In this document, HoREA proposed to add that medium-sized enterprises are subject to a tax rate of 18%, lower than the normal Corporate Income Tax rate, to ensure consistency and consistency with legal regulations on supporting small and medium-sized enterprises.

Mr. Le Hoang Chau, Chairman of HoREA analyzed: The corporate income tax (CIT) rate for small, medium and micro enterprises currently has many support policies.

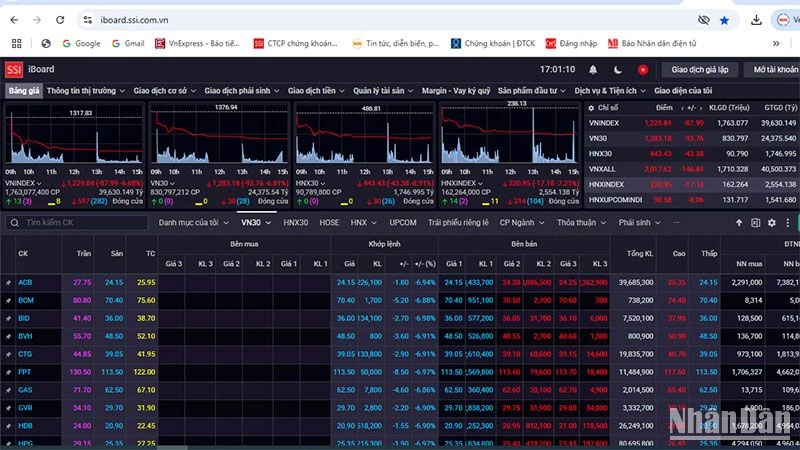

Illustration photo. (Source: ST)

Specifically, for enterprises with total revenue of no more than 3 billion VND/year, the corporate income tax rate will be 15%; Enterprises with revenue of no more than 50 billion VND will be subject to a tax rate of 17%. For enterprises with revenue of 50 - 300 billion VND/year, the tax rate will be 18%.

According to Mr. Chau, Vietnam has about 920,000 enterprises, of which small and medium enterprises hold a very important position in the economy, accounting for 98% of the total number of enterprises.

In particular, small and micro enterprises contribute about 40% of GDP, about 30% of state budget revenue and employ over 50% of the workforce.

“Therefore, the National Assembly issued the Law on Support for Small and Medium Enterprises 2017 and the Government also issued Decree 39/2018/ND-CP detailing the mechanism to support small and medium enterprises,” said Mr. Chau.

According to the Law on Support for Small and Medium Enterprises, small and medium enterprises will be entitled to a corporate income tax rate lower than the normal tax rate applicable to enterprises for a limited period of time.

Regarding the criteria for determining small and medium-sized enterprises, Decree 39/2018/ND-CP clearly stipulates: Small enterprises in the fields of agriculture, forestry, fisheries and industry and construction have an average number of employees participating in social insurance of no more than 100 people per year and total revenue of the year of no more than VND 50 billion or total capital of no more than VND 20 billion.

Small enterprises in the trade and service sector have an average number of employees participating in social insurance of no more than 50 people per year and total annual revenue of no more than 100 billion VND or total capital of no more than 50 billion VND.

Medium-sized enterprises in the fields of agriculture, forestry, fishery, industry and construction have an average number of employees participating in social insurance of no more than 200 people per year and total annual revenue of no more than 200 billion VND or total capital of no more than 100 billion VND.

Medium-sized enterprises in the trade and service sector have an average number of employees participating in social insurance of no more than 100 people per year and total annual revenue of no more than 300 billion VND or total capital of no more than 100 billion VND.

“Thus, the regulations are very clear about applying “preferential” tax rates to small and medium-sized enterprises, so the drafting agency needs to add the case of “medium-sized enterprises” which are enterprises with total annual revenue from over 50 billion VND to no more than 300 billion VND to enjoy preferential tax rates,” said Mr. Chau.

Source: https://www.congluan.vn/de-xuat-doanh-nghiep-vua-nho-va-sieu-nho-duoc-huong-uu-dai-ve-thue-tndn-post312519.html

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Infographic] Government bond market March 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/e13239cdbcfd4968abc836c201204c43)

Comment (0)