(Dan Tri) - VN-Index continued to lose more than 11 points this morning, plunging to the 1,220 point mark. Vingroup stocks increased but were not strong enough to "balance" the index.

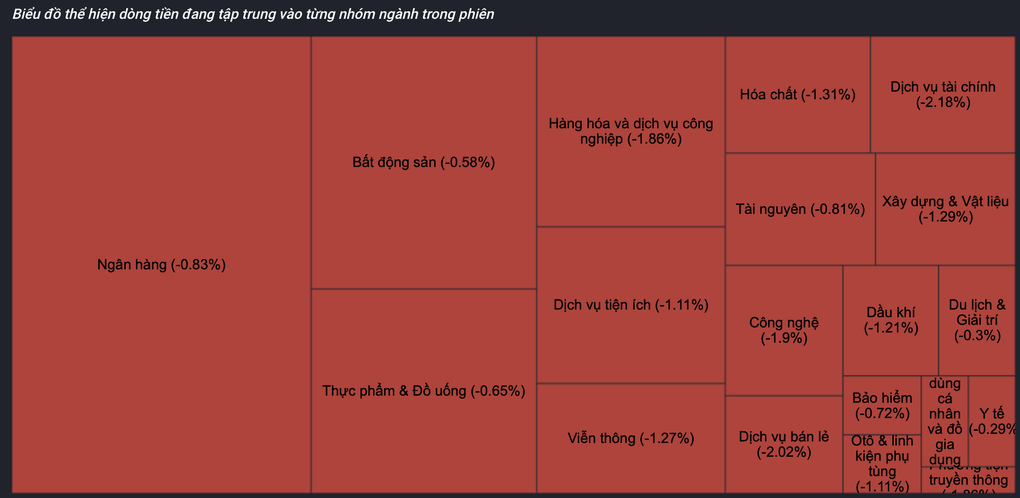

Selling pressure in the market continued to increase this morning (November 15), with most indices moving below the reference range. VN-Index plummeted, plunging to 1,220.42 points, recording a loss of 11.47 points, equivalent to 0.93%. Previously, the index had also had a sharp decline yesterday afternoon.

VN30-Index lost 11.43 points, equivalent to 0.89%; HNX-Index decreased 2.21 points, equivalent to 0.99% and UPCoM-Index decreased 0.4 points, equivalent to 0.44%.

Stocks lost value across the board, the decline spread widely, of which, on HoSE alone, there were 326 stocks decreasing in price and only 37 stocks increasing.

Liquidity improved significantly in the context of most discounted stocks, showing that a number of investors have accepted to disburse. Low price demand helped the trading volume on HoSE increase to 359.46 million units, equivalent to VND8,789.81 billion. HNX had 31.7 million shares traded, equivalent to VND552.71 billion, and this figure on UPCoM was 19.58 million shares, equivalent to VND222.74 billion.

The number of stocks decreasing overwhelmed the VN30 basket, however, Vingroup still turned green. VRE increased by 1.1%; VIC and VHM increased slightly, inching up by 0.2% and 0.1% respectively.

Red dominates the market picture on the morning of November 15 (Screenshot).

The price declines were widespread across the market, but there was no sell-off. In the banking sector, although most stocks were adjusted, the decline was not large. The stocks with the biggest declines in the "king stocks" group were MSB, HDB, EIB, all down 2.2%; CTG down 1.6%; BID down 1.2%. The rare bank stock that increased was SSB with a margin of 0.3%.

Securities stocks are highly marketable and very sensitive to trends. In this group, there are some stocks that have fallen sharply, such as CTS down 3.5%; TVB down 3.4%; TVS down 3.3%; VDS down 3%; DSC down 2.9%; SSI down 2.8%; HCM down 2.8%; BSI down 2.8%... However, no stock code has hit the floor on HoSE this morning.

Even in the real estate sector, the code with the sharpest decrease on the HoSE was TDH with an adjustment of 4.1%; KDH decreased by 3.7%; NBB decreased by 3.4%; NLG decreased by 3%, no stock hit the floor. Even outside the Vingroup group, there were still some codes that increased such as: VRC increased to the ceiling, TLD increased by 1.9%; KBC increased by 1.4%; SZC increased by 1%; HAR, NTL, CRE increased slightly.

Electricity, water, and petroleum groups also decreased in price across the board and recorded deep declines in some stocks: SFC, TTE hit the floor, no buyers; CNG decreased by 3.6%; POW, KHP, GEG, TTA were all adjusted.

The stocks that have performed well in recent times are now under pressure to take profits. Viettel was sold off quite strongly: CTR decreased by 3.2%; VGI decreased by 3.8%; VTK decreased by 4.5%; VTP decreased by 2.6%.

The same is true for the IT industry. ST8 and ITD shares hit the floor before narrowing their losses, losing 5.2% and 6.5% respectively. ICT fell 3.9%; CMG fell 3.5%; ELC fell 3%; SAM fell 2% and FPT also fell 1.8%.

According to analysts, yesterday's bearish signal has pushed the market out of the support zone and the downward momentum is increasing. It is forecasted that the market will continue to be under downward pressure in the coming time with the next support zone being the 1,200 point zone.

Therefore, investors are advised to continue to be cautious and wait for specific support signals from cash flow in the coming time. Currently, the market stability is low and there are potential risks, so investors need to consider reasonable portfolio management to avoid falling into an overbought state.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-lao-doc-vn-index-rot-ve-moc-1220-diem-20241115132127606.htm

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

Comment (0)