Thanks to the active implementation of policy credit programs in Ngu Hanh Son district (Da Nang), local people have access to policy capital to develop household economy, contributing to job creation and sustainable poverty reduction.

These results were achieved thanks to the effective implementation of the dissemination and implementation of Directive No. 40-CT/TW of the Central Secretariat; advising local authorities to issue action plans, programs, and relevant documents for timely implementation...

Providing livelihoods, helping to stabilize sustainable life

In Ngu Hanh Son district, from policy credit capital, many families have overcome difficulties to improve their family life. For example, the story of Ms. Le Thi Kim Loan in residential group 53, Hoa Hai ward, Ngu Hanh Son district, who works in stone carving at Non Nuoc Stone Craft Village - a small-scale facility, mostly processing for hire for large facilities, taking labor as profit. Ms. Loan wishes to invest in more machinery to expand and develop the stone carving workshop.

In response to Ms. Loan’s difficult situation, the Savings and Loan Group (S&L) together with the Women’s Union of the ward guided Ms. Loan’s household to borrow capital from the program to support job creation, job maintenance and expansion from the Social Policy Bank (SPB) with an amount of 100 million VND. With the capital, Ms. Loan invested in more machinery and equipment, hired more workers to expand her production and business facilities.

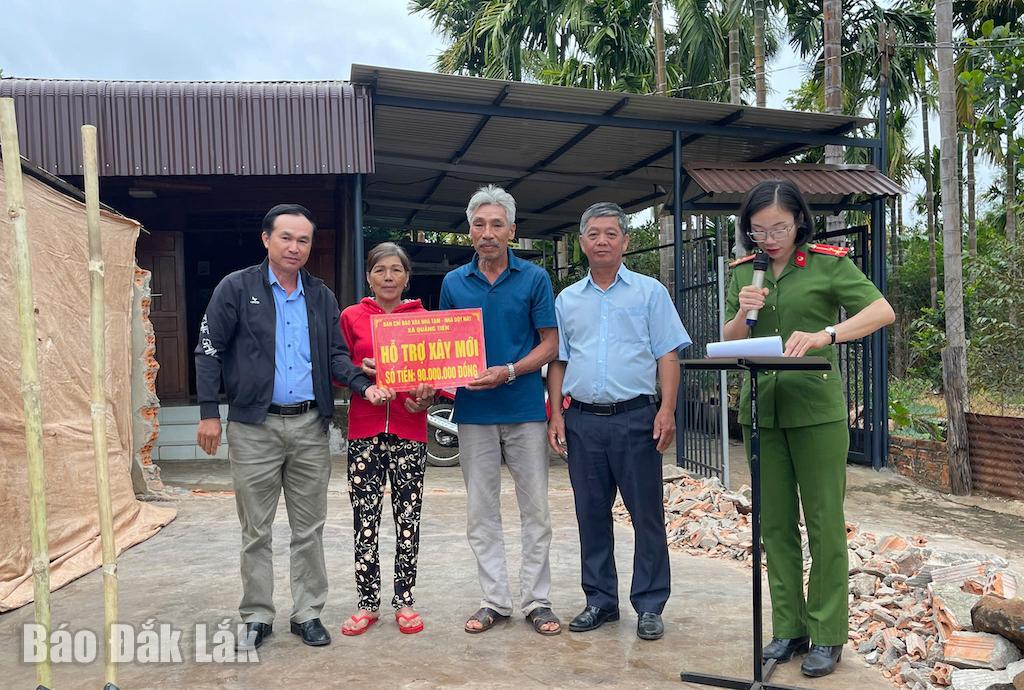

|

| In Ngu Hanh Son district, from policy credit capital, many families have overcome difficulties and improved their family life. |

Thanks to thorough investment, effort and perseverance in the profession, up to now, the Phuoc Tai stone art brand of her family has had a solid position in the market. The establishment has many decorative stone art products for interior and exterior... not only consumed domestically but also favored by customers in many countries around the world such as Thailand, Korea...

Or, the story of Mr. Pham Van Be's family in residential group 8, Khue My ward, Ngu Hanh Son district. In 2015, Mr. Be's family had to relocate to make way for urban renovation. At that time, Mr. Be received compensation that was only enough to pay for resettlement land use, and his savings were only enough to build a makeshift level 4 house, which was hot in the sun and leaky in the rain.

While the family was having difficulty with housing and worrying about building a decent, stable house to "settle down", Mr. Be's family received information from the local government and the Savings and Credit Group about a loan program to build a house according to Decision 3212/QD-UBND of the People's Committee of Da Nang City, with a preferential interest rate of 4.8%/year for households subject to relocation and clearance. In 2021, the family boldly borrowed capital from the Ngu Hanh Son District Social Policy Bank to build a house.

“With a loan of 500 million VND from the preferential credit program for households and individuals subject to relocation and clearance, having a solid and spacious house is no longer a worry about not having enough money to build a house. The preferential loan capital from the Social Policy Bank helps my family “settle down and make a living” - an aspiration of countless people in the same situation" - Mr. Be was moved.

Another case, Mr. Tran Chien, residential group 30, My An ward, Ngu Hanh Son district, his family's situation is very difficult. Mr. Chien works in wood processing, his income is unstable, his wife is often sick, 2 children are in university. All the hardships are put on Mr. Chien. Despite the difficulties, the family always believes that the children must go to school to get an education to escape poverty, so they are determined to encourage their children not to drop out of school, to strive and excel in their studies...

With the attention and encouragement of the government and the ward's unions to promote preferential loan policies to cover study costs for students in difficult circumstances through the Ngu Hanh Son District Social Policy Bank, Mr. Chien's family was given the key to open the door to new hope. With a loan of 125 million VND for his two children to study. Up to now, Mr. Chien's eldest child has graduated, has a stable job and has saved up with his family to pay off the debt of 50 million VND.

Mr. Chien shared that to achieve the above results, in addition to the efforts and striving to study from the children, the teaching from the teachers, there is also the active support from the preferential loans of the State through the Social Policy Bank. Without this support, perhaps the children would not have the opportunity to go to university, have jobs with stable income today.

Proactive and timely

The effectiveness of preferential credit policy capital has really been effective in Ngu Hanh Son district, not only Mrs. Loan, Mr. Be, Mr. Chien but also thousands of other households in difficult circumstances have risen up to escape poverty and become rich legitimately.

To achieve practical results, in recent years, the Ngu Hanh Son District People's Credit Fund has thoroughly grasped Directive 40-CT/TW and Conclusion No. 06-KL/TW of the Secretariat, Official Dispatch No. 298-CV/QU of the District Party Committee Standing Committee on the implementation of Conclusion 06-KL/TW of the Secretariat on continuing to implement Directive No. 40; Official Dispatch No. 3433/UBND-NHCSXH of the District People's Committee on implementing Official Dispatch No. 298-CV/QU of the District Party Committee Standing Committee to staff in improving the effectiveness of policy credit activities; closely coordinating with socio-political organizations and relevant departments and branches in the work of deploying and effectively implementing policy credit activities in the area.

|

| Social policy credit work according to Directive 40-CT/TW of the Central Party Secretariat and Conclusion 06-KL/TW is increasingly promoted, the quality of policy credit is constantly improved. |

At the same time, the district's Social Policy Bank proactively advised the district Party Committee and government to balance, review and allocate additional capital from the local budget for the district's Social Policy Bank to provide loans, increasing the total entrusted capital of the district before handing over the remaining balance to the Da Nang City Social Policy Bank due to the implementation of urban government in early 2022 to VND 15,169 billion (an increase of VND 14,669 billion compared to the time of implementing Directive No. 40-CT/TW).

In addition, since implementing Directive 40, the District People's Committee has supported the Transaction Office in arranging tools, machinery and equipment, organizing preliminary and final conferences, etc. This shows the active participation of all levels, sectors and localities in creating conditions for bringing policy credit to the poor and other policy beneficiaries.

Social policy credit work according to Directive 40-CT/TW of the Central Party Secretariat and Conclusion 06-KL/TW has been increasingly promoted, the quality of policy credit has been constantly improved, growing in both quality and quantity. Outstanding loans have grown over the years: In 2013, it was 119,880 million VND, by May 31, 2024, it was 475,843 million VND, an increase of 396.9% after 10 years of implementing Program 40-CT/TW.

Overdue debt has been very high at times and is gradually decreasing over the years. In 2013 it was 0.84%, in 2015 it was 0.73%, in 2016 it was 0.25%, in 2020 it was 0.08%. By May 31, 2024, overdue debt will be only 0.01%.

Preferential credit capital has been invested in lending to the right beneficiaries through public and democratic lending evaluation from the grassroots level, with confirmation from the ward People's Committee as a basis for the district's Social Policy Bank to make loans. Propaganda and timely implementation of documents have helped poor households and other policy beneficiaries access capital conveniently and easily. Preferential credit capital has helped 40,544 poor households and other policy beneficiaries in the area borrow capital from the Social Policy Bank.

Of which, 17,770 poor, near-poor, and escaped-poverty households have capital to do business; support job creation, maintain and expand employment for 16,290 workers, 6,050 households borrow capital for their children to go to school, 220 cases borrow to buy social housing, build new houses, repair houses for living, 23 households borrow to pay land debt... and other policy beneficiaries have capital to do business, invest in production and business, gradually rise out of poverty, reduce unemployment rate, promote local socio-economic development, contribute to limiting black credit, and ensure social security.

The important contribution from the State's preferential credit capital through the Vietnam Bank for Social Policies to the cause of economic development and social security of the locality in the context of frequent fluctuations in the world and domestic economy is extremely meaningful and deeply humane. This proves the correctness and popular acceptance of the policy that the Party and the State have put forward on preferential credit for the poor and other policy subjects...

Source: https://thoibaonganhang.vn/chi-thi-40-tao-suc-bat-lon-cho-hoat-dong-tin-dung-chinh-sach-xa-hoi-152687.html

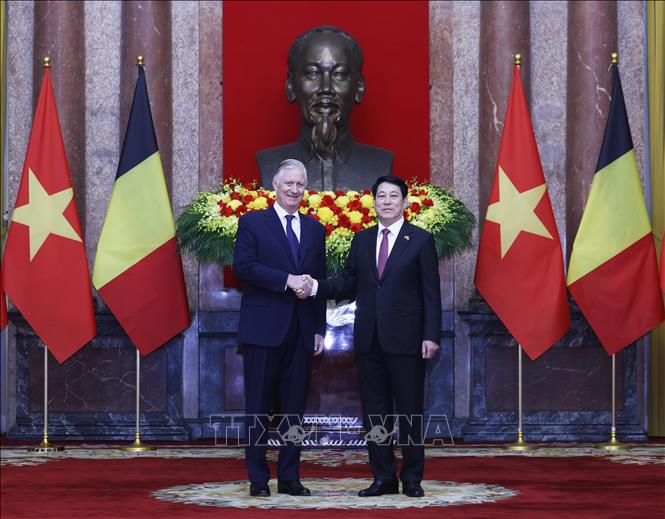

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

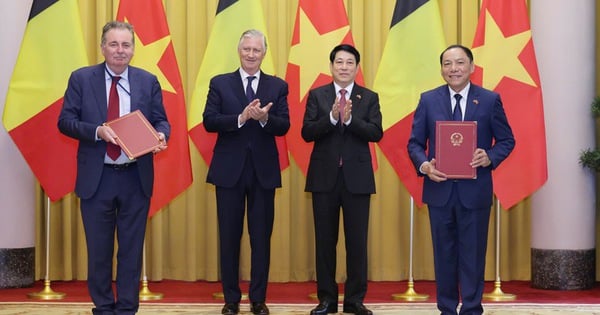

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![Sustainable future for the wood industry: [Part 3] Green transition](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/36992964bb75439ba4d1db5a33dafae0)

![Positioning the value of Dien Bien rice: [Part 1] 'Pearl' in the field of bombs and mines](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/3dede394986d44c69c2624111659c003)

![[Infographic] 10 factors to consider when deciding to buy or rent a house](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d6e87dce074b455d95231a4c3e22353a)

Comment (0)