The National Assembly's Finance and Budget Committee proposed that the Government have appropriate policies and consider removing the regulation on value-added tax (VAT) exemption for imported goods with a value of less than 1 million VND sent via express delivery via platforms such as Shopee, Lazada, TikTok...

On the afternoon of June 17, Minister of Finance Ho Duc Phoc, on behalf of the Government, presented the draft VAT Law (amended) with many new policies.

According to Minister Ho Duc Phoc, the draft law amends and supplements provisions in 11 articles of the current law, including taxpayers; non-taxable subjects; taxable price; tax rate; tax deduction method; direct calculation method on VAT; input VAT deduction; tax refund cases; invoices, documents; effective date; implementation organization.

Minister of Finance Ho Duc Phoc. GIA HAN

45 - 63 million USD worth of goods every day

In the review report, Chairman of the Finance and Budget Committee Le Quang Manh said that the draft law supplements regulations on gifts, presents, movable assets, and border goods within the import tax exemption limit according to the law on export tax and import tax that are not subject to VAT.

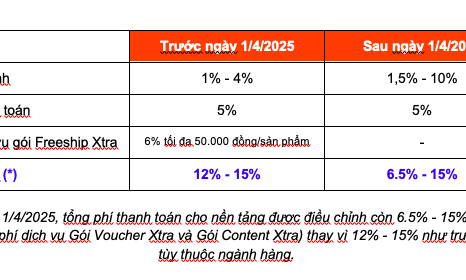

Although not stipulated in the law, in practice, VAT exemption associated with import tax exemption is also applied to imported goods with a value of less than 1 million VND sent via express delivery (according to Decision No. 78/2010 of the Prime Minister).

According to the inspection agency, with the explosion of cross-border e-commerce, the volume of cross-border transactions of small-value goods has increased many times in recent times.

In Vietnam, every day there are an average of 4 - 5 million small-value orders shipped from China to Vietnam via Shopee, Lazada, Tiki, TikTok...

The report of the Finance and Budget Committee cited data from the Joint Stock Post and Telecommunications Corporation, March 2023, with the value of each order being divided into 100,000 - 300,000 VND; on average, about 45 - 63 million USD per day, about 1.3 - 1.9 billion USD worth of goods are circulated through Shopee, Lazada, Tiki, TikTok...

Mr. Manh also informed that currently, many countries have abolished the VAT exemption for imported goods of small value to protect revenue sources and create an equal business environment between domestically produced and imported goods.

"The Government is requested to have appropriate policies to expand and cover revenue sources in the context of current budget constraints, and to explain the legal basis of Decision No. 78/2010 for the above content," said the Chairman of the National Assembly's Finance and Budget Committee.

Proposal to increase VAT before 2030

The draft law transfers fertilizers, offshore fishing vessels, specialized machinery and equipment for agricultural production from non-taxable goods to goods subject to a 5% tax rate.

Chairman of the Finance and Budget Committee Le Quang Manh. GIA HAN

On the contrary, the dissenting stream argues that applying a 5% tax rate will increase input costs of agricultural production, increase product prices, and reduce the competitiveness of domestic agricultural products.

Therefore, the Finance and Budget Committee recommends that the Government carefully assess and report more fully on the impact of this policy amendment, from the perspective of impact on domestic production sectors as well as from the perspective of impact on farmers.

Another issue, also according to the Chairman of the Finance and Budget Committee, the current general tax rate of 10% in Vietnam is lower than that of other countries in the region and the world, showing that Vietnam has room to increase the VAT rate, especially in the context of needing to expand the revenue base.

The audit agency's report cited that the average tax rate in Asia is 12%, Latin America is 14%, Africa is 16%, countries in the Organization for Economic Cooperation and Development (OECD) are 19%, the European Union (EU) is 22%, and the current global average tax rate is 15%.

According to Mr. Manh, some ASEAN countries have been increasing VAT rates as a solution to improve budget collection efficiency since the Covid-19 pandemic. At the same time, the tax system reform strategy until 2030 has also determined the direction of "researching to increase VAT rates according to a roadmap".

"The Government is requested to assess the impact of some options to increase tax rates according to the roadmap to consider the possibility of increasing tax rates in the draft law appropriately, after the economy has recovered, possibly at the end of the 5-year period 2026 - 2030," Mr. Manh stated.

Le Hiep

Source : https://thanhnien.vn/de-xuat-danh-thue-vat-tat-ca-hang-hoa-nhap-khau-qua-shopee-lazada-tiktok-185240617125717058.htm

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

Comment (0)