Oil prices spike after President Donald Trump's announcement

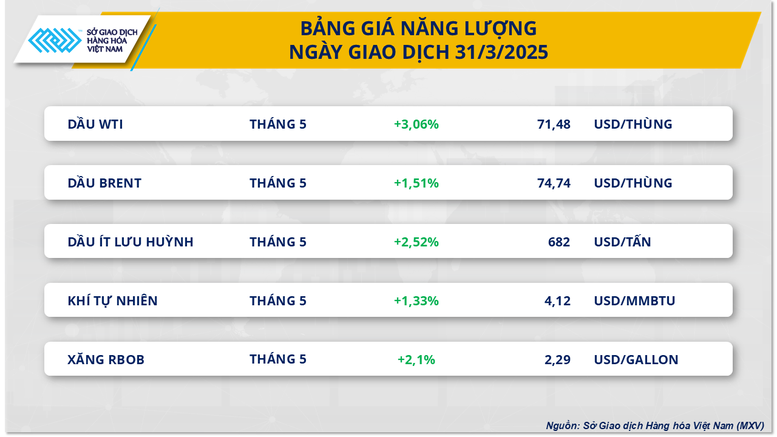

At the end of the last trading session of March, green covered all 5 energy products. In particular, the price of two crude oil products increased sharply after recent statements by President Donald Trump targeting Russia and Iran.

Closing, both oil products were at their highest levels since early March. Of which, Brent oil price increased by 1.51% to 74.74 USD/barrel; WTI oil price increased by 3.06% to 71.48 USD/barrel. This is the strongest increase of WTI oil price since the beginning of this year.

Over the weekend, US President Donald Trump made two major statements targeting Russia and Iran, two of the world's largest oil suppliers. In an interview with NBC News, Trump expressed displeasure with Russian President Vladimir Putin's criticism of Ukrainian President Volodymyr Zelenskiy and warned that he could impose secondary tariffs of 25% to 50% on countries importing oil from that country. The move is intended to put pressure on Moscow if it is seen as hindering Washington's efforts to end the conflict in Ukraine. However, he still affirmed the "good" relationship between the two leaders and was optimistic about the peace process in Ukraine, something the Kremlin also agreed with.

On Iran's side, Mr. Trump continued to emphasize his tough stance, warning of stronger measures if the two countries failed to reach an agreement on Tehran's nuclear program. He even did not rule out the possibility that the US would use force - which could increase tensions in the already unstable Middle East region with hotspots such as the Gaza Strip and Yemen.

In addition, two other factors that have pushed oil prices to record highs recently are the increase in demand in China and the decrease in crude oil production in the US. According to a report on March 30 by the US Energy Information Administration (EIA), crude oil production in the country has dropped to its lowest level in more than a year. Meanwhile, China's manufacturing PMI index exceeded expectations, showing that energy demand in this country is recovering strongly.

Copper prices plunge amid oversupply concerns

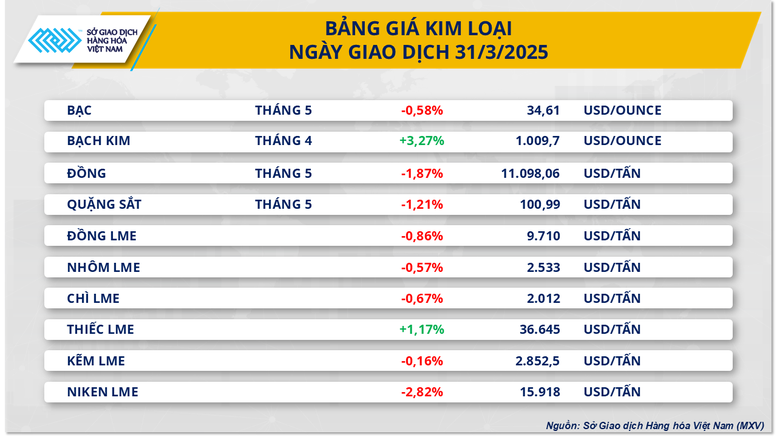

According to MXV, selling pressure dominated the metals market in yesterday's trading session. Except for platinum, which rose, most other base metals weakened due to the poor demand outlook.

At the close of trading on March 31, silver prices fell slightly by 0.58% to $34.61/ounce, but were still 17% higher than at the beginning of the year. Meanwhile, platinum prices jumped 3.27% to $1,009/ounce, up 11% from early January.

Platinum is one of the essential metals in the auto industry. The market is in a state of panic as the US is expected to announce its reciprocal tariff policy on April 2 and officially impose a 25% tariff on imported cars and components from April 3. The imposition of this tariff is likely to disrupt the supply chain and significantly increase the price of cars and components in the context of inflation that has already made cars more expensive.

In addition to the upcoming auto tariffs, Trump has previously imposed an additional 25% tariff on imported aluminum and steel and threatened to impose more on copper. These are three important materials for car production, so increasing tariffs on these metals would also increase the cost of car production in the US.

In the base metals market, at the close of yesterday's trading session, copper prices lost 1.87% to $11,098/ton. Meanwhile, iron ore also reversed and decreased 1.21% to $100.99/ton.

Copper prices came under pressure after BNP Paribas warned that prices could fall to $8,500 a tonne by the end of the second quarter due to a drop in demand as the speculative wave in the US ends. The bank also cut its forecast for global copper consumption growth in 2025 from 3.1% to 2.3%, while raising its forecast for a supply surplus to 460,000 tonnes.

Iron ore is also under pressure as steel demand in China slows. China’s Ministry of Transport said transport investment fell 5.66% year-on-year in the first two months of the year, with road investment down 7.2%. However, the decline in the base metals group was limited by China’s manufacturing PMI, which rose to 50.5 in March, its highest level in a year, thanks to improving domestic demand and rising exports amid concerns about additional tariffs from the US.

Source: https://baochinhphu.vn/chi-so-mxv-index-chinh-phuc-lai-vung-2300-diem-102250401100824257.htm

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)