Bitcoin price reached a historic high when it surpassed the $100,000 mark this morning, bringing its market capitalization to $2,000 billion.

After many days of passing, Bitcoin (BTC) started the uptrend late last night, quickly reclaiming the $99,000 mark around 4am today. The chart continued to hover around the above price range before a new uptrend.

At around 9:40 a.m., Bitcoin jumped to a historic $100,000 per unit, up more than 5% in 24 hours. Cryptocurrency The world's largest continued to accumulate, recording over $103,250 at 10:10.

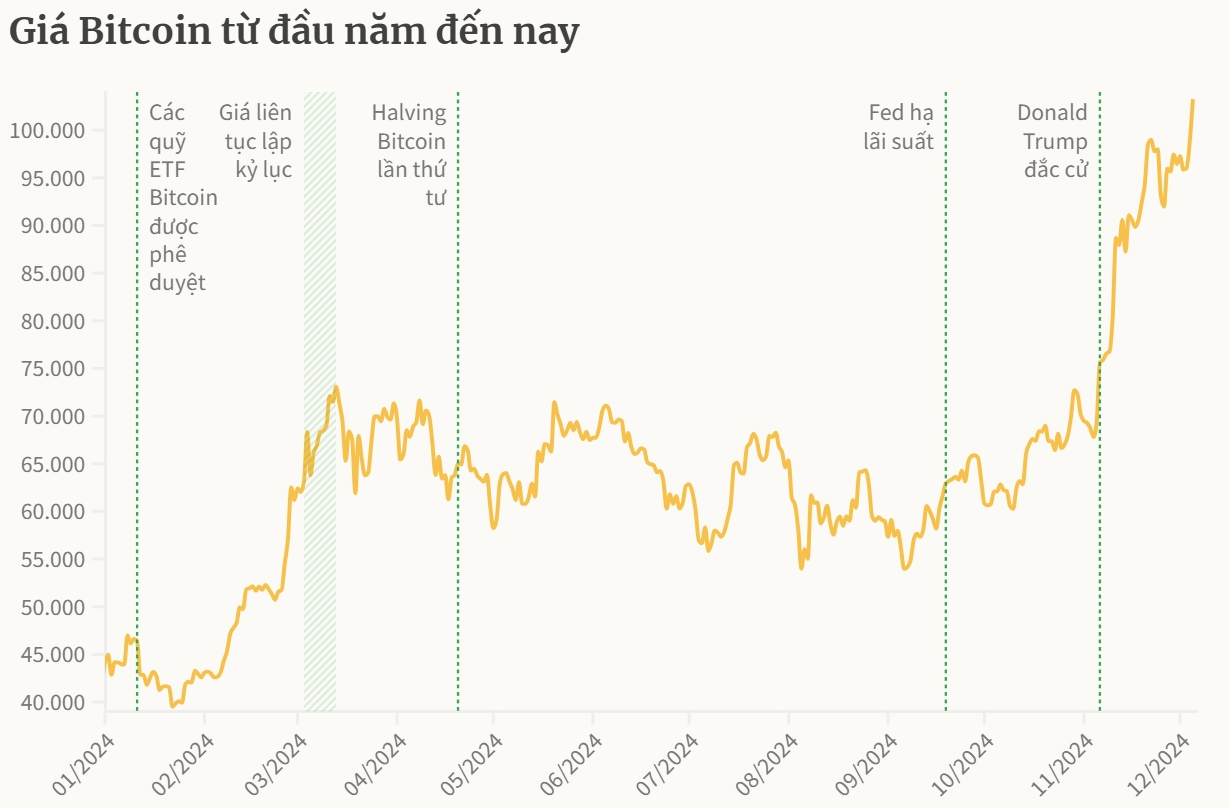

CoinDesk The new record was supported by institutional demand and high expectations for crypto-friendly policies under Donald Trump's presidency. BTC has risen about 130% year-to-date, with a market capitalization of $2 trillion just 15 years after its inception. The currency is now the seventh largest in the world in terms of capitalization, behind only gold and major tech companies such as Apple, Nvidia, Microsoft, Amazon and Alphabet.

This year's Bitcoin boom is led by funds ETF Spot ETFs from asset management giants including BlackRock and Fidelity were approved earlier this year. These products have been a huge success, managing about $30 billion in less than a year.

Despite the success of ETFs, Bitcoin prices then stagnated for much of this year, in part due to regulatory uncertainty surrounding the US presidential election. However, the early November victory of Donald Trump - a crypto-friendly person - fueled the new rally. BTC quickly reached a high of $80,000, then $90,000 and finally $100,000 today.

Another driver of the bull story is growing institutional and corporate adoption, led by MicroStrategy and its executive chairman Michael Saylor, who began buying Bitcoin in August 2020 and has continued to raise billions of dollars to accumulate it, bringing its holdings to 386,700 tokens, now worth more than $38 billion.

Saylor and his team have inspired other publicly traded companies like Semler Scientific (US) and Metaplanet (Japan) to pursue similar strategies. Even tech giant Microsoft has a proposal before its board of directors on whether it should pursue a “Bitcoin treasury” strategy.

Source

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)