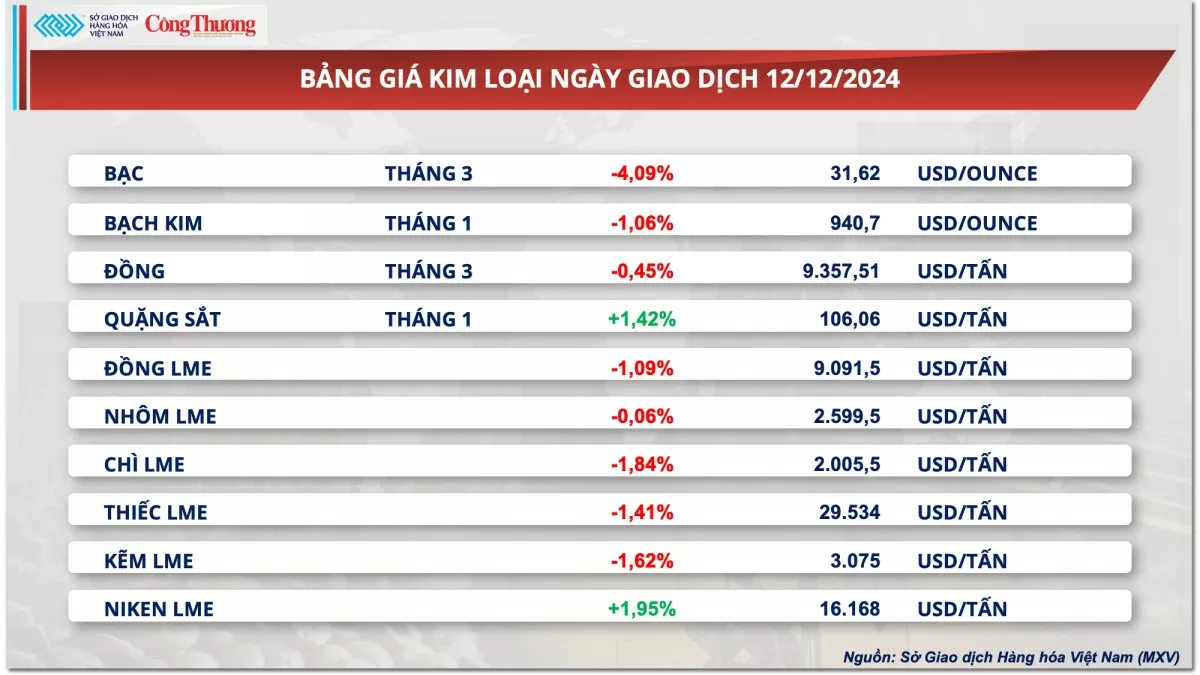

Red covers the metal price list

Most metals ended the trading day lower, with the exception of iron ore and LME nickel. As for precious metals, silver prices fell sharply from a one-month high, breaking a three-session winning streak. This was partly due to investors taking profits at high prices.

|

| Metal price list |

At the close of the session, silver prices fell more than 4% to $31.6/ounce. Platinum prices also fell more than 1% to $940.7/ounce.

In addition, prices of both commodities were under pressure after the US announced inflation figures that increased more than expected yesterday, raising concerns that the US Federal Reserve (FED) will delay the process of lowering interest rates in 2025. Specifically, according to data released by the US Department of Labor's Bureau of Labor Statistics yesterday, in November, the country's producer price index (PPI) increased by 3.4% compared to the same period last year, 0.2 percentage points higher than the forecast.

Notably, compared to the previous month, the PPI index increased by 0.4% in November. This exceeded the market forecast of a 0.2% increase and was the highest level since June this year, reflecting a rebound in inflation in the factory sector. Previously, data also showed that consumer price inflation increased to a 7-month high.

Although these data do not change the market's expectations that the Fed will cut interest rates next week, investors are still betting on a 98% chance that the Fed will cut by 25 basis points. However, signs of rising inflation are making the market worry that the Fed may delay cutting interest rates in 2025. The Fed is unlikely to implement a 150 basis point cut next year as predicted in the September meeting. Accordingly, the pessimistic sentiment that pervades the market has pulled money out of the precious metals market, causing silver and platinum prices to weaken.

For base metals, COMEX copper prices continued to decline by 0.45% to $9,357/ton. In the context of still-sluggish consumption, the market has continuously appeared optimistic signals about supply, which is increasing the risk of oversupply in the market, thereby putting pressure on copper prices.

Total copper output in Chile, the world's largest copper producer, is expected to reach 5.4 million to 5.6 million tonnes next year, up from around 5.2 million tonnes last year, according to forecasts from the Chilean National Mining Association (Sonami). Earlier figures also showed Chile increased copper output to nearly 489,000 tonnes in October, up 6.4% year-on-year and up 3% month-on-month.

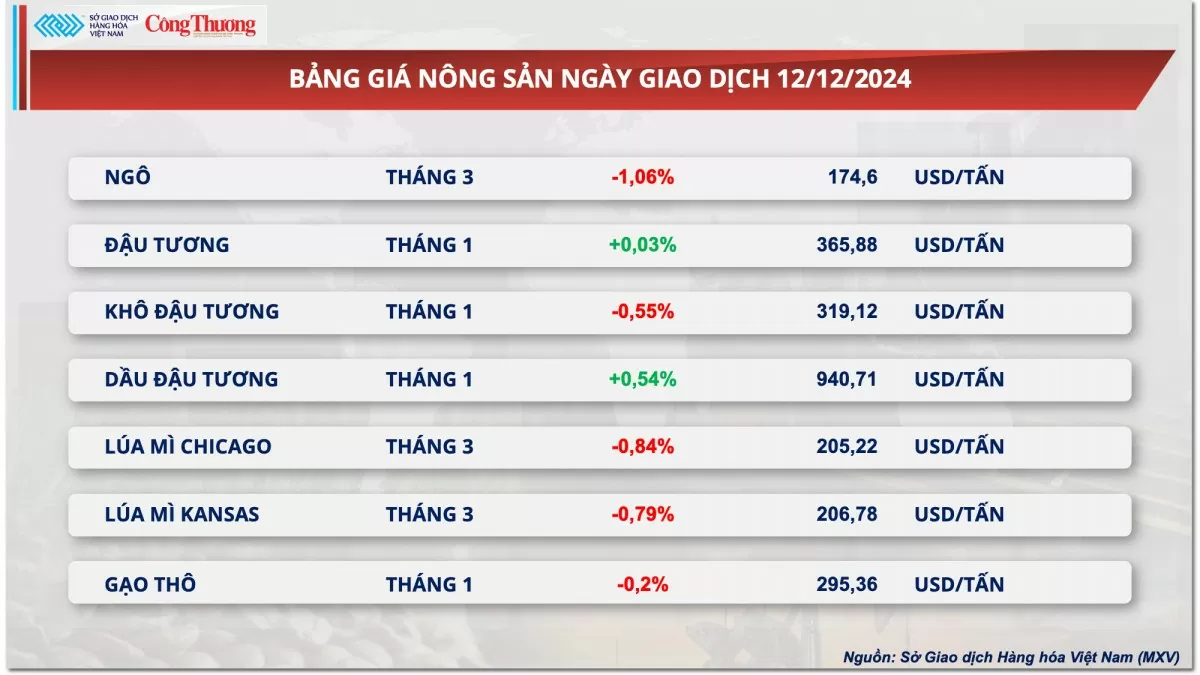

Corn prices weaken, soybean prices remain flat

According to MXV, selling pressure dominated the agricultural market in yesterday's trading session. With 5 out of 7 commodities falling in price, corn was the commodity with the strongest price decline in the context of slowing US export activities.

|

| Agricultural product price list |

In its Export Sales report, the US Department of Agriculture (USDA) said that corn sales for the week ending December 5 were 947,000 tons, the first time it has fallen below 1 million tons in nearly 3 months and down 45% from the previous week. This raised concerns that US corn exports are slowing down, especially with the lack of new orders in the Daily Export Sales report.

In the soybean market, in yesterday's trading session, prices fluctuated around the reference level when basic information was relatively mixed.

In its Export Sales report, the USDA said that U.S. soybean volumes for the week ending December 5 were down nearly 50% from the previous week and 42% below the two-month average. Delivery activity last week was also relatively dismal, with the U.S. delivering just 1.86 million tons of soybeans, down 24% from the previous week.

On the other hand, in the Daily Export Sales Report, the US sold a large order of 334,000 tons of soybeans for delivery in the 2024-2025 crop year to an unnamed country. The appearance of a new order after a long period of market silence has brought positive signals, balancing the selling pressure.

This month’s report from Brazil’s Government Crop Supply Agency (CONAB) did not reveal any significant changes to the soybean market in particular or the overall commodity market in general. CONAB maintained its forecast for Brazil’s 2024-25 soybean production at 166.2 million tons and exports of 105.5 million tons next year. This figure is lower than forecasts from some consulting firms but still shows a positive supply outlook.

Current weather conditions in South America are generally favorable, but there is some uncertainty about the future forecast, which contributed to soybean prices remaining largely flat yesterday.

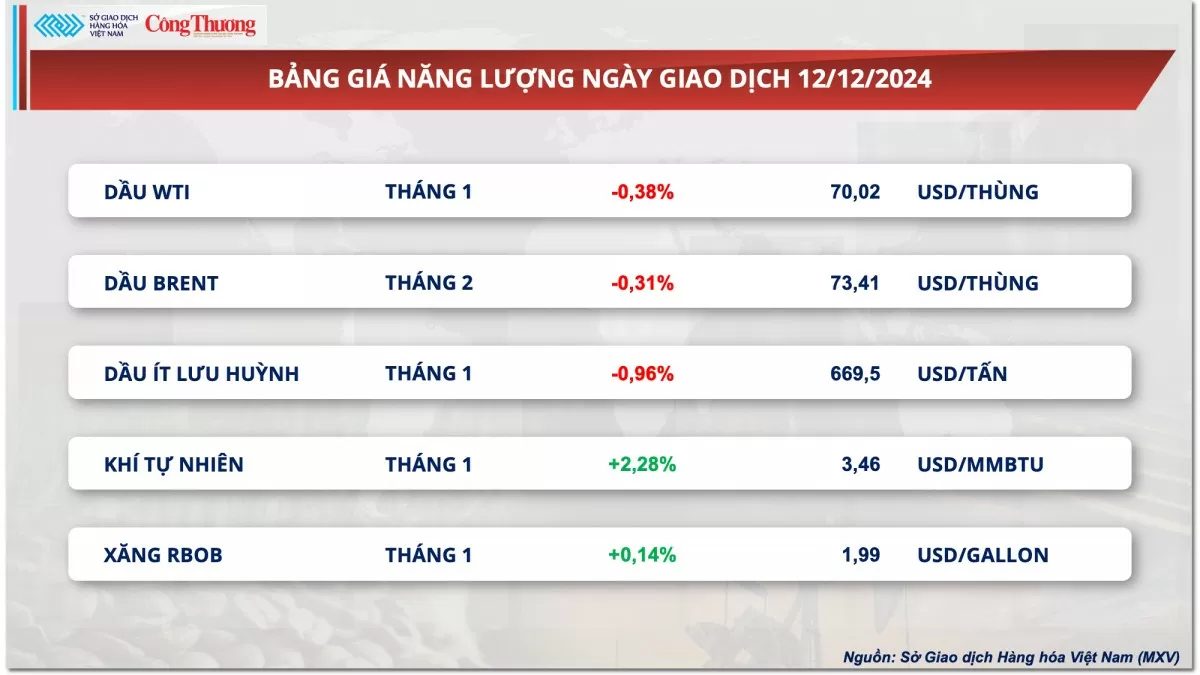

Prices of some other goods

|

| Energy price list |

|

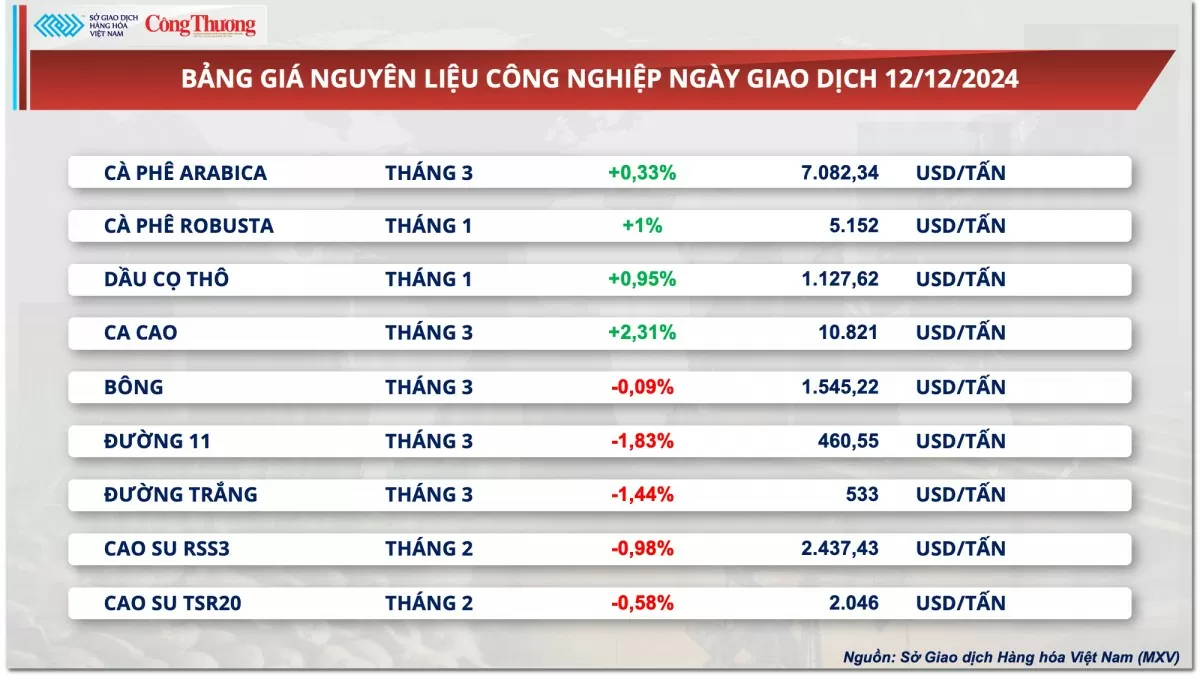

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-1312-gia-ngo-suy-yeu-gia-dau-tuong-di-ngang-364031.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)