Industrial park stocks hit ceiling on Trump re-election day

Today's trading session (November 6) recorded a series of industrial real estate stock codes increasing strongly in price.

Right from the beginning of this morning's session, the codes KBC, SIP, and VCG attracted investors' attention, with matching prices trending upward and simultaneously hitting the ceiling at the end of the session.

Today is also an important day for American and world politics as the US presidential election comes to an end.

With Donald Trump dominating the vote and having a high chance of winning, positive indicators have appeared in the industrial real estate group since the beginning of the day. By noon on November 6, the election results were finalized with Republican candidate Donald Trump winning. This result had a strong impact on industrial real estate stocks in the afternoon session. At the end of the session, the Vn-Index returned to increase by more than 15 points, equivalent to +1.25%, the most positive result since mid-September.

Since the beginning of June 2024, SIP shares of Saigon VRG Investment JSC have only had one session of ceiling price increase. Liquidity is also the highest in the past 5 months. In the ATC session, a trading order of more than 155 thousand units listed at the ceiling price was the reason why SIP turned purple at the end of the day, closing at VND 79,100/share, up 6.89%. Foreign investors net bought more than VND 8.9 billion worth of SIP in today's session.

Viglacera Corporation (VGC) also witnessed a sudden surge in liquidity. More than 3.5 million orders were matched in the session on November 6, 13 times higher than yesterday's liquidity and 5 times higher than the average of previous sessions. Of which, foreign investors net bought more than 18.1 billion VND of VGC. The strong price increase effect spread to VGC from mid-afternoon, causing the stock to increase by 7%, closing at 42,800 VND/share.

When talking about industrial park real estate stocks, we cannot help but mention KBC - the stock of Kinh Bac Urban Development Corporation. Not only was foreign investors net buying VND20.6 billion in today's session, domestic investors were also equally interested in this stock. The total trading volume increased dramatically with more than 20 million shares bought and sold, bringing KBC's market price to VND28,850/share, up 6.85%.

At the end of September 2024, through its subsidiary Hung Yen Hotel Services JSC, KBC joined hands with the Trump Organization Group to implement a hotel - golf course project complex with a total investment of 1.5 billion USD.

The price increase effect spread strongly to the entire industrial real estate industry. On the floor, other stock codes such as SZC, GVR, TIP, IDC also had a surprisingly "sublime" session.

|

| Industrial real estate stocks "soared" in today's session (November 6). |

The industrial real estate sector has long been expected to react positively if Donald Trump is re-elected.

According to Mirae Asset’s analysis, Donald Trump’s rise to power will create many impacts and strong changes to current policies. Vietnam can benefit from shifting its supply chain from China, due to the US imposing high tariffs on imported goods from China. However, it will also face risks from domestic protectionist policies and strict US trade agreements such as increasing tariffs on imported goods from other countries by 10-20%.

For example, the industrial real estate industry may benefit from the shift of FDI capital flows away from China, or the oil and gas industry is likely to benefit from Trump's tendency to invest heavily in energy and oil and gas exploitation.

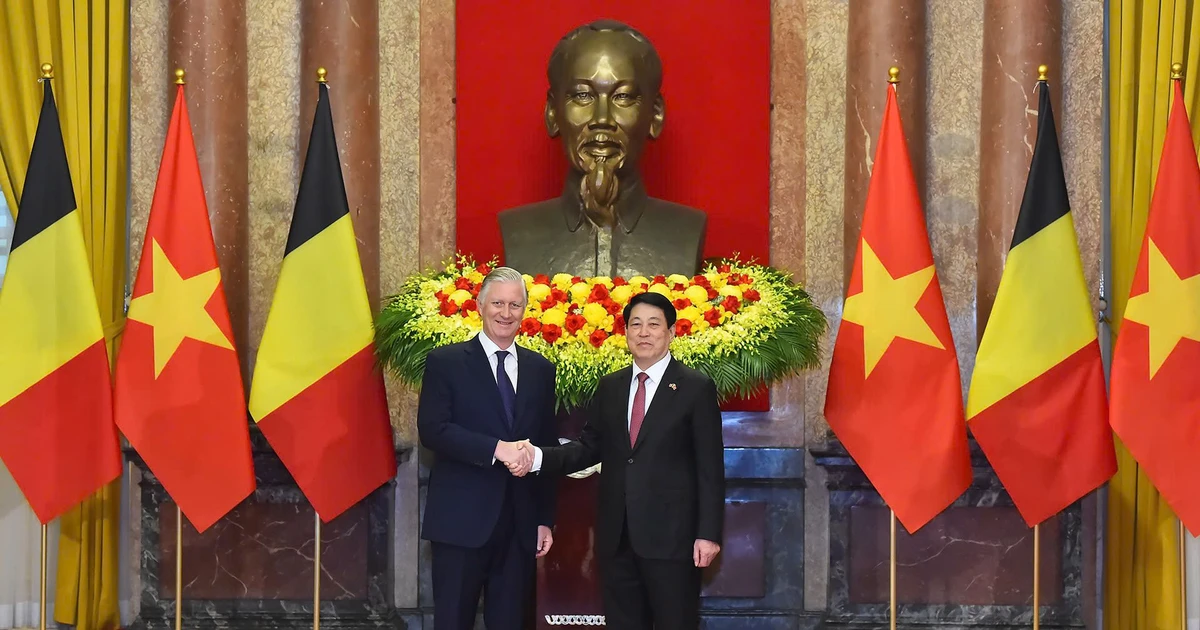

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

Comment (0)