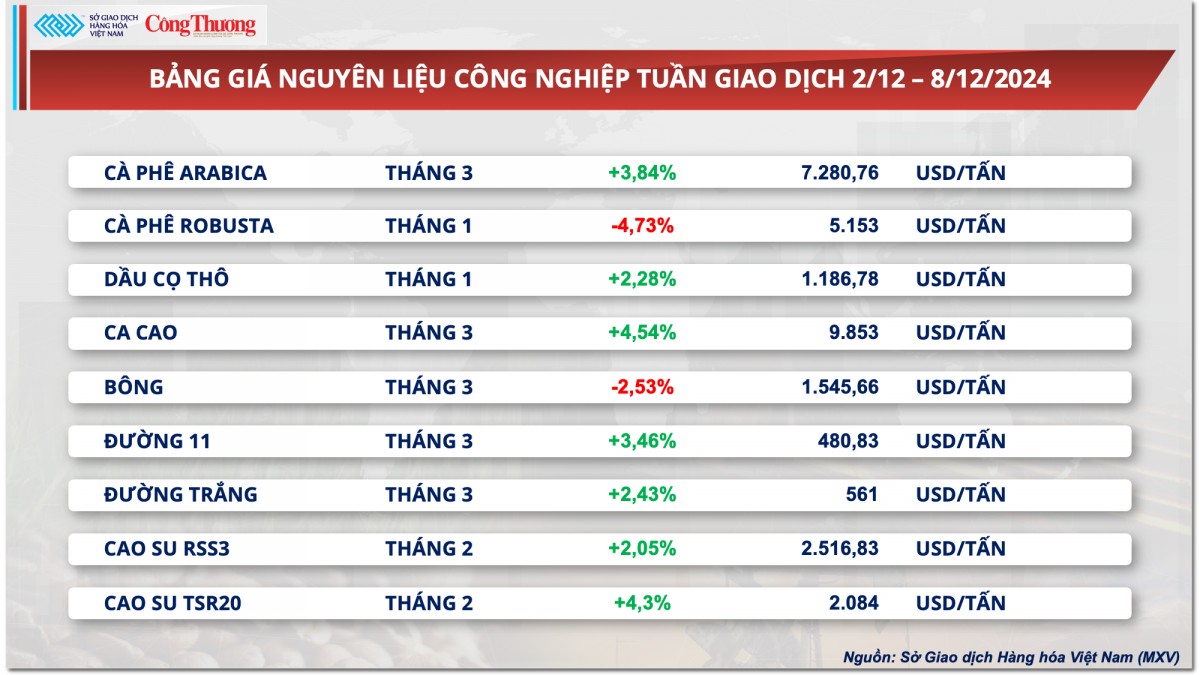

According to MXV, at the end of the week, Arabica coffee prices increased by 3.84%, surpassing the 7,200 USD/ton mark. Robusta coffee prices decreased by 4.73% compared to the historical peak.

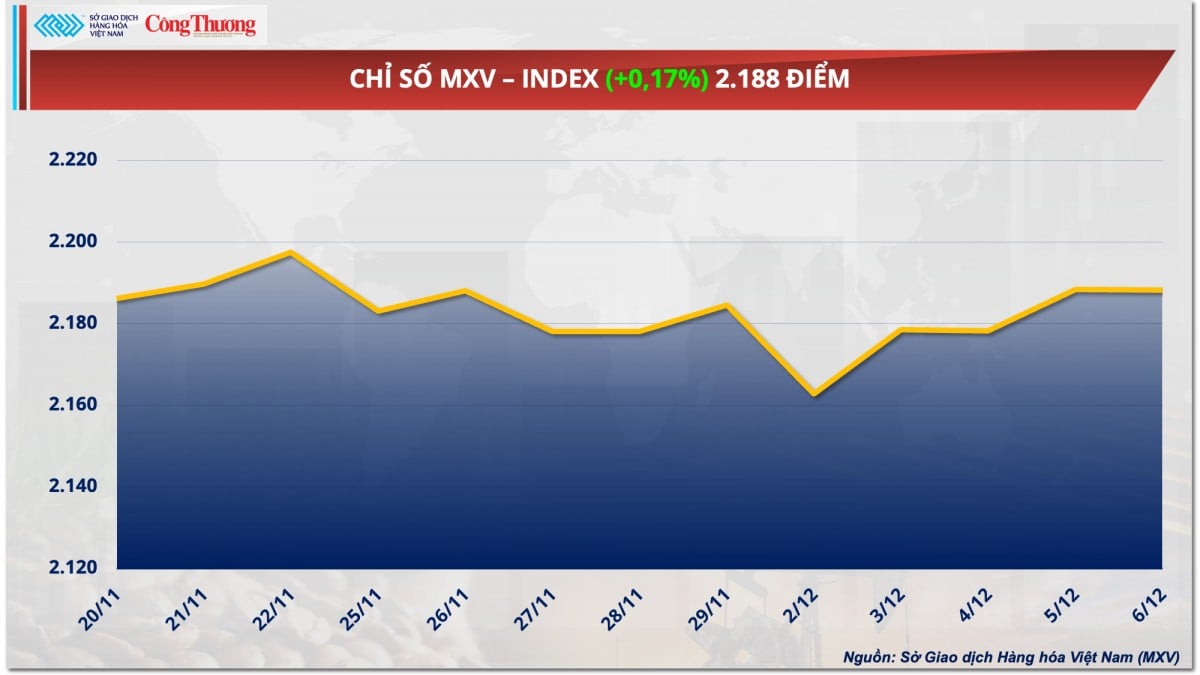

According to the Vietnam Commodity Exchange (MXV), green dominated the world raw material price list last week (December 2-8). At the close, the MXV-Index increased by 0.17% to 2,188 points. Notably, the industrial raw material group led the increase in the entire market with 7 out of 9 commodities increasing in price simultaneously. Of which, the price of Arabica coffee surpassed the 7,200 USD/ton mark, setting the highest level in the past 47 years. In a similar trend, the agricultural products group also witnessed many commodities increasing in price.

|

| MXV-Index |

World coffee prices move in opposite directions

Closing the last trading week, green dominated the price list of industrial raw materials. The focus of the market is still on the price of coffee.

|

| Industrial raw material price list |

The prices of the two coffee commodities experienced a volatile week, with the first two sessions of the week plunging but quickly recovering in the last three sessions. At the end of the week, the price of Arabica coffee increased by 3.84%, surpassing the 7,200 USD/ton mark and setting a new historical peak in 47 years. Meanwhile, the price of Robusta coffee decreased by 4.73% compared to the historical peak set last week.

At the beginning of the week, the prices of two coffee products suddenly fell sharply, especially Robusta coffee, losing more than 15% in just two trading sessions. Basic information remained unchanged, prices were under pressure from profit-taking by investors and pressure from the USD/BRL exchange rate. In the session on December 2, the Dollar Index jumped nearly 1% after Mr. Trump announced on social media that he would impose a 100% tariff on BRICS countries if they tried to create a new currency to replace the USD. Meanwhile, Brazil's domestic Real weakened, causing the USD/BRL exchange rate to skyrocket by 1.42%, to a historic high. The widening gap fueled concerns that Brazilian farmers might increase coffee sales to profit. This pulled money out of the coffee market, causing prices to fall sharply.

However, prices quickly reversed course mid-week as supply concerns returned to the market. Rainfall levels have been consistently below historical averages in Brazil’s main coffee-growing region, keeping the outlook for 2025-2026 supply negative. Somar Meteorologia reported 17.8 mm of rainfall in Minas Gerais, Brazil’s largest Arabica-growing state, last week, or 31% of the historical average.

In addition, according to the General Statistics Office of Vietnam (GSO), preliminary estimates show that Vietnam exported 60,445 tons of coffee in November, equivalent to 50.87% of the amount of coffee exported in the same period in 2023. In the first 11 months of the year, Vietnam exported 1.21 million tons of coffee, down 14.26% over the same period last year. This figure also contributed to the price increase.

Last week, the market also received some important coffee supply and demand information. Notably, the Vietnam Coffee and Cocoa Association (VICOFA) raised its forecast for Vietnam's 2024-2025 coffee output to 28 million bags, 1 million bags higher than the previous forecast. The Colombian Coffee Federation (FNC) also estimated the country's 2024 coffee output at 13.6 million 60kg bags, up 20% from 2023 and 600,000 bags higher than the previous forecast thanks to disease control and adaptation to climate change. In addition, the FNC also reported that in November, the country produced 1.76 million 60kg bags of washed Arabica coffee, up 37% compared to the same period in 2023. In the first 11 months of the year, exports increased by 8% compared to the same period last year, to 1.19 million bags. In addition, according to data from the Brazilian Government, in November, Brazil exported 285,447 tons of green coffee, up 21.6% compared to the same period in 2023.

In the domestic market, coffee prices in the Central Highlands and the Southeast this morning (December 9) were recorded at 123,000 - 124,000 VND/kg, unchanged from December 8. However, compared to the same period last year, coffee prices have now doubled.

Soybean prices post second week of recovery

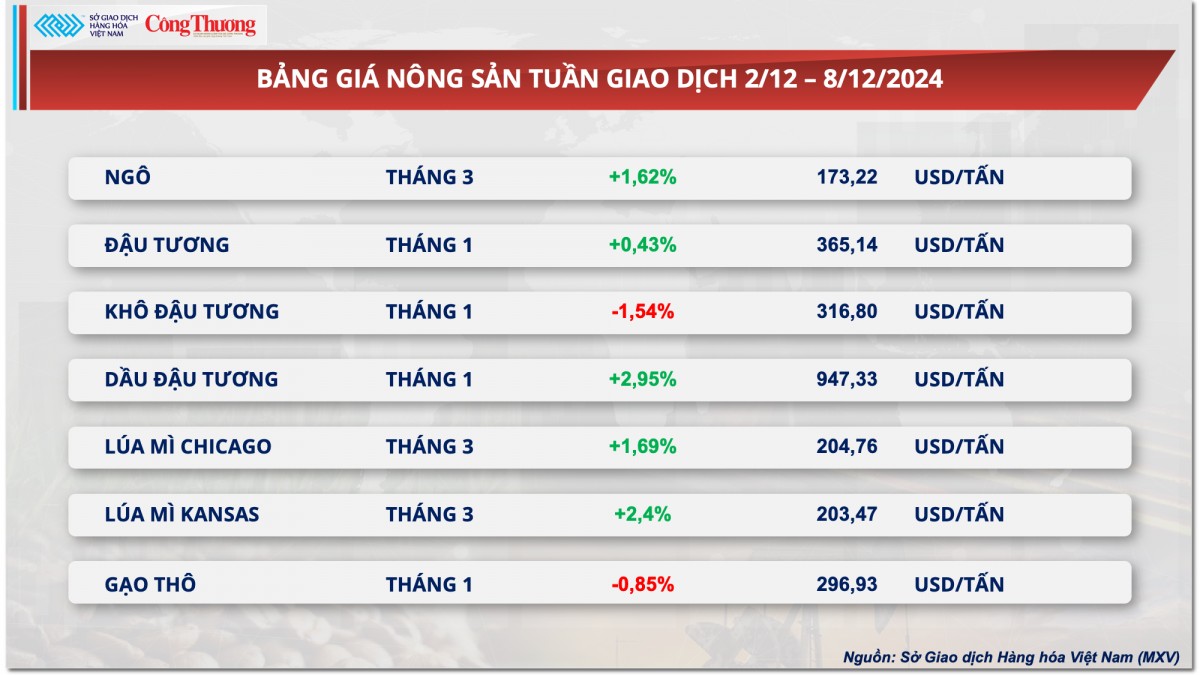

According to MXV, buying power dominated the agricultural market last trading week. The soybean market fluctuated but prices still recorded a second consecutive week of recovery. Positive demand and favorable weather prospects in major producing countries in South America were factors affecting the performance of this commodity.

|

| Agricultural product price list |

According to the USDA's Weekly Export Sales report, soybean sales last week were recorded at 2.3 million tons, at the top of the forecast range and 17% higher than the average of the previous four weeks. Soybean deliveries in the reported week reached 2.4 million tons, up 17% from the previous week, indicating that US export activities are strengthening. In addition, the appearance of new orders in the Daily Export Sales report also strengthened market demand, supporting soybean prices.

In addition, according to data from the National Association of Cereal Exporters (ANEC), Brazil is expected to export only 1.24 million tons of soybeans in December, down sharply from 3.79 million tons in the same period last year. Total soybean exports in 2024 are estimated at 97.1 million tons, lower than the forecast of 98 million tons announced in early November. The decline in exports from Brazil shows that the market is still mainly focused on supplies from the US, boosting buying pressure on prices.

On the other hand, favorable weather conditions in South America, particularly in Brazil and Argentina, are adding pressure to the market. Steady rainfall in major producing regions is considered sufficient to support crops without causing major problems. Some traders say that improving weather conditions in South America are evident. Despite the possibility of some areas experiencing dryness in the next two weeks, the overall crop outlook remains positive, which is keeping a lid on prices.

In the domestic market, on December 6, the offer price of South American soybean meal imported to our country increased. At Vung Tau port, the offer price of soybean meal for delivery in January 2025 was VND 10,400/kg, while the offer price for delivery in February 2025 fluctuated around VND 10,450/kg. At Cai Lan port, the offer price was about VND 100 - 150/kg higher than at Vung Tau port.

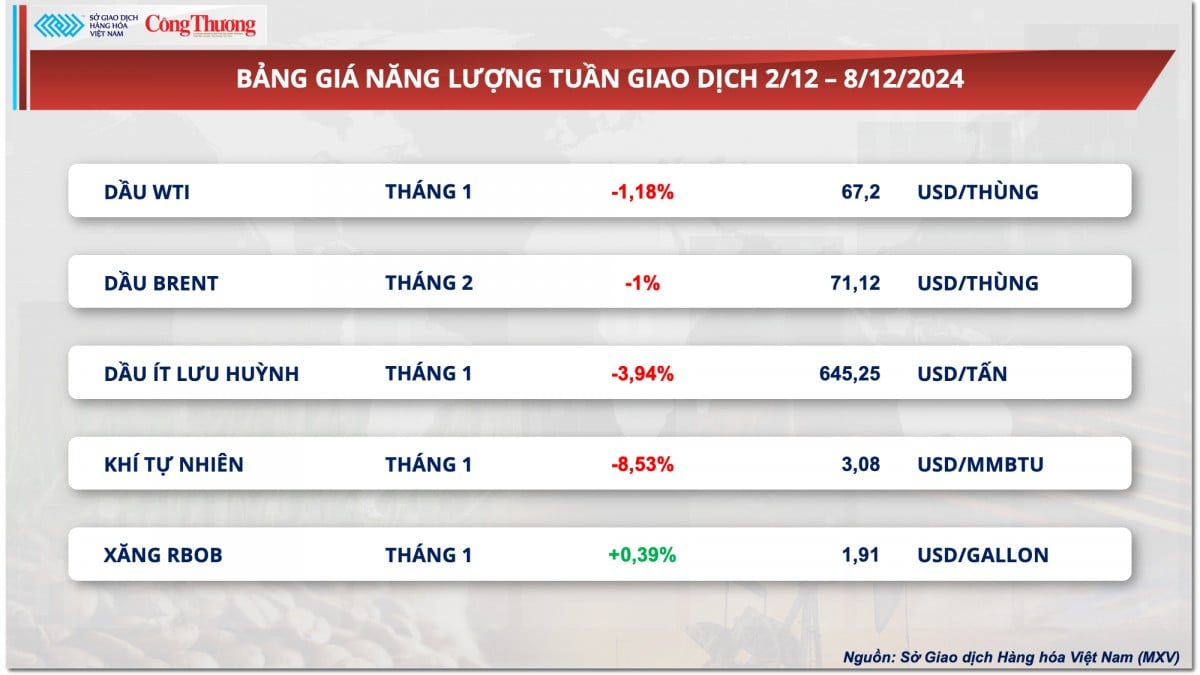

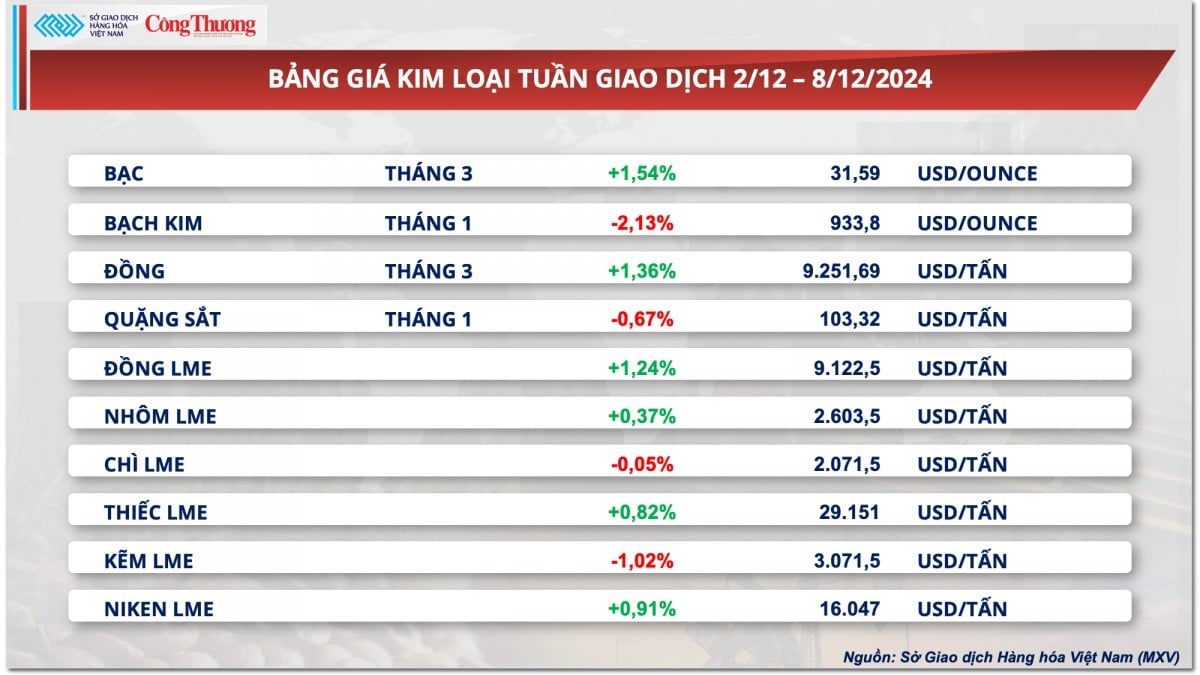

Prices of some other goods

|

| Energy price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-912-gia-ca-phe-the-gioi-dien-bien-trai-chieu-363259.html

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

Comment (0)