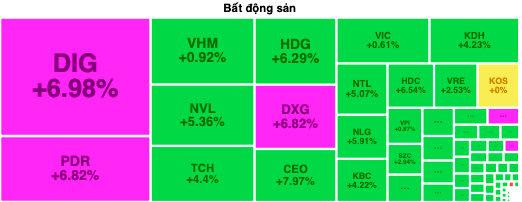

Investor sentiment gradually became more optimistic, helping green appear right from the beginning of the weekend session on August 16, led by the real estate group.

Notably, DXG stock unexpectedly hit the ceiling early to 14,100 VND/share and had a buy surplus of 10 million units, with no sell side. Similarly, PDR code also bloomed in purple to 18,800 VND/share and had a buy surplus of 5.3 million units, with no sell side.

Although the remaining purchase volume was lower at 130,000 units, DIG code also quickly responded and increased to the ceiling price of VND 23,750/share.

Liquidity of all 3 codes above was also active when DIG matched orders of more than 25 million units, PDR matched orders of more than 17 million units and DXG matched orders of more than 12 million units.

In addition to the above ceiling price increases, the remaining stocks in the real estate group also increased well, such as CEO, NTL, NVL, TCH, HDG, VHM, KDH, KBC, HDC, NLG. Green covered the entire industry, with only a few stocks decreasing slightly, such as D2D, TEG, SZL, NVT, HD8, and headwinds such as EFI and BII hitting the floor.

Real estate stocks soon hit the ceiling.

Previously, many opinions said that the three real estate laws approved to take effect early from August 1 would "untie the knot" for real estate businesses to recover.

For example, VIS Rating forecasts that three real estate laws that were approved and will take effect as early as August 1, 2024 will help speed up project legal approval and improve supply from 2025.

In the second half of 2024, housing demand will remain high, boosting developers’ sales as new projects are launched. In the first months of the year, most new projects were sold out as soon as they were launched; transactions in the secondary market also recovered; and housing prices continued to rise in Hanoi and Ho Chi Minh City. Housing demand is partly driven by the low interest rate environment.

"The high demand for housing will boost sales of investors when new projects are launched. This leads to the expectation that sales and cash flow of investors will improve slightly in the next 12-18 months when new projects are launched," said experts from VIS Rating.

Sharing the same view, Dragon Viet Securities (VDSC) assessed that the three laws on real estate have provided a relatively complete legal framework.

Thereby, it has a clear impact on companies in the industry, with the civil real estate sector developing more sustainably, reducing real estate speculation; protecting the rights of home buyers; encouraging the development of social housing projects for those with real housing needs.

Regarding the sales prospects of real estate businesses, VDSC expects that supply and absorption in tier 1 cities will continue to be the driving factors for recovery, along with a clearer recovery in the Ho Chi Minh City market and neighboring areas.

Buyer sentiment is becoming more positive as lending interest rates are expected to remain low and the Government has new legal policies to protect buyers and remove obstacles for current real estate projects.

In the second half of 2024, KBSV Securities expects real estate businesses to recover more clearly thanks to improved homebuyer sentiment and increased supply from the launch of new projects and the next phase of old projects.

Investors can consider and choose businesses with good prospects, large clean land funds, full legal documents, strong project implementation capabilities and safe financial structures. Some notable investment opportunities are stocks VHM, KDH and NLG.

Source: https://www.nguoiduatin.vn/dxg-pdr-dig-cham-tran-co-phieu-bat-dong-san-boc-dau-tang-204240816113857778.htm

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)