Considerations for tighter screening of primary securities markets

In the latest draft amendments to the Securities Law, many screening regulations for issuers are made stricter. Responsibilities for related organizations are also added.

|

| The slow increase in the number of quality goods entering the stock market is an obstacle in attracting foreign capital. Photo: D.T. |

The screening door is tighter

In the summer of 2016, the story of Central Mining and Mineral Import-Export Joint Stock Company (stock code MTM) became a “hot” topic, attracting special attention and creating a stir among investors. A business with shares registered for trading on the UPCoM exchange with top liquidity, but surprisingly, this company is headquartered in a restaurant and is in the status of “ceased operations, but has not completed the tax code closure procedure”, when looking up on the taxpayer information website of the General Department of Taxation.

Even the subsequent investigation showed that the Company had no assets, no business activities; the registration documents for trading on the UPCoM exchange, the documents for the shareholders' meeting... were all fake. The former Chairman of the Company, Tran Huu Tiep, was sentenced to life in prison for fraud and appropriation of property - one of the heaviest penalties for criminal proceedings in the stock market in its more than 20-year history.

Despite the heavy and deterrent sentences, looking back over the past 8 years, there are still more listed business owners and bond issuers who continue to stand before the bar, even with the scale of damage determined at an unimaginable level.

|

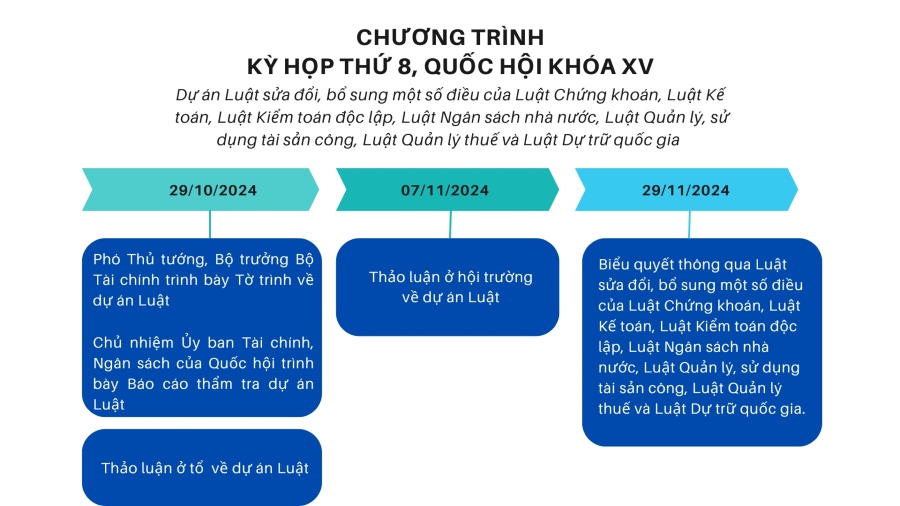

| The Draft Law amending 7 Laws in the field of finance and budget will be considered and approved at the 8th Session of the 15th National Assembly (Source: The Program of the 8th Session was approved by the National Assembly at the preparatory meeting on the morning of October 21, 2024). |

The 8th session of the 15th National Assembly began working today (October 21). Among them, many changes in the Securities Law affecting the primary securities market will be submitted to the legislature - part of the Draft Law amending 7 laws in the finance and budget sector.

Presenting at the Workshop "Getting Business Opinions on the Draft Law Amending the Law on Securities; Law on Accounting; Law on Independent Auditing; Law on Tax Administration", organized by the Vietnam Federation of Commerce and Industry (VCCI) last weekend, Mr. Nguyen Minh Duc, Legal Department (VCCI) pointed out many contents that increase the responsibility of businesses in the latest updated draft. In particular, regarding the primary securities market - where newly issued securities are bought and sold, publicly offered..., the Draft adds restrictions on the issuance of securities such as adding issuance conditions, increasing restrictions on the issuance of securities. At the same time, organizations related to securities issuance such as consulting organizations, auditing organizations... are given additional responsibilities, or increased administrative penalties for violations in the auditing field.

For example, the Draft supplements the responsibilities of organizations and individuals participating in the process of preparing records, confirming records and reporting documents; record consulting organizations and practitioners participating in record consulting; auditing organizations, approved auditors, and persons signing audit or review reports.

In addition, the registration dossier for the initial public offering of shares of a joint stock company will need to include an audited report on the contributed charter capital within 10 years from the date of registration for the initial public offering, or from the date of establishment if the enterprise has been established for less than 10 years. Transfers will be restricted for a minimum of 3 years, except in cases of transfers between professional securities investors or in accordance with a judgment. For comparison, previously, the transfer restriction period was 3 years for strategic investors and a minimum of one year for professional securities investors.

Finding a balanced solution

According to Ms. Tran Thi Thuy Ngoc, Vice President of the Vietnam Association of Certified Public Accountants, the requirement to report charter capital within 10 years is likely to be unfeasible. The reason is that many enterprises have gone through the process of separation, merger, change from state-owned enterprises to joint-stock companies, or sold a part to foreign countries, so it is not easy to collect documents on capital within 10 years.

In addition, according to Ms. Ngoc, capital contribution can be in cash or tangible or intangible assets. The above regulation raises questions about the requirement for independent valuation of contributed assets - something that was not included in previous regulations.

“There will be companies such as family businesses that have not previously intended to list their shares on the stock exchange, have not prepared complete and clear records within 10 years, and may never have the opportunity to list their shares on the stock exchange,” said a representative of the Vietnam Association of Certified Public Accountants.

Meanwhile, the slow increase in the number of quality goods entering the stock market in recent years is considered an obstacle in attracting current and future foreign capital flows in the scenario of Vietnam's stock market being upgraded from a frontier market to a secondary emerging market.

There are also opinions that the transfer restriction should be reduced, instead of increased as currently regulated. Even according to the leader of a bank, the approval process from closing the books to registering shares on the stock exchange is "consuming" a lot of time, affecting investment decisions when investors have to face market risks during the period from the time of investment to the time of transaction.

The integration of public offering and listing/registration of stock trading into one process is a solution that the State Securities Commission has proposed and affirmed to be implemented soon, in order to shorten the time for investors and bring more quality stocks to the stock exchange.

Many provisions in the Securities Law were amended in the context of the law being drafted according to a shortened procedure. This, according to the representative of VCCI, needs to be carefully considered, especially in the addition of provisions that increase obligations according to a shortened drafting process. Recalling the goal of the amendment is to remove difficulties and promote economic growth, Mr. Duc also raised the question of whether the new provisions are consistent with the revised goal of the law.

Economist Dr. Can Van Luc also believes that there needs to be a more balanced and harmonious perspective, in the direction of both creating market development and controlling risks.

Source: https://baodautu.vn/can-nhac-khi-sang-loc-chat-che-hon-thi-truong-chung-khoan-so-cap-d227886.html

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Infographic] Vietnam's manufacturing industry recovers: Positive signals in early 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/53389fc2248e47c8a06ec8c00a632823)

Comment (0)