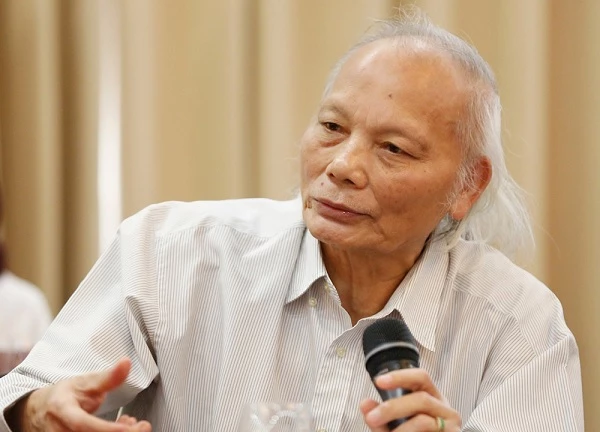

DNVN - Sharing at the workshop "Developing the corporate bond market towards professionalism and sustainability", on the morning of August 16, Professor, Dr. Nguyen Mai - Chairman of the Association of Foreign Investment Enterprises, commented that the pressure to pay maturing bonds of real estate enterprises is difficult to relieve when the market has not fully recovered.

According to Professor, Dr. Nguyen Mai - Chairman of the Association of Foreign Investment Enterprises, the private corporate bond market in the first quarter of 2024 showed a slowdown in issuance value. Compared to 2023, the market faces the burden of corporate bond lots with delayed principal/interest payments extended through Decree 08. Decree 08/2023/ND-CP dated March 5, 2024 amends and suspends the validity of a number of articles in the Decrees regulating the offering and trading of private corporate bonds.

The estimated value to be processed is VND99,700 billion, including restructured and deferred corporate bonds worth VND195,000 billion from 135 issuers until December 31, 2023. Accounting for 16.13% of total outstanding corporate bonds and 23.76% of the value of outstanding non-bank corporate bonds.

Real estate bonds with delayed payment accounted for 31%, energy accounted for 47.1%, trade and services accounted for 19.92%.

“In 2024, the value of corporate bonds maturing is estimated to reach VND234,000 billion. Of which, the real estate industry accounts for more than 41%, and credit institutions account for 22.2%. Since Decree 08/2023/ND-CP took effect, businesses have tended to choose restructuring options to deal with immediate liquidity issues,” said Mr. Mai.

Mr. Mai emphasized that the payment pressure of real estate enterprises is expected to be difficult to relieve when the market has not fully recovered, legal problems continue due to policy delays. Enterprises need time to rebalance their business cash flow.

At the same time, the risk of late payment in the market will also increase due to the expiration of some extension provisions in Decree 08/2023/ND-CP. In addition, there is pressure from corporate bond issuances with buyback commitments in 2024.

However, the Chairman of the Association of Foreign Investment Enterprises said that experts and financial institutions expect corporate bonds to be more active in 2024 thanks to macroeconomic improvements that increase investment activities and long-term capital mobilization. Along with that, low bank interest rates are maintained; discipline is enhanced as the market gradually gets used to new regulations.

Specifically, Fiingroup expects the corporate bond market in 2024 to enter a new phase of development in a more stringent direction with higher requirements applied to all market participants. Thereby helping new bond issuance activities gradually recover.

In addition, many regulations in Decree 65/2022/ND-CP (amending Decree 153/2020/ND-CP regulating the offering and trading of individual corporate bonds in the domestic market and the offering of corporate bonds to the international market) coming into effect in 2024 will establish stricter discipline for all relevant parties.

“This will help restore market confidence. The large issuance demand of the banking group to supplement capital sources and meet financial safety indicators will lead the bond market in 2024,” Mr. Mai commented.

Hoai Anh

Source: https://doanhnghiepvn.vn/kinh-te/chung-khoan/dao-han-trai-phieu-doanh-nghiep-bat-dong-san-ap-luc-kho-giai-toa/20240816120959509

Comment (0)