The Q1/2025 market report by Knight Frank Vietnam and several other agencies shows that the office leasing market is expected to see a decrease in absorption this year. Specifically, in the first quarter of 2025, the country only recorded 8,400 m² of new office space, significantly lower than the 88,000 m² in the same period last year.

In Ho Chi Minh City, despite a record absorption rate in 2024, the first quarter of 2025 remained stable at 1,300 m² for Grade A offices and 7,600 m² for Grade B. However, the total net absorption area in 2025 is expected to halve compared to the previous year, to about 50,000 m².

Despite the decline in net absorption, Ho Chi Minh City remains a competitive office market thanks to its improved infrastructure and leading economic position, according to Leo Nguyen from Knight Frank. Tenants are increasingly discerning about location, amenities and sustainability.

Ms. Lai Thi Nhu Quynh from Savills Ho Chi Minh City commented that the rental trend is shifting. Previously, companies prioritized the central area, but now, the development of transport infrastructure, especially the metro, is attracting attention to areas such as Thu Duc City, where there are many high-quality offices outside the center.

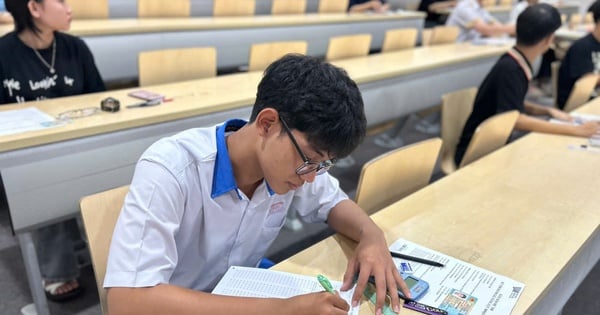

Good connectivity attracts tenants of Grade A buildings outside the city center

In Hanoi, large rental demand of 1,000–3,000 m² increased, helping total net absorption of Grade A and B reach 15,000 m² in the first quarter. New green buildings with modern amenities continued to drive demand in the two major cities, especially with strong participation from technology and engineering businesses.

Rents in Ho Chi Minh City remained high, at US$59.3/m²/month for Grade A (up 1.6%) and US$33.3/m²/month for Grade B (up 2.4%). In Hanoi, Grade A rents reached US$36.1/m²/month and Grade B rents were US$19.5/m²/month.

Knight Frank forecasts that Hanoi will have more new supply in the next three years, while Ho Chi Minh City will be boosted by the return of large projects such as Eco Smart City and One Central.

According to Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, it is still too early to assess the impact of US tax policy on the real estate market, because the situation is still volatile and businesses cannot quickly change their supply chains.

Source: https://nld.com.vn/du-bao-bat-ngo-ve-van-phong-cho-thue-nam-2025-196250413121634459.htm

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)