(CLO) Delegate Tran Hoang Ngan - Ho Chi Minh City National Assembly Delegation said that in the current period, the Revolutionary Press plays a very important role in propagating the Party and State's guidelines and policies to the people. Therefore, there should be many preferential policies for press agencies. In particular, Mr. Ngan expressed his wish to exempt corporate income tax for press agencies.

Electronic newspapers are not given preferential treatment so it is very difficult.

Recently, the Draft Law on Corporate Income Tax (amended) is attracting the attention of businesses, especially press agencies. According to the current Law on Corporate Income Tax, the income of press agencies from print newspaper activities, including advertising on print newspapers according to the provisions of the Press Law, enjoys a preferential corporate income tax rate of 10%. Meanwhile, press agencies of other types such as electronic newspapers, television, and radio have no regulations.

One of the new points of the draft Law on Corporate Income Tax (amended) is the addition of a provision to apply a preferential tax rate of 15% to the income of press agencies from press activities other than print newspapers. Print newspapers will continue to apply a preferential tax rate of 10% as currently regulated.

According to Mr. Truong Ba Tuan - Deputy Director of the Department of Management and Supervision of Tax, Fee and Charge Policies (Ministry of Finance), recently, the financial situation of all press agencies, including print newspapers, electronic newspapers, radio and television, has encountered great difficulties. The main reason is the sharp decline in advertising revenue - one of the most important sources of income for the press industry.

On the other hand, currently, according to the provisions of Article 10 of the Law on Corporate Income Tax, press agencies, except for print newspapers, are subject to a general tax rate of 20%. This tax rate has created a disparity between types of press, causing difficulties for online newspapers and other types in the context of fierce competition for revenue sources.

“In that context, the Ministry of Finance has coordinated with relevant ministries and sectors to research and develop tax incentive plans to support all types of press, not just print newspapers. Specifically, the draft Law on Corporate Income Tax (amended) has added a provision to apply a preferential tax rate of 15% to income from press activities other than print newspapers. For print newspapers, the preferential tax rate of 10% will remain the same as current,” said Mr. Tuan.

Mr. Truong Ba Tuan said that the proposal of a preferential tax rate of 15% for other types of press besides print newspapers was considered based on many factors, including the correlation with other industries. This tax rate is considered reasonable in the current context, ensuring fairness between industries and helping press agencies overcome financial difficulties.

Mr. Truong Ba Tuan - Deputy Director of the Department of Tax, Fee and Charge Policy Management and Supervision (Ministry of Finance).

With the above proposed adjustment, the Ministry of Finance hopes to create more equality in tax policy for all types of press, while encouraging the development of press in the digital age and digital transformation. For printed newspapers, the preferential tax rate of 10% will still be maintained, while other types of press will enjoy a tax rate of 15%.

Regarding the above issue, according to Chairman of the National Assembly's Committee on Culture and Education Nguyen Dac Vinh, currently, print media agencies are enjoying a corporate income tax incentive of 10%, while electronic media agencies are not, so they are facing many difficulties. According to Mr. Vinh, press agencies, whether print, electronic, television or radio, are all Revolutionary Press, public service units under state agencies. Currently, the income of press agencies mainly depends on advertising; however, the advertising pie is also shrinking, causing many difficulties for press agencies.

“We propose a common income tax incentive for print newspapers, electronic newspapers and other types of newspapers as currently applied to print newspapers ,” proposed Chairman of the Culture and Education Committee Nguyen Dac Vinh.

Hope that press agencies will enjoy a preferential corporate income tax rate of 0%

Talking to reporters on the sidelines of the National Assembly, delegate Tran Hoang Ngan – Ho Chi Minh City National Assembly Delegation said that in the current period, the Revolutionary Press plays a very important role in propagating the Party and State’s guidelines and policies to the people. Therefore, there should be many preferential policies for press agencies.

“I don’t think the tax rate should be 10% or 15%, but rather a corporate income tax exemption for press agencies. If press agencies make profits in their operations, that’s great. At that time, they will have the resources to invest in infrastructure, equipment, and machinery, improving the lives of journalists; thereby better serving the propaganda of the Party and State’s guidelines and policies to the people. That is very important,” said Mr. Ngan.

According to Mr. Tran Hoang Ngan, budget investment for press agencies is not much, while advertising revenue has also decreased due to the impact of objective factors such as the rise of social networking platforms, businesses tightening spending - reducing advertising spending for press agencies due to the impact of the COVID-19 pandemic, or recently storms and floods... The lack of revenue leads to the problem of sharing and re-investment, which does not meet the information and propaganda requirements in today's era.

“At this session, I will speak about this issue before the National Assembly, not to reduce but to exempt corporate income tax to increase resources for information and propaganda agencies, thereby both serving well the policy communication work and fighting against the false arguments of hostile forces,” said Mr. Tran Hoang Ngan.

The delegation of Ho Chi Minh City once again emphasized that currently, the work of disseminating the Party and State's guidelines and policies to the people is especially important. When information reaches the people in a complete and accurate manner, it will create consensus among the people, create solidarity and unity, and from there, the work of organizing and implementing will be favorable.

“One of the current difficulties is the organization and implementation. In order for the organization and implementation to be smooth and convenient, people must understand and be able to share information. But in order for people to understand and share, there must be an effective and best tool - that is the press. In particular, reporters also need to have many conditions to participate in propaganda and reflect the real situation,” said Mr. Tran Hoang Ngan.

Mr. Truong Xuan Cu - National Assembly Delegate of Hanoi City.

National Assembly Delegate Truong Xuan Cu - Hanoi National Assembly Delegation expressed his opinion that imposing taxes on enterprises is a consistent and unified policy and is the main source of revenue for the budget. However, the tax rate must be calculated based on the specific activities of each type of enterprise. In particular, press agencies do not operate simply as enterprises but have a particularly important task of propagating the Party's policies and the State's policies, and also orienting public opinion to strengthen people's trust, fight against negativity in society, and refute the wrong arguments of hostile forces.

Therefore, research to have a suitable tax rate for press agencies is extremely necessary, because the press operates for multiple purposes, not just business.

“The press carries out propaganda according to the policies of the Party and the State and creates spiritual strength, unity and consensus among the people. We think that imposing corporate income tax on press agencies as on ordinary businesses is not appropriate. Therefore, competent authorities need to study and adjust policies accordingly.

Adjusting corporate income tax to a lower level for press agencies will help them increase revenue, thereby giving them more resources to develop, serving the main purpose of policy communication," said Mr. Truong Xuan Cu.

Also according to delegate Truong Xuan Cu, the application of tax at two different levels for print and electronic press agencies is appropriate because print press agencies are currently facing much more difficulties than electronic press agencies when this type has more advantages. In particular, print press should enjoy a lower tax policy than electronic press. "The two types of press with higher and lower levels are more suitable for the income, sales, and nature of an agency or unit. And these two types are combined into the revenue of the press agency to balance all activities of the press agency and the lives of reporters," said Mr. Cu.

Quoc Tran

Source: https://www.congluan.vn/can-mien-thue-thu-nhap-doanh-nghiep-cho-cac-co-quan-bao-chi-post318193.html

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

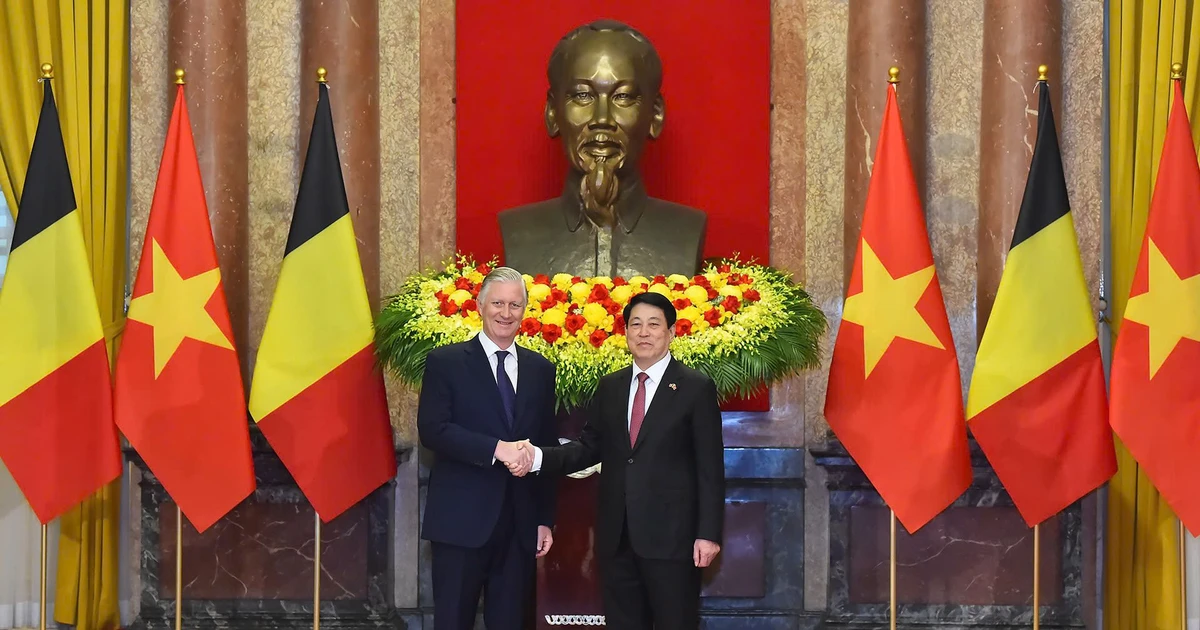

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

Comment (0)