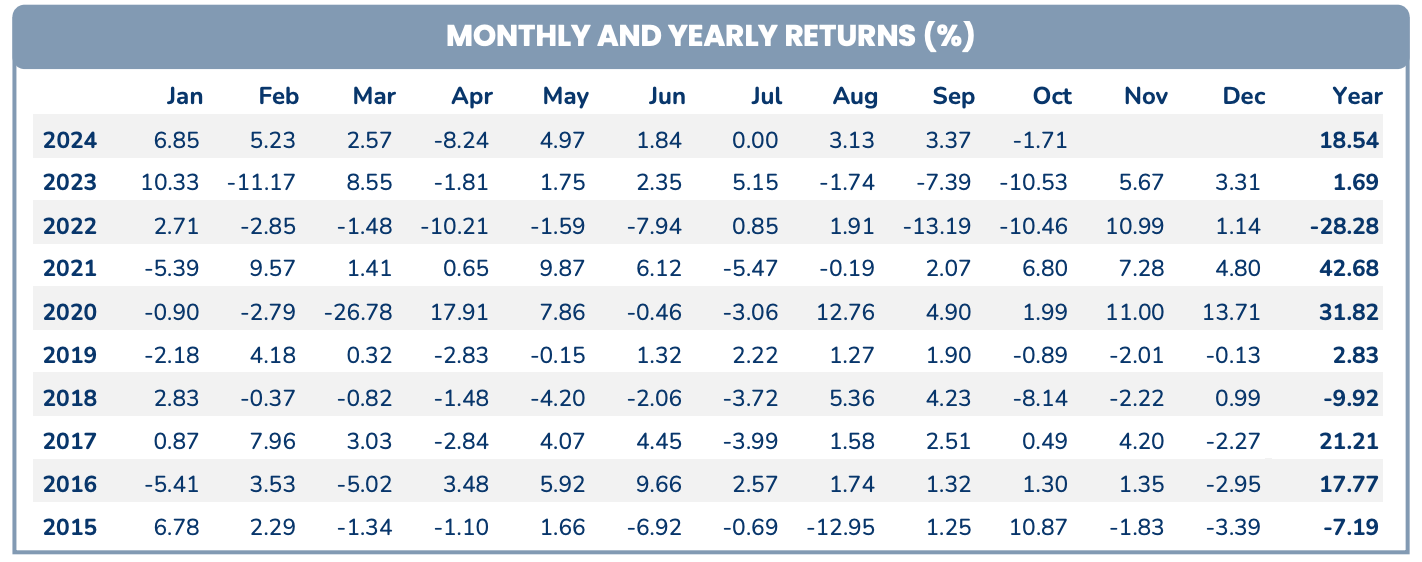

In October 2024, PYN EIite's performance decreased by 1.7%. However, with strong growth in the first months of the year, the fund's 10-month performance still reached 18.54%.

In October 2024, PYN EIite's performance decreased by 1.7%. However, with strong growth in the first months of the year, the fund's 10-month performance still reached 18.54%.

The October 2024 report of Finnish investment fund PYN Elite said that the VN-Index decreased by 1.8% in October due to weak market sentiment due to a stronger USD, leading to a 2.8% monthly depreciation of the VND against the greenback.

Due to the market impact, PYN Elite's performance decreased by 1.7% in the month, this slight decrease was supported by codes such as STB (+5.5%), ACV (+13.7%) and HVN (+10.5%). Compared to the beginning of the year, PYN Elite's performance increased by 18.5%, while VN-Index increased by 11.9%.

|

| PYN Elite Fund Monthly Performance Report. |

According to this investment fund's assessment, the recent Q3/2024 business results report showed a solid recovery trend. The total net profit of companies listed on the HoSE increased by 28% compared to the same period last year, while the income of key stocks in the PYN Elite portfolio also increased by 30%.

PYN Elite also highly appreciates Vietnam's political stability and growth in the third quarter of 2024 despite the impact of Typhoon Yagi.

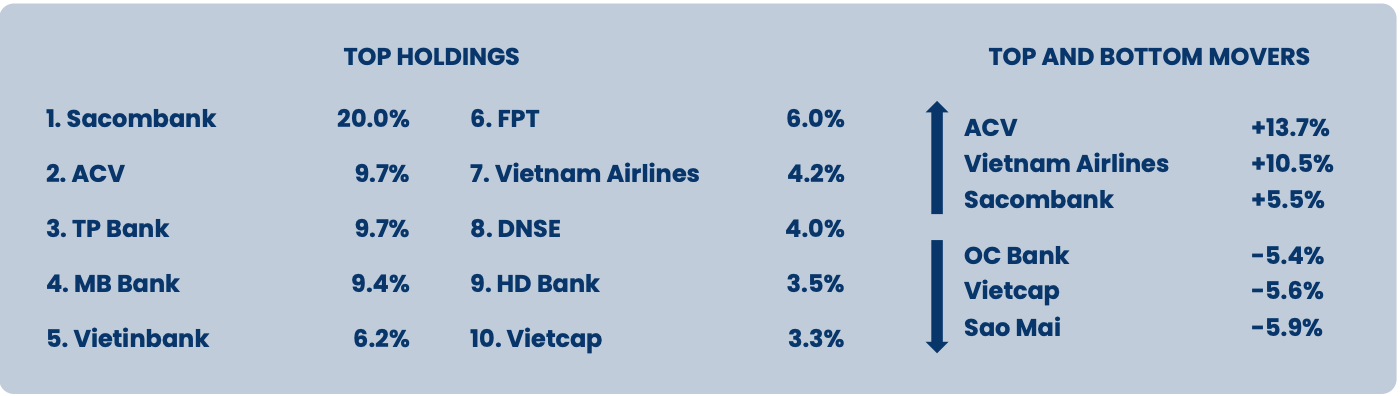

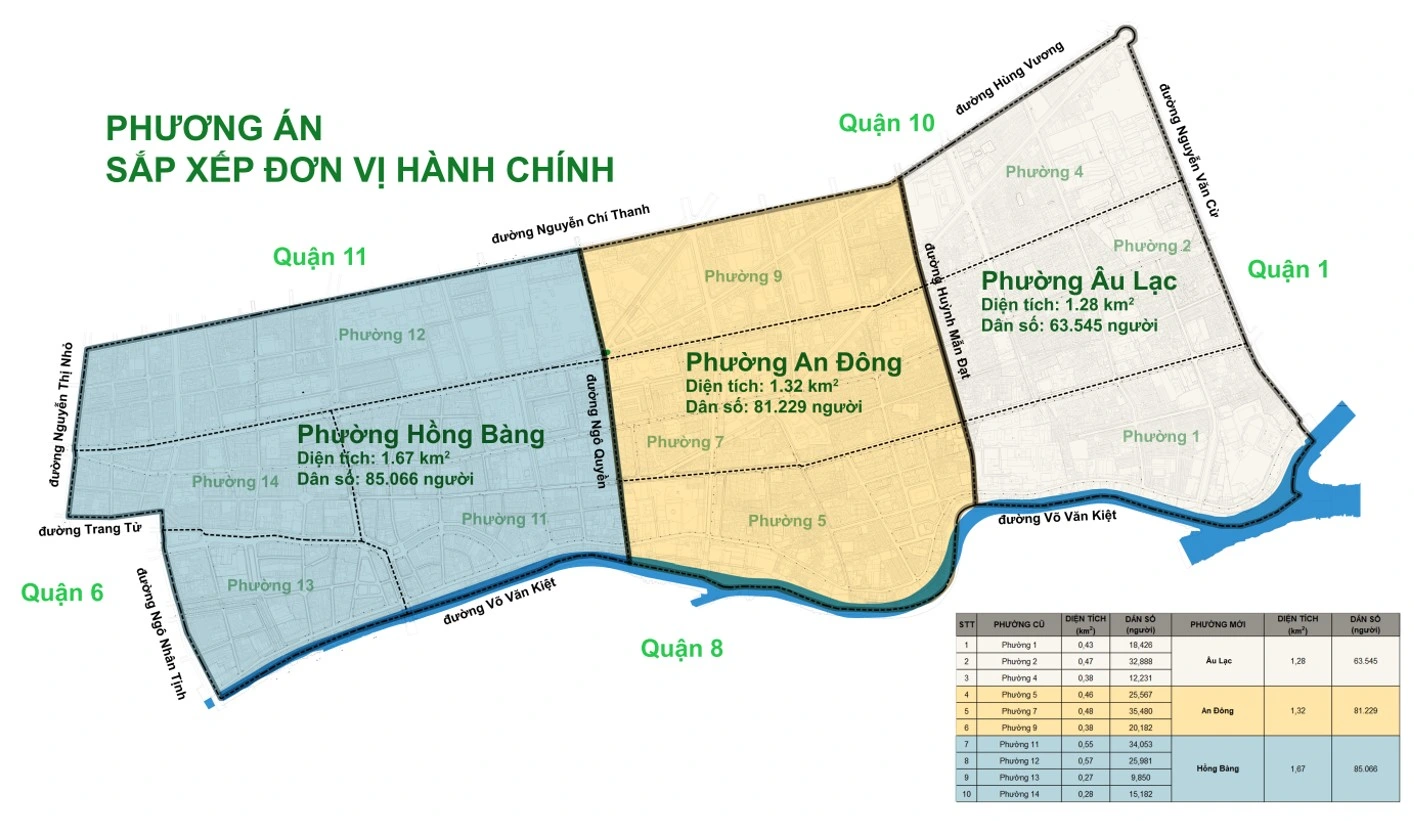

Banking and securities stocks are the largest group in PYN Elite's portfolio. Currently, STB accounts for 20%, TPB - MBB - CTG - HDB accounted for a total of 28.8%. On the securities company side, DNSE accounted for 4% and VCI accounted for 3.3%.

In response to this expectation, compared to September, the Finnish investment fund increased its weight in STB from 18.7% to 20%. At the same time, despite the price decrease in October, VCI is still highly expected by PYN Elite as this securities company is ready to benefit if the Vietnamese stock market is upgraded in the third quarter of 2025, especially after the pre-funding regulations are loosened in November.

This investment fund is also interested in the group of aviation stocks when owning ACV and HVN in the list with a significant proportion. In October, ACV was bought more and increased the proportion from 8.4% to 9.7%.

In this reporting period, while ACV - HVN - STB had good growth momentum, on the contrary, OCB - VCI - ASM declined sharply, dragging down the performance of PYN Elite.

|

| The stocks held most by PYN Elite Fund in October 2024. |

Source: https://baodautu.vn/co-phieu-nao-keo-tut-hieu-suat-cua-quy-dau-tu-pyn-elite-d229533.html

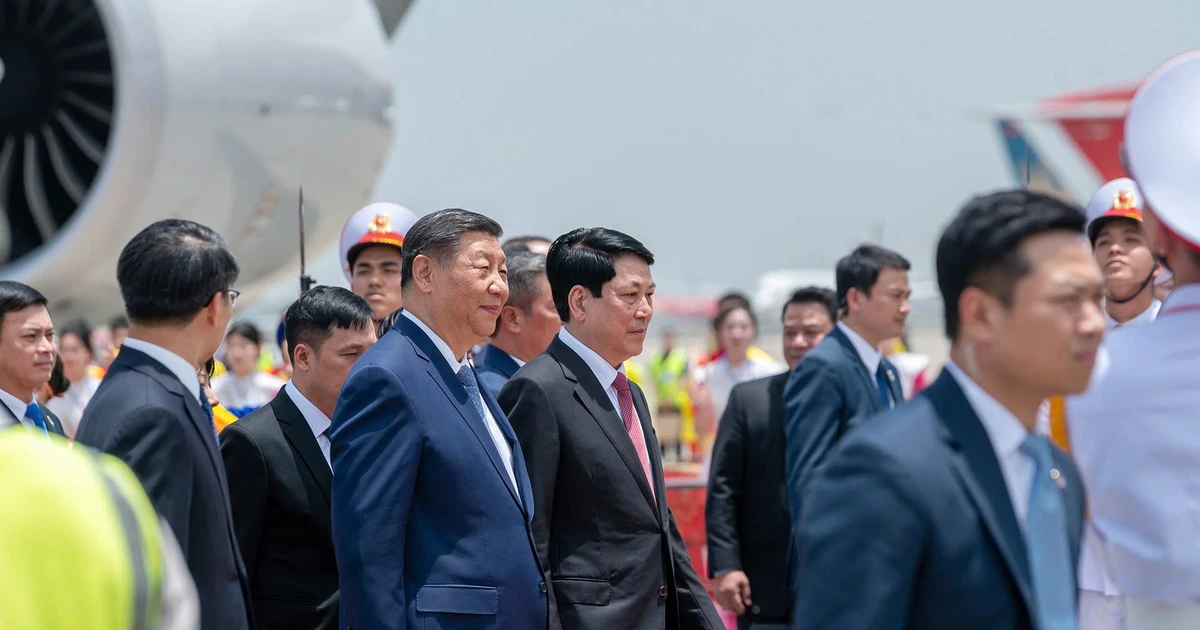

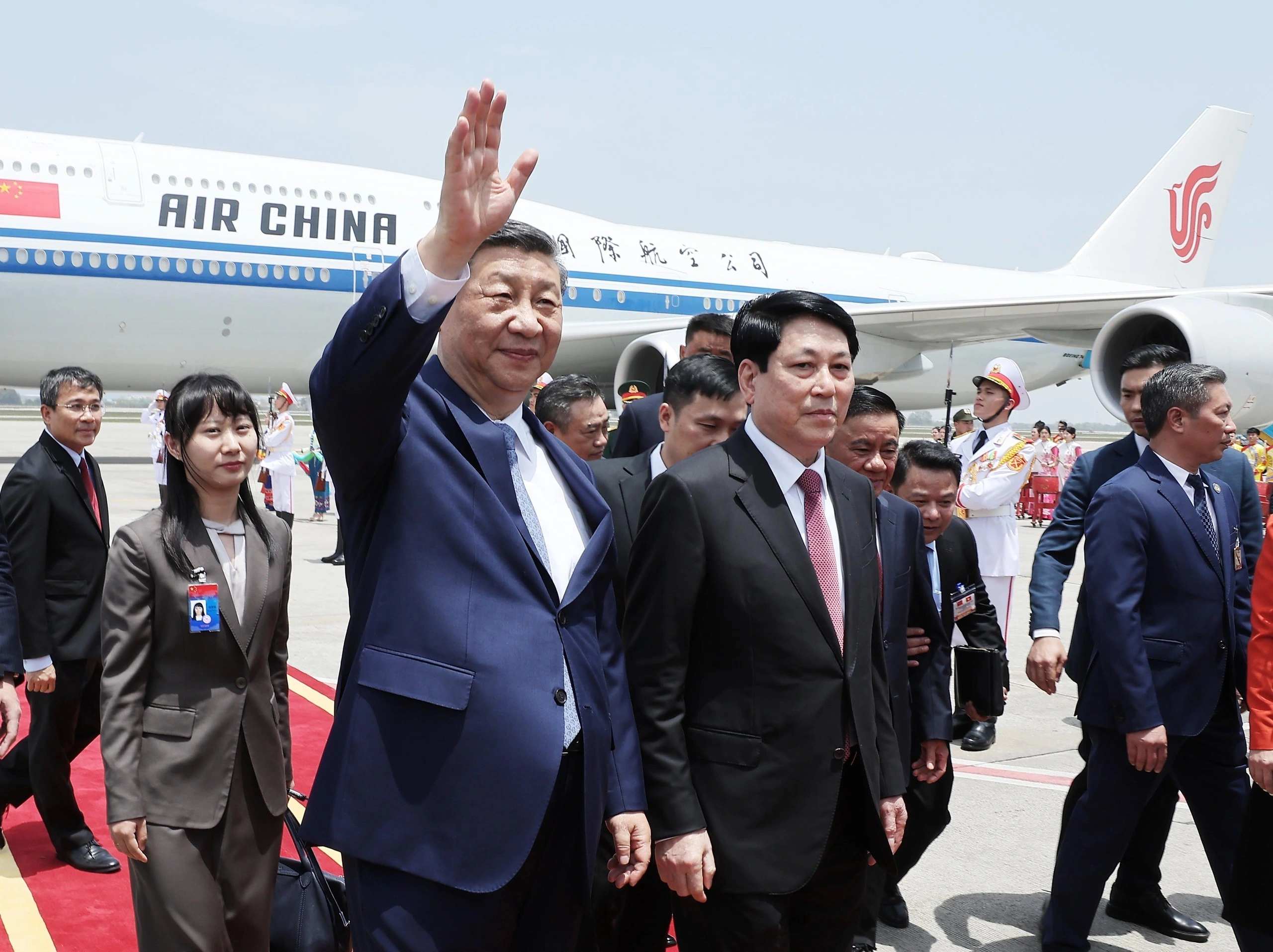

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

Comment (0)