Reconciling conflicts is inevitable for every business. After 35 years of development, it is time for Eximbank's Board of Directors to have a high level of consensus on strategic vision, for the goal of long-term stability and sustainability.

Pity for Eximbank brand

Established in 1989 and becoming one of the first joint stock commercial banks in Vietnam, Vietnam Export Import Commercial Joint Stock Bank (Eximbank) used to be a strong brand in the Finance - Banking industry of Vietnam during the renovation period.

After more than a decade of development, Eximbank has a charter capital of VND 17,470 billion and 216 transaction points nationwide. It is a bank with strengths in supporting businesses in the import-export sector.

Eximbank’s EIB shares were also once a “hot” stock on the stock market. Even Japan’s leading financial group, Sumitomo Mitsui Banking Corporation (SMBC), invested 225 million USD to become a major shareholder of this bank by holding 15% of the bank’s shares in 2007.

However, the "fighting" at the top between major shareholders has turned Eximbank from a strong bank into a "mess" in recent years. From a bank earning a profit of more than 4,000 billion VND in 2011, by 2023, Eximbank's pre-tax profit only reached more than 2,700 billion VND.

The crisis at Eximbank was briefly described by the media in the phrase “a decade of chaos” with 9 changes in the Chairman of the Board of Directors within 10 years. After Mr. Le Hung Dung withdrew from the position of Chairman of the Board of Directors, Eximbank elected the following Chairmen of the Board of Directors, in turn: Mr. Le Minh Quoc, Ms. Luong Thi Cam Tu, Mr. Cao Xuan Ninh, Mr. Yasuhiro Saitoh, Mr. Nguyen Quang Thong, then Mr. Yasuhiro Saitoh, then Ms. Luong Thi Cam Tu, Ms. Do Ha Phuong and currently Mr. Nguyen Canh Anh. Behind each change in the Chairman of the Board of Directors is an uncompromising war between shareholder groups.

It is not excluded that due to being too tired of the power struggle at the top, by January 2023, strategic shareholder SMBC officially announced that it was no longer a major shareholder at Eximbank. Before that, in October 2022, a group of shareholders related to Thanh Cong also withdrew capital from this bank.

The culmination of these internal disagreements was the unsuccessful General Meetings of Shareholders, making the story of Eximbank always a hot topic every General Meeting season.

Eximbank needs a turning point

It was thought that the situation would be less chaotic when Eximbank welcomed two new shareholders, who are also the two largest shareholders of the bank: Gelex Group (holding 10% of shares) and Vietcombank (4.51% of shares).

However, the market has recently circulated a document "urgently requesting and reflecting on serious risks leading to unsafe operations and the risk of Eximbank system collapse". The incident has forced Eximbank to officially confirm that this document did not originate from the bank and has not been authenticated.

Eximbank will hold an extraordinary general meeting of shareholders in Hanoi on November 28, 2024, with the main content being to approve the relocation of its headquarters from Ho Chi Minh City to Hanoi. This historic turning point decision is expected to be a big push for Eximbank to have a new look. This bank needs a proper restructuring strategy to solve current problems; consolidate and upgrade business activities and risk management... This can be seen from the successful lesson of TPbank after businessman Do Minh Phu's DOJI Group invested capital and participated in restructuring. The sharing of potential shareholders/strategic partners, not dominated by group interests and a capable, dedicated and experienced executive board has helped TPbank completely "transform".

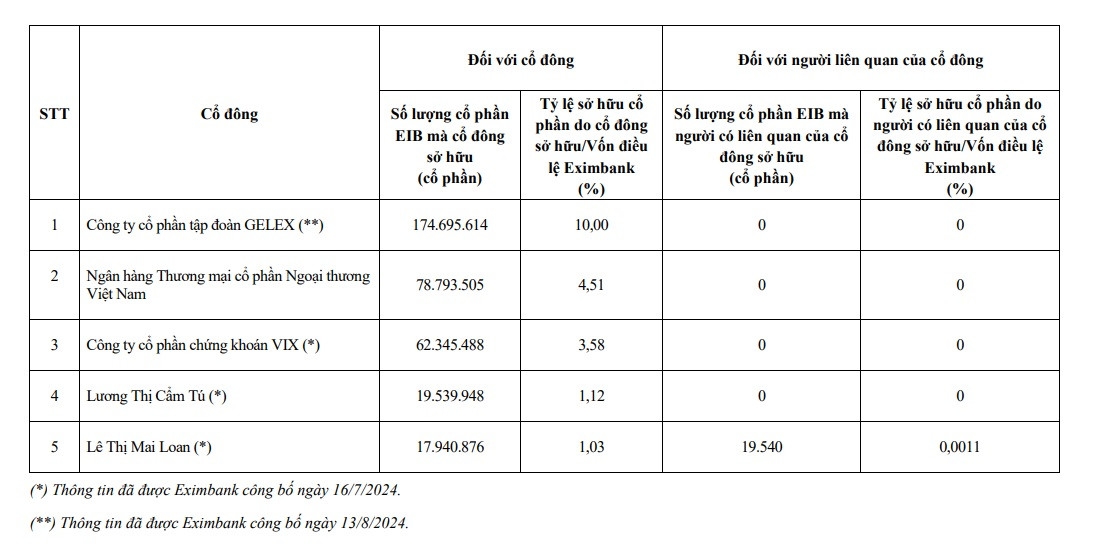

According to Eximbank's latest report on the list of shareholders owning 1% of charter capital, the three largest institutional shareholders are Gelex, Vietcombank, and VIX Securities and there are only two individual shareholders: Ms. Luong Thi Cam Tu (1.12%) and Ms. Le Thi Mai Loan (1.03%).

With the above-mentioned concentrated shareholder structure, along with Eximbank's desire to move its headquarters to Hanoi, investors expect that Eximbank's Board of Directors will leave behind "a decade of chaos" to look in the same direction, helping Eximbank regain its inherent position.

In fact, with the history of the bank, Eximbank has full potential and advantages to be able to break through and become a dynamic and effective bank. As of the end of the third quarter of 2024, Eximbank's total assets increased by 11% compared to the beginning of the year, reaching VND 223,683 billion. Of which, outstanding loans increased by 14%, reaching VND 159,483 billion, and capital mobilization from economic organizations and residents increased by 7%, reaching VND 167,603 billion. In the first 9 months of the year, Eximbank earned VND 2,378 billion in pre-tax profit, up 39% over the same period last year.

Currently, Eximbank declares that it is accelerating to become “the leading commercial bank in Vietnam led by professionalism and integrity”. That is not only Eximbank’s vision but also the expectation of customers and investors in the market.

Source: https://vietnamnet.vn/eximbank-da-den-luc-khep-lai-thap-ky-hon-don-2341421.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)