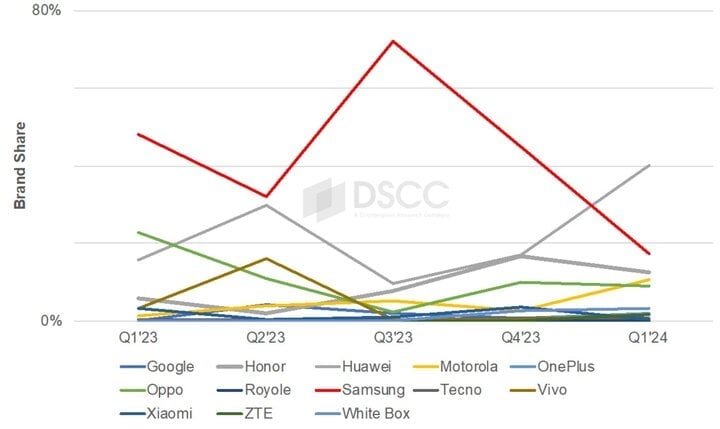

According to statistics from display supply chain consulting firm DSCC, in the last quarter of 2023, the global foldable phone market recorded strong growth.

Specifically, the total number of units sold in the 3 months from September to December reached 4.2 million, up 33% compared to the same period last year. Samsung still leads the market even though the Galaxy Z Fold5 and Flip5 duo sold lower than expected.

Meanwhile, Huawei promises to be a "bright star" returning to the market, as its two foldable models, the Mate X5 and Pocket 2, both grew well. DSCC even predicts that with the current momentum, Huawei will lead the foldable smartphone market share for at least the first two quarters of 2024.

Samsung could lose its "throne" in the foldable phone market from early 2024, according to DSCC.

The top five most popular foldable phones today include Samsung Galaxy Z Flip5, Huawei Mate X3, Honor Magic Vs2, Samsung Galaxy Z Fold5 and Oppo Find N3 Flip.

The Korean manufacturer occupies 4 positions in the Top 10, the rest belong to Chinese companies: Oppo and Honor each have 2 devices, Huawei and Xiaomi share the remaining 2 positions.

Samsung will not release the 6th Galaxy Z foldable phone duo until July or August 2024, so technology experts predict that demand for the company's products will slow down due to the waiting and considering mentality of users whether to choose the new model or buy the previous generation at a cheaper price.

Huawei will have six months to consolidate its position as the top seller of foldable smartphones, and the third quarter of 2024 could see a change of throne when a new series of devices are launched.

DSCC's market research data shows that in recent quarters, Samsung's foldable phone sales have continuously decreased sharply, although not to the point of "falling vertically" but still "plunging", while other brands have had slight fluctuations or clearly increased (as in the case of Huawei).

It is understandable that Samsung has been leading the market for a long time as it was the first company to commercialize the foldable phone design on the market.

However, after 5 generations of devices, Samsung still has not been able to fix the obvious crease on the screen at the hinge position, which is considered "unaesthetic", causing a lack of seamlessness in the swiping and touching experience and especially "losing points" when compared to models from Chinese manufacturers.

Take Oppo for example, when it launched the Find N2 Flip, the device left almost no creases. In the Find N3 Flip and Find N3 generations (a high-end model that folds like a book like the Galaxy Z Fold), Oppo even significantly improved this problem.

Or like the Huawei Mate X3, Mate X5 is similar when the screen is much more seamless than its Korean competitor.

The Galaxy Z Flip5 (above) clearly shows the screen crease when placed next to the Oppo Find N3 Flip, even though Samsung is many years ahead in technology as well as research and development of foldable flexible screens.

Returning to the general market, one of the obstacles when approaching foldable smartphones today is the price. With the same configuration, flexible screen models are often more expensive than conventional bar-shaped devices.

Another reason is the instability in the quality of foldable screens, which whether intentionally or unintentionally is greatly influenced by the "market leader" when in fact the company's foldable models have a high screen failure rate, while the warranty and replacement policies often make it difficult for users. The cost of replacing a foldable screen is not cheap at the present time.

However, observers also noticed a trend of "cooling down" prices as manufacturers have to adjust to retain customers. Not only do the opening prices tend to be cheaper, the ability of folding phones to retain their value is also worse than that of straight phones. Many models drop in price quickly, causing users to lose tens of millions of dong if they buy early at the time of launch compared to waiting 3 or 6 months later.

Source

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

Comment (0)