Nearly 11.5 billion USD in residential real estate inventory

Statistics from the third quarter 2024 financial reports of 10 residential real estate enterprises on the stock exchange show that the total value of net inventories as of September 30 reached VND 291,439 billion (about 11.5 billion USD), an increase of 7.9% over the same period last year. Compared to September 30, 2021, the inventory growth of this group even reached 45.6%.

Among these 10 enterprises, No Va Real Estate Investment Group Joint Stock Company (Novaland - stock code: NVL) has the largest inventory of about VND 145,006 billion, up 5.4% over the same period last year. This inventory ratio accounts for 49.7% of the total inventory value of the above group of enterprises, a slight decrease compared to nearly 51% at the same time in 2023.

According to the financial statement, Novaland's largest inventory is real estate for sale under construction (mainly including land use fees, design consultancy, construction and other expenses). This item recorded about VND 136,812 billion, accounting for 94.1%. At the same time in 2023, real estate inventory for sale was VND 126,796 billion, accounting for 92.3% of inventory value.

Novaland said that as of September 30, the group used VND57,972 billion worth of inventory as collateral for loans.

In second place in terms of inventory is Vinhomes Joint Stock Company (stock code: VHM) with VND 57,981 billion, up 5.2% compared to the end of the third quarter of last year. Compared to the end of the third quarter of 2021, the inventory of this enterprise increased by 81.4%.

Similar to Novaland, the majority of Vinhomes' inventory is real estate for sale under construction at VND50,009 billion, mainly land use fees, site clearance costs, construction and development costs of Vinhomes Ocean Park 2, Vinhomes Ocean Park 3, Vinhomes Smart City urban area projects and some other projects.

Another company with a sharp increase in inventory is Van Phu - Invest Joint Stock Company (stock code: VPI). At the end of the third quarter, the company's net inventory was VND3,348 billion, up 64% over the same period last year. Most of the inventory of this unit is unfinished real estate at the projects The Terra Bac Giang, Vlasta Thuy Nguyen, Song Khe - Noi Hoang.

Nam Long Investment Joint Stock Company (stock code: NLG) also had an inventory growth of 20.9% compared to the end of the third quarter of 2023. Inventory is concentrated in unfinished projects such as Izumi Project (VND 9,037 billion), Waterpoint Phase 1 (VND 3,556 billion), Waterpoint Phase 2 (VND 1,528 billion), Akari (VND 1,045 billion) and some other projects.

Why is real estate inventory still large?

In fact, not everyone fully understands the meaning of the inventory item of a real estate business. According to Mr. Nguyen Huu Thanh - Deputy General Director & Strategic Consultant, Weland Company - real estate is a specific business sector different from the manufacturing sector.

For manufacturing businesses, when inventory increases, it can be understood that the business cannot sell products. But with real estate, the more inventory shows that the business has a larger land fund.

An apartment project in Hanoi (Photo: Tran Khang).

Even a large inventory is a good sign that the business has products available to deliver to customers. Meanwhile, a business running out of inventory shows that there is no new land fund, new products to sell to the market. This is a sign that the future cash flow, future sales of the business are likely to be disrupted.

In essence, inventory fluctuations have both upward and downward directions. When inventory decreases, the business will record revenue. If the business is still implementing the project and has not yet delivered the product, the real estate inventory will still increase.

For example, in the past, Vinhomes' project in Dong Anh district had a lot of transactions, but the company only accounted for prepaid customers, and inventory continued to increase. It was not until the company handed over the house to the customer that inventory decreased. In this case, the inventory was sold but not recorded in revenue.

According to the Vietnam Association of Realtors (VARS), the Vietnamese real estate market in the third quarter in particular and the past 9 months has had a positive recovery after a difficult period, thanks to the stability of the economy and the Government's support policies.

Therefore, if only looking at the inventory figures on the financial statements of real estate enterprises cannot reflect the market developments. To evaluate the business situation of real estate enterprises, investors need to evaluate many other indicators such as the growth of prepaid money from customers during the period, recording revenue on the financial statements.

Source: https://dantri.com.vn/bat-dong-san/bat-dong-san-khoi-sac-doanh-nghiep-van-om-291000-ty-dong-hang-ton-kho-20241105144602290.htm

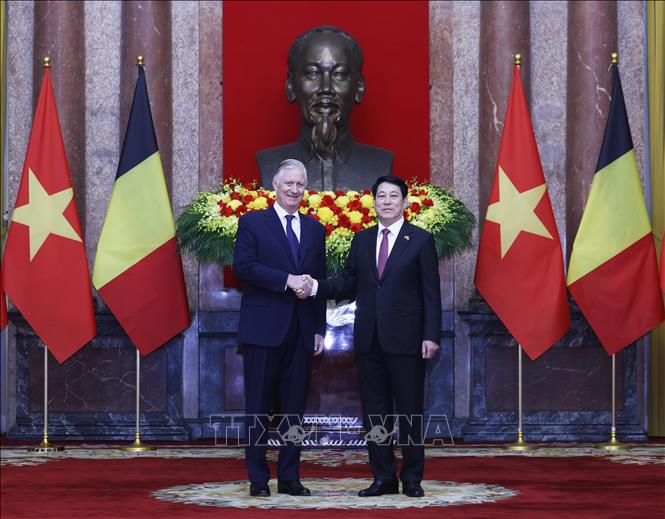

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

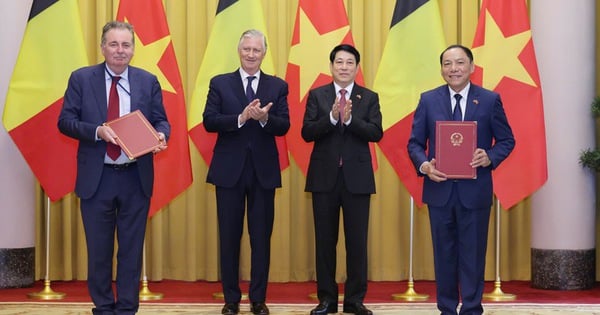

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

Comment (0)