Many securities companies propose to increase capital from several hundred to thousands of billions of VND to expand investment and margin lending.

At the shareholders' meeting in early April, Vietcap Securities Company (VCI) will present a plan to issue more than 280 million shares, bringing its charter capital to over VND7,000 billion.

Vietcap increased its capital through the issuance of employee stock option plan (ESOP) shares, bonus shares for shareholders and private placement. Estimated proceeds are about VND2,400 billion (excluding bonus shares), of which 88% (about VND2,100 billion) is used to provide capital for margin lending.

Similarly, many other securities companies have also prepared plans to increase capital since the beginning of this year. Guotai Junan Securities (Vietnam) said it is about to sell more than 69 million shares to existing shareholders to double its capital. The selling price has not been decided, but based on par value, the scale of the mobilization is nearly 700 billion VND. The purpose of increasing capital is mainly for margin lending, accounting for 75% of the proceeds. 10-15% for derivative securities activities and investment banking.

Nhat Viet Securities (VFS) also plans to issue an additional 120 million shares to existing shareholders, increasing its capital to VND2,400 billion this year. 50% of the proceeds will be used for self-investment, the rest will be used to expand margin lending.

In addition, FPTS, ACBS and SSI - the leading companies in terms of charter capital with more than 15,000 billion VND - are also planning to increase capital from several hundred to thousands of billion VND.

An investor's online trading screen, on the Yuanta Securities exchange. Photo: Quynh Tran

Unlike previous capital increases, according to analysts, this expansion plan of securities companies is also a step to prepare for the new trading system KRX, with the expectation of a sharp increase in market liquidity.

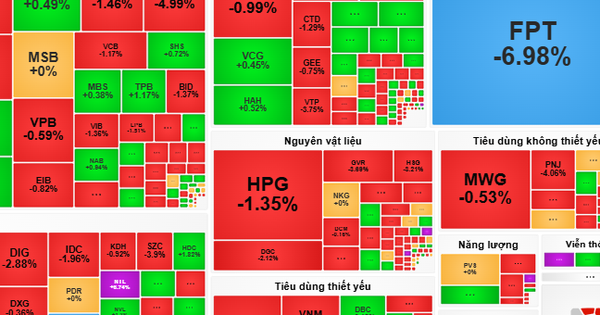

"In the context of a slowing real economy, low savings interest rates from banks and a frozen real estate market, capital is flowing into the stock market," VNDirect's strategy report earlier this year wrote.

KRX - the new information technology system that HoSE has been testing since March 4, after many delays. This system is expected by many investors, securities companies and analysis units to become a "east wind" for the market in the long term, helping to supplement the missing conditions for upgrading securities.

According to KB Securities Vietnam (KBSV), the new system helps the average trading value per session of VN-Index increase by 30-70% compared to the average liquidity of the past 5 years.

As in the case of VietCap Securities, according to SSI Research , with a strategy focusing on expanding retail brokerage and preparing resources to implement a payment support model for institutional investors (NPS), the pressure to increase capital this year is very large, especially since VCI has not increased capital since 2017.

"The current margin lending space of many securities companies is still sufficient, but it is difficult to say how much liquidity and investor demand can increase before the new system is launched," said the head of consulting at a securities company in Hanoi.

Charter capital is the basis for securities companies to provide margin to customers. According to regulations, securities companies are not allowed to lend margin exceeding twice their equity at the same time. Therefore, increasing the margin lending quota in advance is the foundation for the race for market share, which has been very fierce recently.

Since the beginning of 2024, the cash flow into the stock market has continuously increased. Liquidity in many trading sessions has returned to the threshold of 1 billion USD, a figure equivalent to the time when the market peaked at 1,500 points.

Despite expanding operations and trading, revenue from brokerage fees and margin lending remains the main source of income for many securities companies. For example, revenue from brokerage and margin lending activities brought Vietcap more than VND1,200 billion last year, accounting for 50% of total revenue.

However, unlike the stability of the previous decade, the top 10 brokerage market share rankings have been shaken up in recent years. Companies that have "nailed" the top position for a long time can also lose their position after a short time.

Minh Son

Source link

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Deputy Prime Minister Neth Savoeun](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/e3dc78ec4b844a7385f6984f1df10e7b)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] General Secretary To Lam gave a speech at the National Conference to disseminate the Resolution of the 11th Central Conference, 13th tenure.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/04e0587ea84b43588d2c96614d672a9c)

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

Comment (0)