A series of investments worth hundreds of billions of VND were made by technology enterprises in 2024. The increasing demand for technology investment globally and the AI trend will be an important driving force for technology companies in the service provision sector.

Technology companies invest heavily, stocks in the investment "focus"

A series of investments worth hundreds of billions of VND were made by technology enterprises in 2024. The increasing demand for technology investment globally and the AI trend will be an important driving force for technology companies in the service provision sector.

|

| Technology businesses still have a good growth rate in the market (Photo: Le Toan) |

Heat on the stock market

In 2024, FPT is one of the three stocks that will be under the strongest net selling pressure from foreign investors, with a net selling value of more than VND 6,000 billion. However, despite the strong supply from foreign profit-taking, domestic demand supports and is one of the driving forces that helps FPT shares maintain an increase of up to 85% by the end of 2024.

Not only FPT, technology stocks recorded a shining year. According to statistics from SHS Securities Company, the market capitalization of technology and telecommunications enterprises, after many consecutive years of only accounting for about 2%, has rapidly increased strongly in the past 3 years and now accounts for 9% of total capitalization.

The appeal of technology stocks on the stock market is reflected in both stock price movements and trading volume on the stock exchange. The strong rise of technology stocks is taking place in Vietnam and globally. Previously, the wave of investment in technology stocks had spread from the US to most markets. However, it is not just a phenomenon of price increases due to psychological effects, the growth of business activities of enterprises is also a driving force supporting the investment performance of technology stocks.

In terms of liquidity, trading volume in both telecommunications and information technology groups increased sharply in 2024, with increases of 395.3% and 213.9%, respectively.

Updating the business results of 1,088/1,660 enterprises that have announced their financial reports for the fourth quarter of 2024, the analysis department of An Binh Securities Company (ABS) calculated that the net profit in 2024 of companies on the three stock exchanges increased by nearly 18% over the same period. In particular, the information technology group recorded an outstanding increase of 24.2% for the whole year.

Viettel Global will have the strongest increase in profit in 2024, with after-tax profit reaching VND7,181 billion, 4.4 times higher than the previous year. This is also the highest profit that this enterprise has ever recorded. In addition to the large exchange rate difference profit (an increase of VND2,350 billion), the company's leaders said that business activities in foreign markets have grown well, especially at e-wallet companies. VGI shares have increased from VND26,000/share to nearly VND109,000/share by mid-year.

FPT's business results continued to extend double-digit growth, with full-year revenue reaching VND62,849 billion, up nearly 20% and after-tax profit reaching VND9,420 billion, up 21% over the previous year. The profit of Electronic and Telecommunication Technology Development Investment Joint Stock Company (Elcom - code ELC) also increased by 20% compared to 2023.

In particular, CMC Technology Group (CMG) despite good revenue growth, its profit in the third quarter of 2024 decreased compared to the same period due to a decrease in profits transferred from member units. However, its profit in the first 9 months of the 2024 fiscal year still increased slightly.

Series of businesses investing heavily

In addition to impressive revenue growth, the technology group also increased its investment strongly. In 2024, Viettel Construction invested more than 158.5 billion VND to build BTS infrastructure for rent. This is also the largest capital construction investment of the year for this enterprise, bringing the number of BTS stations owned by Viettel Construction to about 10,000 by the end of 2024, one and a half times higher than one year ago.

Investment activities are quickly reflected in business results and show efficiency at this company. Analysis from experts at SSI Securities Company also shows that revenue from infrastructure leasing is the growth driver with the largest contribution to total revenue.

Meanwhile, Elcom also made a large investment by acquiring a plot of land with an area of over 7,561m2 in Tay Ho Tay Urban Area (Hanoi) to build an office complex project. The investment value of this project until the end of 2024 is 213 billion VND. CMC Technology Group (CMG) has also invested in this urban area since previous years, building CMC Creative Space in Hanoi, with the goal of building an office complex, commercial center, including information technology, high technology, education and training activities. The investment value to date is 623 billion VND.

At FPT, the AI Factory project alone has spent nearly VND980 billion in new investment. Along with investments in the District 9 data center, F-Town 3, FPT Complex 3..., the value of unfinished basic construction costs by the end of 2024 reached VND2,600 billion, double that of a year earlier. Regarding the AI factory alone, FPT said that the factory in Japan is expected to start operating from the end of March 2025, later than the original plan, while the factory in Vietnam is still being deployed on schedule and is expected to start generating revenue in the first quarter of the year.

Assessing the appearance of DeepSeek, FPT believes that the demand for Nvidia H100 GPUs will not be affected, but can create more opportunities for AI-based IT services.

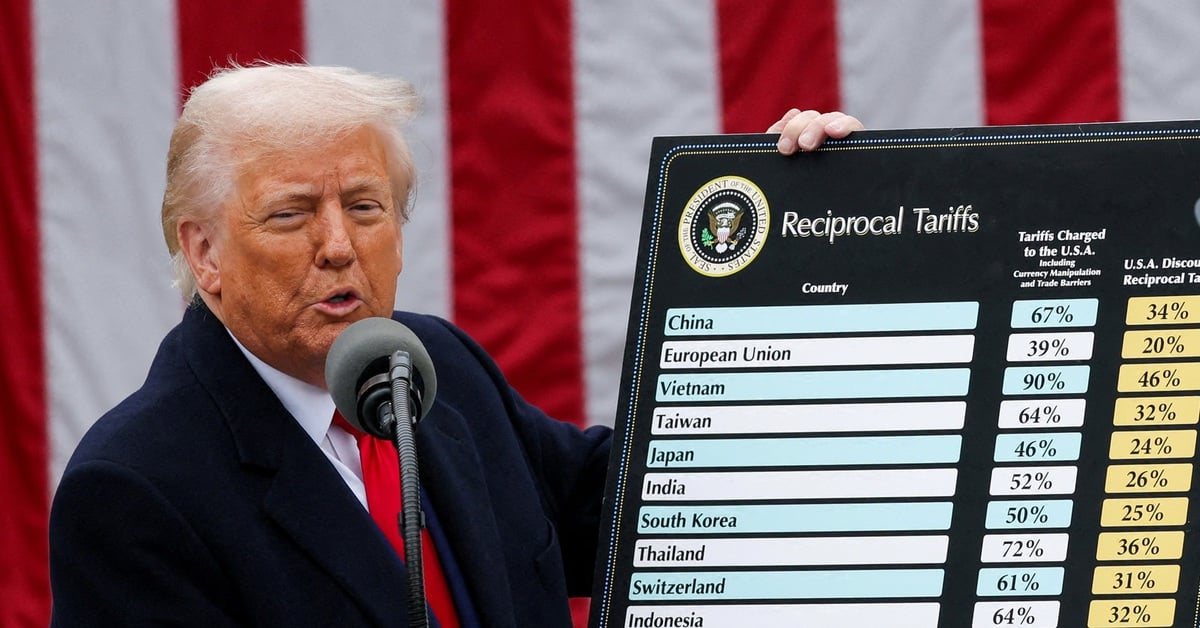

With the potential of the market, the technology industry group has been put in the "focus" of investment by many securities companies in 2025. According to SHS Securities Company, the increasing demand for investment in technology globally along with the AI trend will be an important driving force for Vietnamese technology companies in the service supply sector. Along with that, the policy and strategy to promote IT along with the advantage of human resources are the conditions for Vietnam to take advantage of the wave of diversifying the supply chain and participating in the global semiconductor and AI value chain.

Source: https://baodautu.vn/doanh-nghiep-cong-nghe-dau-tu-khung-co-phieu-vao-tieu-diem-dau-tu-d247570.html

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

Comment (0)