Both Brent and WTI crude fell more than 1% today, as the risk of supply disruptions became increasingly low and US oil inventories rose sharply.

Brent crude oil price fell 1.4% this afternoon to 86 USD per barrel. US WTI crude oil fell 1.2% to 82.1 USD per barrel.

“Crude oil failed to sustain its gains late last week as the market took the view that Israel-Iran tensions could ease following Iran’s conciliatory remarks,” said Yeap Jun Rong, market strategist at IG, explaining that the risk of a supply disruption in oil prices is fading as the scenario becomes increasingly unlikely.

Both Brent and WTI rose 3% in early trading on April 19 after reports that Israel may have attacked Iran. However, the gains later faded when Tehran said it had no plans to retaliate.

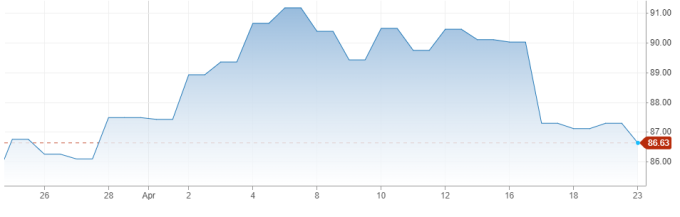

World crude oil price developments over the past month. Chart: CNBC

Rising US crude inventories also added to the pressure on oil prices. The latest figures from the US Energy Information Administration (EIA) showed that US crude inventories rose by 2.7 million barrels last week, double analysts' forecasts.

"Oil prices are under pressure from large US oil inventories and the possibility of the US Federal Reserve delaying interest rate hikes, which has strengthened the US dollar," Tina Teng, an independent market analyst, told Reuters . A strong US dollar makes oil more expensive for buyers using other currencies.

On April 19, Chicago Fed President Austan Goolsbee signaled that the US could maintain high interest rates for a while longer, as the fight against inflation has not progressed. Investors now believe that the Fed will not start lowering interest rates until September.

Still, analysts at ANZ said the turmoil in the Middle East would keep the oil market “vulnerable.” On April 20, a massive explosion occurred at a pro-Iranian militia base in Iraq. On April 21, Hezbollah said it had shot down Israel’s “best drone in the world.” Hezbollah and Israel have been at war for more than six months.

Ha Thu (according to Reuters)

Source link

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)