Construction and installation stocks increased sharply in the first session of the week, helping the market close in the green.

After a week of volatile trading, investors' sentiment has become more cautious. This is reflected in today's session, when the VN-Index fluctuated no more than 5 points. After ATO, the HoSE index exceeded the reference, but the green color could not be maintained for long. The decline of some large-cap stocks pulled the market closer to the reference. Divergence in banking stocks - the group with a high proportion of capitalization - caused the market to move sideways.

Instead, cash flow is directed towards mid-cap and penny segments, such as construction and installation groups and some real estate codes.

After a slowdown at the end of the morning session, construction stocks all increased sharply. HBC and LCG were in a "blank sell" state, while C4G, VNE and VCG increased by over 5%. Along with the construction group were construction material stocks, with cement and steel stocks all increasing sharply.

In the real estate group, CII, NBB, SCR, NLG remained green at the close. DIG increased by 1.4% at one point but was forced back to the reference price by selling pressure at the end of the session.

In the large-cap group, trading was somewhat more balanced. Banking stocks led the active trading group, with TCB, VPB, MBB, TPB, and STB closing up more than 1%. However, on the contrary, VCB was also the stock with the biggest decline, losing 1.2%.

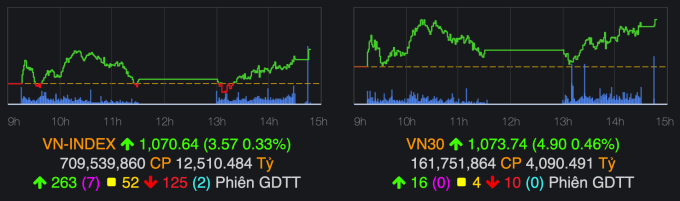

VN-Index closed the session up slightly by 3.57 points (0.33%) to 1,070 points. VN30-Index increased by nearly 5 points to nearly 1,074 points. On the Hanoi Stock Exchange, HNX-Index and UPCOM-Index closed in green.

As green spread across the mid-cap and penny groups, the number of stocks increasing dominated on HoSE. This exchange closed with 263 stocks increasing, compared to 125 stocks decreasing. Meanwhile, trading in the VN30 group was more balanced with the ratio of increasing to decreasing stocks being 16:10.

HoSE liquidity recorded more than 12,500 billion VND, with the VN30 group alone trading more than 4,000 billion VND. Foreign investors maintained a net selling status with a scale of nearly 470 billion VND.

Minh Son

Source link

Comment (0)