(Dan Tri) - VN-Index closed the session on December 25 with a strong increase of nearly 14 points, more than 600 stocks increased in price across the market. Money poured heavily into banking and construction stocks.

The market's upward momentum continued until the end of the afternoon session. The VN-Index closed at 1,274.04 points, up 13.68 points, or 1.09%. The VN30-Index increased by 19.21 points, or 1.45%; the HNX-Index increased by 1.45 points, or 0.64%; and the UPCoM-Index increased by 0.57 points, or 0.61%.

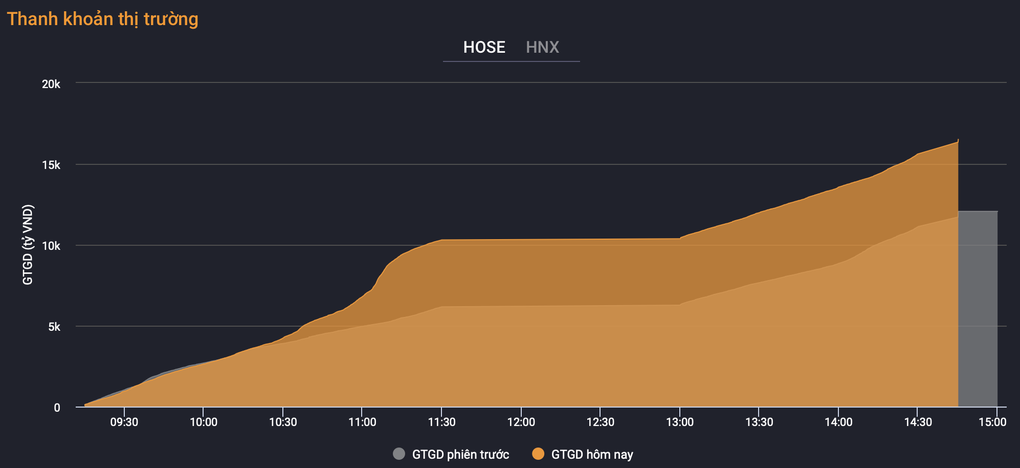

Liquidity improved significantly. Trading volume on HoSE increased to 810.46 million shares, equivalent to VND18,844.03 billion; HNX had 66.94 million trading units, equivalent to VND1,102.96 billion and the figure on UPCoM was 62.22 million trading shares, equivalent to VND694.53 billion.

Liquidity improved strongly in the session of December 25 (Source: VNDS).

The number of codes increased overwhelmingly, with 624 codes increasing in price, 42 codes hitting the ceiling compared to 259 codes decreasing, 14 codes hitting the floor. Of which, HoSE had 326 codes increasing, 92 codes decreasing, all 30 codes in the VN30 basket increased in price.

Large-cap stocks, especially in the banking group, contributed significantly to the VN-Index. CTG alone contributed 2.64 points to the index; BID contributed 0.98 points; TCB contributed 0.78 points; MBB contributed 0.72 points and STB also contributed 0.72 points to the main index.

Trading on the market also focused on bank stocks. Money poured into the "king" stocks, helping these codes increase sharply with large liquidity. CTG increased by 5.5%, with 25.2 million units matched; STB increased by 4.5%, with 24.4 million units matched; MBB increased by 2.3%, with 14.8 million units matched; TPB increased by 2.2%, with 14.5 million units matched; TCB increased by 1.9%, with 18.4 million units matched.

In the financial services sector, except for APG hitting the floor and DSE falling 1.3%, most of them increased in price. SSI increased 2.3%, with 26.2 million units matched; HCM increased 2.1%, with 10.1 million units matched; TCI increased 2.1%; VND increased 2%.

The construction materials and basic resources sectors continued to attract attention with a series of stocks hitting the ceiling price, with no sell orders. Accordingly, FCM, HVX, HHV, FCN; BMC, SMC, KSB were sold out and all had ceiling price buy orders.

VCG increased by 5.5%, with 17.4 million units matched; LCG increased by 5.1%; THG increased by 5.1%; BCE increased by 4.1%; CTD increased by 3.8%; TCD increased by 3.5%; CII increased by 2.8%. HPG also achieved an increase of 1.7% and matched 17.1 million shares.

While the market is booming, some stocks are under pressure to take profits after a period of good price increases. For example, HVN decreased by 3.9%, with 5.6 million shares traded; HTN decreased by 4.7%; VCA decreased by 2.4%.

Foreign investors were active when they net bought VND231 billion in the whole market and VND254 billion on HoSE. They focused on buying SSI and HPG with net buying values of VND109 billion and VND108 billion, respectively.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-tung-bung-ngay-le-giang-sinh-tien-do-vao-co-phieu-nao-20241225170713319.htm

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)