The Government stipulates that the maximum salary of the Chairman of the Board of Directors in a state-owned enterprise shall not exceed VND 80 million. The salary of the General Director and Director shall not exceed 10 times the average salary of employees.

The Government issued Decree No. 44/2025 regulating the management of labor, wages, remuneration and bonuses in state-owned enterprises.

The Decree clearly stipulates the principles: Labor, wages, remuneration, and bonuses in enterprises are determined in connection with tasks, labor productivity, and production and business efficiency, in accordance with the industry and nature of the enterprise's operations, aiming to ensure the wage level in the market.

Another principle is to implement an appropriate salary mechanism so that enterprises can attract and encourage high-tech human resources in high-tech fields prioritized for development by the State.

The State shall manage labor, wages, and bonuses for enterprises in which the State holds 100% of charter capital by assigning tasks and responsibilities to the owner's representative agency and the direct owner's representative at the enterprise.

For enterprises in which the State holds more than 50% of the charter capital or total voting shares, the representative of the State capital shall be assigned tasks and responsibilities through the owner's representative agency to participate, vote and make decisions at meetings of the board of members, board of directors or general meeting of shareholders.

The Decree also clearly states the separation of salaries and remuneration of board members and controllers from salaries of the executive board.

The Executive Board is determined by 2 methods: Determining the salary fund through the average salary level; Determining the salary fund through the stable salary unit price. In which, the second method is only applicable to enterprises that have been in operation for at least the expected time of applying the stable salary unit price.

Depending on the tasks, nature of the industry, and conditions of production and business activities, enterprises decide to choose one of the two methods of determining the salary fund mentioned above.

Enterprises with many different fields of production and business activities and can separate labor and financial indicators to calculate labor productivity and production and business efficiency corresponding to each field of activity can choose the appropriate method from the above two methods to determine the salary fund corresponding to each field of activity.

Regarding salary distribution, the decree stipulates that employees and executives are paid according to the salary regulations issued by the enterprise. In particular, employees' salaries are paid according to their position or job, linked to labor productivity and the contribution of each person to the production and business results of the enterprise.

The salary of the executive board is paid according to the title, position and production and business results; in which the salary of the general director and director (except in the case of hiring to work under a labor contract) must not exceed 10 times the average salary of the employee.

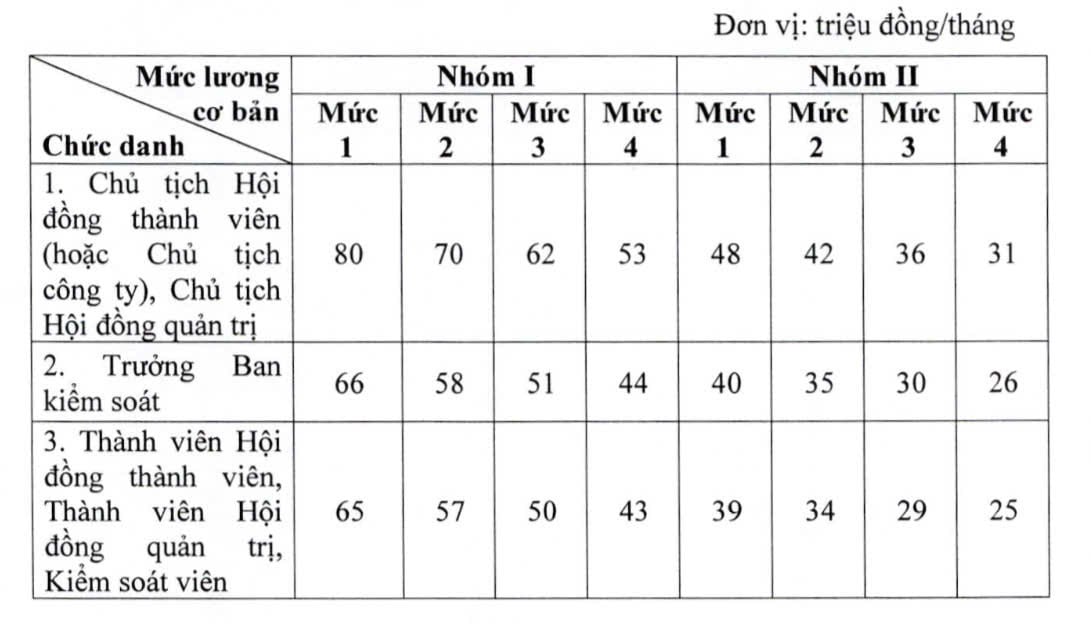

According to the Decree, the basic salary of full-time board members and controllers is prescribed as follows:

Every year, the enterprise, based on the planned production and business targets, determines the basic salary to determine the planned salary level of each member of the board of directors and controller.

Will the minimum wage increase in 2025?

Work for high salary, old age pension is not enough to live on

What is the pension level for workers who retire early under Decree 178?

Source: https://vietnamnet.vn/chu-tich-hdqt-doanh-nghiep-nha-nuoc-duoc-tra-luong-cao-nhat-80-trieu-dong-2376186.html

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)