Last week, the stock market showed many negative signals, VN-Index dropped sharply by 33 points; announcements from securities companies showed that industry profits decreased... What do experts think about the stock market this week?

Last week, VN-Index decreased nearly 33 points.

After a week of negative trading, the VN-Index continued to maintain a "downward" state, losing nearly 33 points, falling below the threshold of 1,252.7 points. Selling pressure dominated with "red" spreading across the market, while cash flow into the market remained weak.

Total market liquidity only reached 14,800 billion VND, of which HOSE floor alone was 13,784 billion VND.

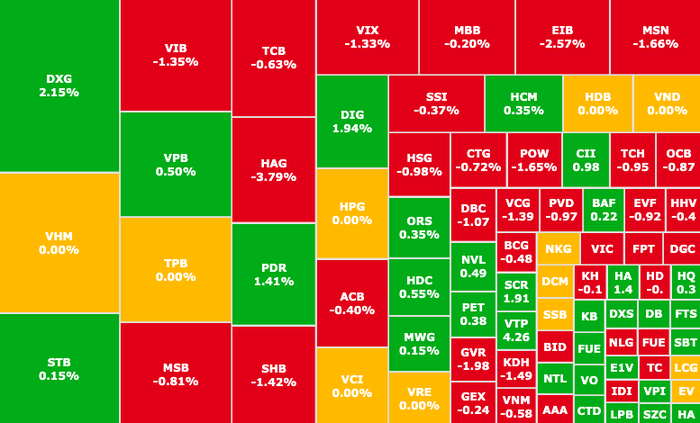

The midcap real estate group stands out with PDR (Phat Dat, HOSE), DIG (DIC Group, HOSE), DXG (Dat Xanh, HOSE),… increasing from 1-2%.

Banking, steel and retail groups suddenly turned around under pressure, slightly adjusting the market.

Leading the group of stocks negatively affected last week were ACB (ACB, HOSE), TCB (Techcombank, HOSE), STB (Sacombank, HOSE), FPT (FPT, HOSE), MBB (MBBank, HOSE), MSN (Masan, HOSE),...

Group of stocks affecting VN-Index

The selling side dominated, VN-Index plummeted continuously last week (Photo: SSI iBoard)

The group of active stocks with insufficient contribution to create resistance to the decline, led by EIB (Eximbank, HOSE), GMD (Gamadept, HOSE), VNM (Vinamilk, HOSE), DXG (Dat Xanh, HOSE), DIG (DIC Group, HOSE),...

Foreign investors maintained selling pressure for 11 consecutive sessions across the market, with a total selling pressure exceeding VND400 billion. MSN was hit the hardest with VND242 billion, followed by DGC, TCB (Techcombank, HOSE), HPG (Hoa Phat Steel, HOSE) with selling pressure of VND50-100 billion. On the other hand, VPB (VPBank, HOSE) was actively bought with 6.8 million units, contributing 0.2 points to the index's increase at the end of the week.

Securities industry profits fall for second consecutive quarter

After a positive first quarter, the business situation in the securities group showed signs of slowing down and declining for two consecutive quarters. In the third quarter, the total profit before tax (PBT) of the securities companies group (CTCK) reached about 6,900 billion VND, equivalent to the same period in 2023 but nearly 7% lower than the previous second quarter.

This was also a period of unfavorable stock market fluctuations. The VN-Index fluctuated strongly at the 1,300-point mark, affecting investor sentiment. Trading in the third quarter was gloomy, with the average value on HOSE reaching less than VND15,000 billion per session, about 25% lower than the same period in 2023 as well as the first half of this year.

These factors have significantly affected the proprietary trading activities of securities companies. Brokerage and proprietary trading are both facing difficulties, and lending has become a profit-saving activity for securities companies.

In the third quarter, interest from loans and receivables of securities companies was estimated at VND5,800 billion, up 20% over the same period in 2023 and nearly 4% higher than the previous quarter. This is the third consecutive quarter that this source of revenue has grown compared to the previous quarter and is a record level in history.

The profits of the securities industry in the third quarter were clearly differentiated, with many securities companies recording a decrease in pre-tax profit of more than a hundred billion compared to the second quarter, such as: SSI Securities (SSI, HOSE), HSC Securities, APG Securities and especially SHS Securities (SHS, HNX).

On the contrary, VPS Securities (VPS, HOSE), VNDirect Securities (VND, HOSE), VIX Securities (VIX, HOSE), ACBS Securities recorded a sharp increase in profit after tax compared to the previous quarter 2.

The 10 most profitable securities companies in the industry all recorded pre-tax profit of over VND200 billion in the third quarter of 2024. Only TCBS Securities had a profit of over a trillion with pre-tax profit of nearly VND1,100 billion. However, the pre-tax profit in the third quarter also decreased compared to the same period in 2023 and the previous second quarter.

Losses mainly fell on small-scale securities companies, the most serious case being APG with negative profit after tax of nearly 150 billion VND.

In general, the third quarter was not a very favorable period for securities companies. All expectations came from the Government's efforts to complete economic growth targets, Circular 68 took effect allowing foreign investors to trade without 100% margin,...

"The Brother Who Overcame a Thousand Difficulties" Helps Yeah1 Triple Its Revenue

According to the latest financial report, Yeah1 Group Corporation (YEG, HOSE) achieved revenue of more than 345 billion VND in the third quarter of 2024, 3 times higher than the same period, this is a record high revenue since the fourth quarter of 2020 of the enterprise.

It is known that Yeah1 has invested in the program "Anh trai vu ngan cong gai" - the Vietnamese version of the famous program "Call me by fire" from China, for stars over 30 years old, broadcast from the end of June.

"The Brother Who Overcame a Thousand Difficulties" helped Yeah1 achieve the highest revenue in the past 4 years (Photo: Internet)

Thanks to the attraction of millions of views, many performances reached the top trending on YouTube and were widely discussed on social networking and media platforms, the program attracted dozens of sponsors, the largest of which was Techcombank.

Since then, advertising and media consulting activities have contributed more than 89% of the company's total revenue, helping this segment's revenue increase 4.5 times compared to the same period last year. Yeah1 recorded a gross profit of more than VND79 billion, an increase of 3.6 times. This is also the company's highest gross profit since the fourth quarter of 2018.

Although business management costs increased 2.5 times due to business recovery, Yeah1 still achieved after-tax profit of nearly VND34.3 billion, 10.7 times higher than in the third quarter of 2023. This is the highest profit since 2022.

In the first 9 months of the year, Yeah1 recorded more than 629 billion VND in revenue, an increase of about 2.5 times compared to the same period, and a profit of nearly 55.8 billion VND, an increase of 4.5 times. Thus, the company has completed nearly 79% of the revenue and 86% of the profit plan for this year.

Steel stocks benefit from anti-dumping policy

In recent years, the Vietnamese steel industry has faced many major challenges: strong fluctuations in raw material prices, pressure from cheap imported steel, especially from China. However, a turning point occurred when the Ministry of Industry and Trade decided to apply anti-dumping tax (CBPG) on steel products imported from China and South Korea.

MB Securities (MBS) said that these measures not only help reduce unfair competition from cheap steel but also create opportunities for domestic steel enterprises to restructure, recover and develop.

The imposition of anti-dumping duties on hot-rolled coil (HRC) from China has created a great opportunity for domestic enterprises. The market share of Vietnamese companies is likely to increase significantly when the supply of cheap steel from China is limited. This helps Vietnamese enterprises not only increase production but also improve profit margins.

However, Shinhan Securities emphasized that, besides many positive prospects, the industry still faces some major challenges such as fluctuations in input material prices and the risk of global economic recession.

Overall, anti-dumping measures are and will continue to be an important factor in reshaping the structure of Vietnam’s steel industry. Steel enterprises need to continue to optimize costs, improve production capacity and expand export markets to take advantage of new opportunities.

Comments and recommendations

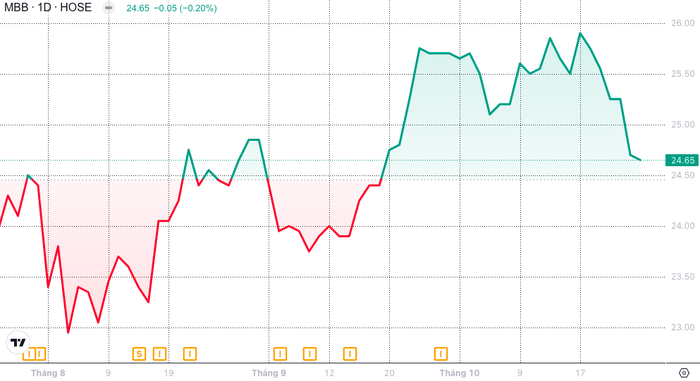

According to TPS Securities, MBB shares (MBBank, HOSE) of Military Commercial Joint Stock Bank - MB (MBB, HOSE) are recommended to be bought with a target price of VND 29,000/share, expected to increase by 18% with the closing price on October 25.

Recent developments in MBB stock (Photo: SSI iBoard)

According to TPS, in the last 5 years, it can be seen that MB Bank's business strategy focuses on individual customers. Specifically, at the end of June 2024, MBB's other non-term deposits of customers reached VND 230,210 billion, second only to the Big4 banking group.

Meanwhile, MBB's non-term deposits (CASA) in 2019 only reached VND92,352 billion, equal to TCB's deposits and slightly higher than other commercial banks. Most of this significant change can be seen since MBB implemented digital transformation in mid-2019.

In addition, thanks to the large number of individual customers, MB's margin is leading the industry at more than 37%, followed by TCB and VPB, which are also very strong in digital transformation, reaching 36% and 33% respectively by the end of June 2024.

It can be said that with a business strategy focusing on individual customers, MB Bank not only has a large amount of deposits but also has a good CASA ratio, helping to reduce the pressure on net interest margins to have more pricing policies and better loan products.

Mr. Vu Manh Minh, Investment Consultant, Mirae Asset Securities , assessed that the market is facing quite challenging short-term factors: The USD/VND exchange rate is escalating, causing the State Bank to sell USD to stabilize the exchange rate, withdrawing VND from the market; at the same time, the State Treasury is buying, increasing short-term pressure on VND liquidity.

Foreign factors also create concerns when there is no clear trend, continuous buying and selling in a short period of time and very clear differentiation; creating instability in investors' psychology.

VN-Index is going through a "difficult" period but there are still many positive fundamental factors.

This is a challenging period for investors as the world and Vietnamese economies follow different paths and are subject to many unpredictable fluctuations. However, the most important thing is that investors need to stay calm, manage risks well and always closely monitor market developments.

In the short term, investors should limit investment in stocks sensitive to exchange rate fluctuations, especially stocks with a large proportion of foreign currency debt. At the same time, prioritize stocks with year-end stories such as real estate and public investment, as these are industries that will directly benefit from the public investment packages approved for 2025.

Although there may be strong corrections in the short term, the fundamentals of the market are still very positive in the medium term . Therefore, investors should focus on the strategy of accumulating stocks with long-term growth potential when the stock price falls to attractive price ranges such as Banking - Real Estate - Industrial Parks; should not buy when the market is hot, patiently build a position by buying when the price adjusts reasonably with the action of buying many times.

KB Securities believes that the selling side continues to dominate, the positive point appears when the low price supply pressure has been better controlled, there is no longer a phenomenon of selling, opening up opportunities for an early recovery. However, the sideways trend is dominating, the recovery reactions at weak support zones are often short-lived and the risk of falling to stronger support zones still exists.

Vietcap Securities commented that the lack of buying power has increased the decline of VN-Index last week. The main support zone this week is 1,240 - 1,250 points. The threshold of 1,265 points acts as resistance for the market, where the high selling pressure from last week will return. However, there is currently no sign of weakening selling pressure or improvement from the buying side. Therefore, investors should wait for a clearer signal from demand before buying.

Dividend schedule this week

According to statistics, there are 9 businesses that have dividend rights from October 21-25, of which all 9 businesses pay in cash.

The highest rate is 4%, the lowest is 20%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| GHC | HOSE | 1/11 | 11/22 | 20% |

| TFC | HNX | 1/11 | 11/20 | 12% |

| CLW | HOSE | October 31 | 11/25 | 4% |

| PCC | UPCOM | October 31 | 11/14 | 15% |

| BHA | UPCOM | October 31 | 11/12 | 6% |

| ABR | HOSE | October 30 | 11/21 | 20% |

| DHT | HNX | October 30 | 11/29 | 5% |

| BDW | UPCOM | October 30 | 11/20 | 12% |

| XDH | UPCOM | 10/29 | 8/11 | 8% |

* The comments and recommendations stated in the article are for reference only.

Source: https://phunuvietnam.vn/nhan-dinh-ve-thi-truong-chung-khoan-tuan-28-10-1-11-20241028083653896.htm

Comment (0)